Pound-Dollar Rate Steadies as USD Takes Breather from Raging Rally

- Written by: James Skinner, Additional Editing by Gary Howes

- GBP/USD finds a footing near 2021 lows

- USD takes breather from road rage rally

- But Fed, global growth fears support USD

- Could limit GBP/USD’s recovery potential

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3437

- Bank transfers (indicative guide): 1.3067-1.3161

- Money transfer specialist rates (indicative): 1.3316-1.3370

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

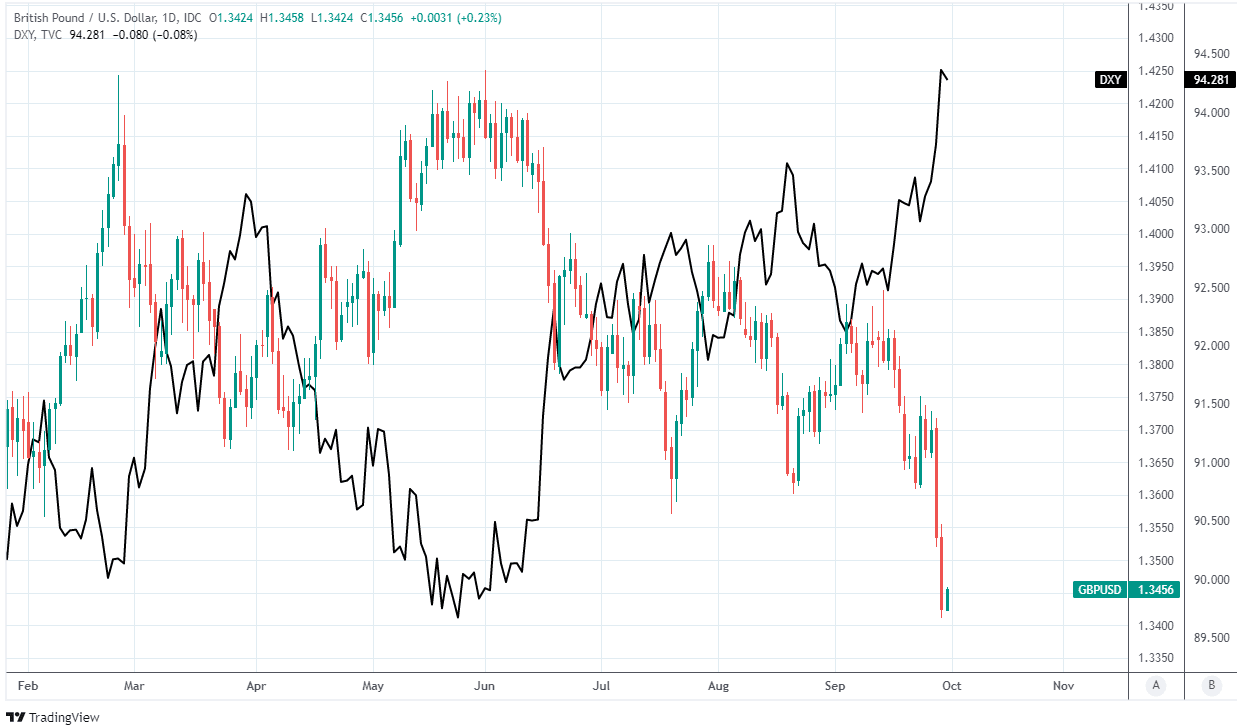

The Pound-to-Dollar exchange rate was seen steadying above 2021 lows while the U.S. Dollar Index had stalled near major resistances on the charts in a tentative sign that the greenback's raging rally may have run its course.

Sterling edged higher against all major counterparts barring the Australian Dollar toward the end of Asia’s Thursday session and ahead of the open in Europe, led by a Pound-Dollar rate that had climbed off its 2021 low at 1.3411.

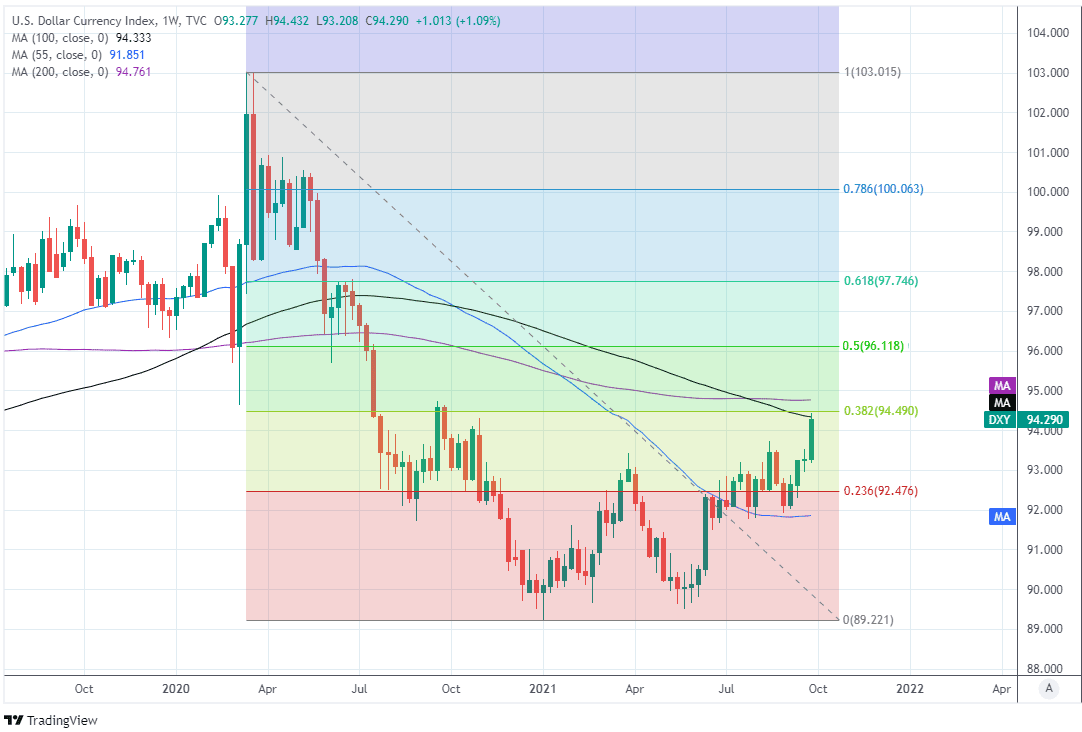

This was as U.S. exchange rates eased across the board and with the Dollar Index holding below its 100-week moving average at 94.33, which is located near the 38.2% Fibonacci retracement of the barometer’s March 2020 decline sited at 94.49.

While these levels could yet keep the Dollar contained and may afford Sterling an opportunity to recover part of the ground lost this week, some analysts are warning that the greenback’s appreciation is not yet over and that the Pound-Dollar rate could still fall further.

“Although some short-covering is possible after the big moves, USD is still viewed as a buy-on-dips,” says Philip Wee, a strategist at DBS Group Research. “CAD and GBP have given up the year’s gains. GBP/USD’s fall below 1.35 was significant.”

Wee has flagged a risk of Sterling falling back to November 2020 levels around 1.31 in the days or weeks ahead and has also suggested the Euro-Dollar rate could rebound to something like 1.1630 before resuming an earlier decline that may ultimately see it falling as low as 1.15.

Above: Pound-to-Dollar rate shown at daily intervals alongside Dollar Index.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“In line with our expectations, the Fed was less convinced about inflation being transitory compared to the ECB, BOE and BOJ at the ECB Forum on Wednesday. Fed Chair Jerome Powell was clearly frustrated that the current high US inflation would run into 2022,” Wee says.

Market concerns about the global economic outlook have risen this week in response to myriad disruptions to global supply chains for raw materials, manufactured goods and other resources, which would also be likely to lend support to the safe-haven Dollar.

But the greenback may always have been likely to strengthen further sooner or later following the market’s limited response to last Wednesday’s policy decision from the Federal Reserve.

This saw the bank prepping the market to expect a swift end to its $120BN per month quantitative easing programme next year and for interest rates to rise even sooner than the Federal Open Market Committee (FOMC) had guided for as recently as June.

Meanwhile, Wednesday’s remarks made by Fed Chairman Jerome Powell at a conference hosted by the European Central Bank on Wednesday have emphasised and underlined the risk of interest rate rises that could come sooner than many had anticipated previously.

“Current elevated inflation pressures were “frustrating”, “apparently getting a little bit worse”, holding up longer than previously thought, and running well into 2022,” notes Mike Smith, a senior economist at ASB Bank in New Zealand, referring to Powell's comments of market relevance.

Above: U.S. Dollar Index shown at weekly intervals with major moving-averages and Fibonacci retracements of March 2020 decline indicating possible areas of technical resistance.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

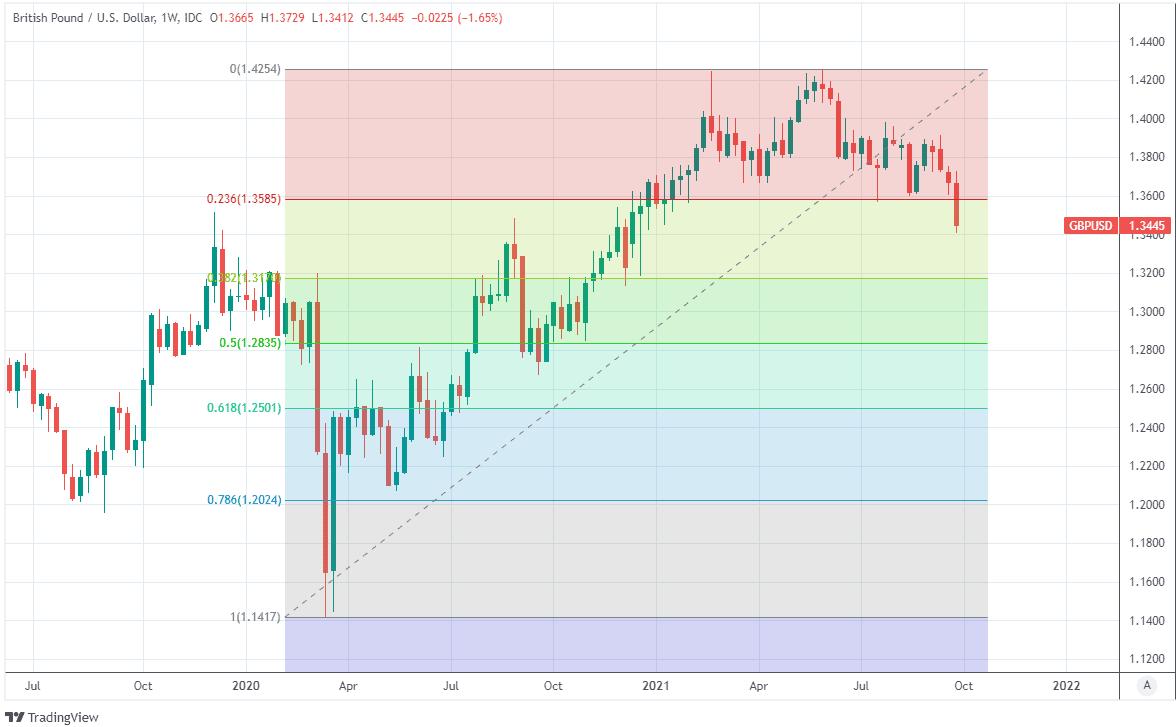

The Pound-Dollar rate had been among the first to crumble this week amid a heightened focus in the media and market on rising natural gas prices and disruptions to other fuel supplies in the UK, but analysts at BofA Global Research say that other factors are likely to explain Sterling’s losses.

"Whilst we are in no way diminishing the importance of such developments we would argue that recent news is neither existential nor new news. Both stories have been permeating through markets for the past week and we think that these developments have been used as a convenient ex-post explanation to fit price action," says Kamal Sharma, an FX strategist at BofA Global Research.

"We think that GBP has succumbed to month/quarter end rebalancing pressures as it has done in Q1 and Q2. Price action appears to be heavily concentrated through the London time zone; foreign buying of UK gilts has been a record for 2021 and these may be adjusting FX hedge ratios; and to some extent GBP has been a "lazy" long," Sharma wrote in a Wednesday note.

Above: Pound-to-Dollar rate heads for largest weekly loss since aftermath of June 2021 Federal Reserve decision.