Pound-Dollar Rate Eyes Payrolls and Fed after BoE Hints at 2022 Rate Rise

- Written by: James Skinner

- GBP/USD buoyant above 1.39 following BoE guidance

- May gain resilience to USD strength on UK rate outlook

- But July job report may have implications for Fed policy

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3930

- Bank transfers (indicative guide): 1.3542-1.3640

- Money transfer specialist rates (indicative): 1.3805-1.3832

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar exchange rate was trading buoyantly above 1.39 on Thursday, aided by the latest Bank of England (BoE) monetary policy decision, although with attention turning toward Friday’s jobs report from the U.S. and its possible implications for Federal Reserve (Fed) policy.

Sterling gave stiff competition for the top spot on the day within the G10 contingent of major currencies Thursday after the BoE’s Monetary Policy Committee went out of its way to draw attention to the fact that its forecasts for inflation and other economic variables are built upon the assumption that Bank Rate will eventually rise in line with market expectations.

That means Bank Rate is likely to rise from 0.1% to 0.2% around the third-quarter of next year, before climbing steadily in smaller-than-usual increments of 0.1% over the subsequent to 12-18 months so that it reaches 0.50% by the end of 2024, and reflects guidance that could potentially dissuade parts of the commentariat from the recently popular view that the BoE would be unlikely to lift Bank Rate before 2023 at the earliest.

“The Bank has made some fairly wholesale changes to its statement here – and is now formally acknowledging that some tightening is likely over the three year forecast horizon. As expected though, policymakers have avoided saying anything more concrete than that,” says James Smith, a developed markets economist at ING.

The BoE has effectively acknowledged the likelihood of an earlier lift-off than was previously assumed, and this is likely the a result of sweeping upgrades to its forecasts for inflation, which is now expected to top out at 4% and twice the targeted 2% level over the final quarter of 2021 and first quarter of 2022 before ebbing back to target by 2024.

The Pound’s buoyancy on Thursday also came amid a softening of the Dollar that was evident against many other currencies, although Sterling could potentially now become more resilient to bouts of strength in the U.S. unit over the coming weeks and months as a result of the BoE’s decision.

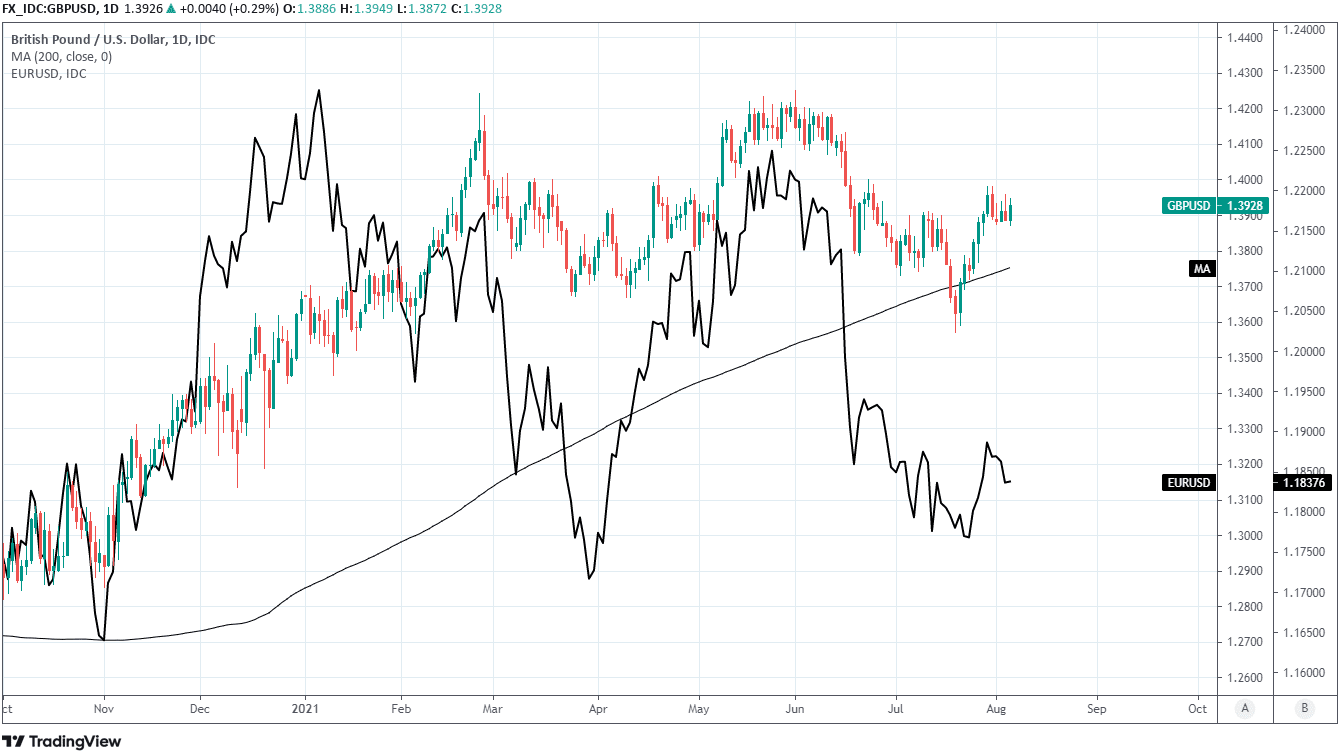

Above: Pound-to-Dollar rate shown at daily intervals alongside Euro-Dollar rate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

As things stood on Thursday, in terms of guidance from the Federal Reserve, about the most ‘hawkish’ the U.S. central bank has gotten is to suggest that there’s only an outside chance of the Fed Funds rate range rising from its current 0% to 0.25% range before 2023.

“The US curve still prices three rate hikes by the end of 2023, and I'm not sure that's a terrible guess of what will happen,” says Kit Juckes, chief FX strategist at Societe Generale.

The most hawkish outlook, or optimistic scenario for those hoping to see rates rise, is that articulated by Vice Chairman Richard Clarida of the Federal Open Market Committee and Federal Reserve Board of Governors in a speech to the Peterson Institute for International Economics on Wednesday.

All of this could yet change however, and as soon as Friday when July’s non-farm payrolls report is published by the Bureau of Labor Statistics in the U.S., which consensus expects to reveal that 895k jobs were created or recovered from the coronavirus last month.

If consensus estimates are on the money then July’s payrolls report would be the second consecutive increase of almost 1 million jobs.

“I am not sure there’s too much sway in yesterday’s events, the data out of the US has been more mixed of late, and even if payrolls come in strong it doesn’t necessarily take the Fed off the glide path towards normalisation,” says an unnamed trader, writing in a morning commentary from the London FX trading desk at J.P. Morgan.

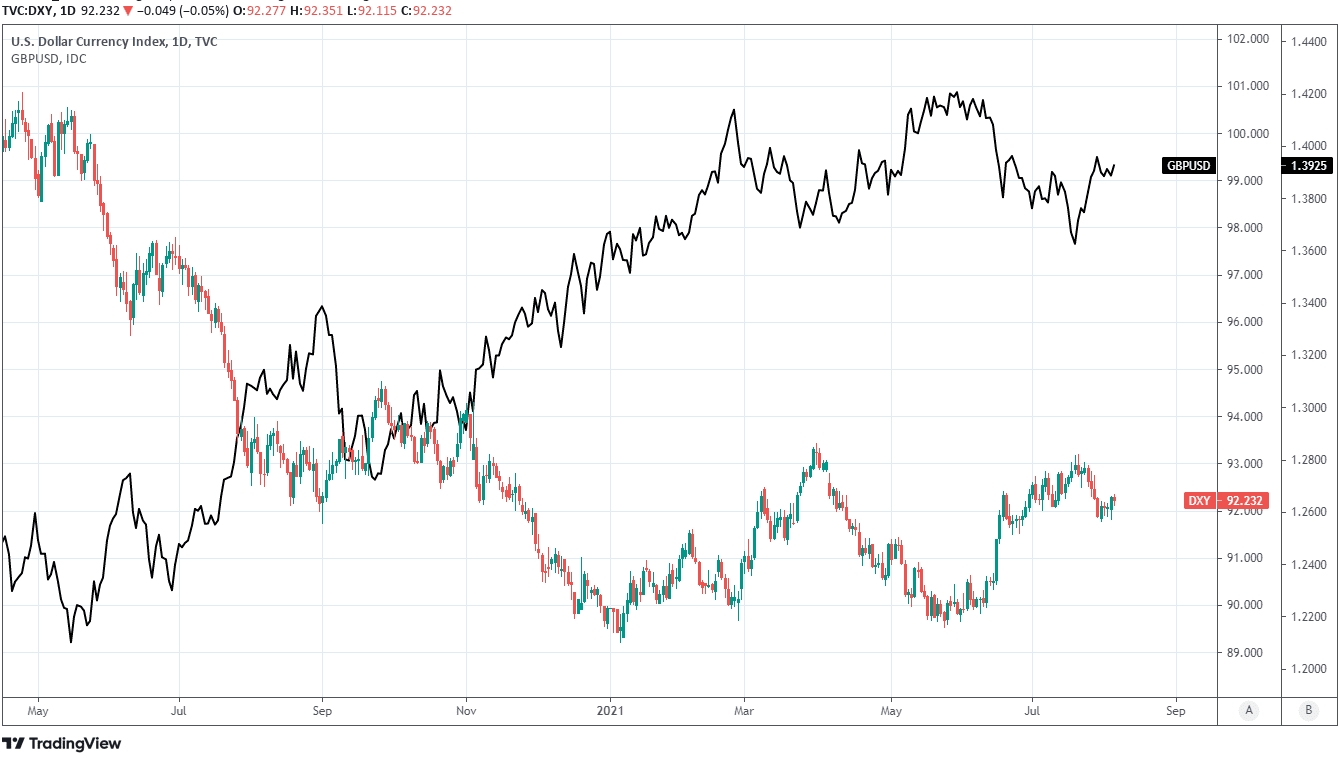

Above: U.S. Dollar Index shown at daily intervals alongside Pound-to-Dollar rate.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“I stick with my main views, long GBP, tactically long NOK although price action is uninspiring, and short USDJPY which obviously was a touch painful yesterday afternoon and was reduced on the way back up and long HUF and RUB in EM. I have added CAD longs to the portfolio too given the currency’s decent performance yesterday in the face of oil weakness and the overall dollar bid,” the J.P. Morgan note reads.

A second consecutive blockbuster job report could be enough to bring more members of the FOMC in the direction of Richard Clarida and the other committee members who in June used their individual forecasts for U.S. interest rates to signal that U.S. borrowing costs could also begin rising sooner than the Fed had previously guided for.

This is after Fed Chairman Jerome Powell and others pushed back against such sentiments in public engagements following June’s meeting, with Powell saying in July I think we’re some way away from having had substantial further progress toward the maximum employment goal. I would want to see some strong job numbers“ before being willing to entertain even a reduction of the Fed’s $120BN per month quantitative easing programme.

“There will be a strong focus on tomorrow’s official employment data given the emphasis from Fed chair Jerome Powell and company on upcoming job reports and its implication for taper timing. This is also the last job report ahead of Powell’s speech at Jackson Hole later in August where he may drop hints of what is coming next in terms of monetary policy,” says Christopher Dembik, head of macro analysis at Saxo Bank.

“Even if tapering is not immediately around the corner, it is getting clearer that the Fed is preparing for it. A good July job report would further fuel tapering expectations,” Dembik adds.

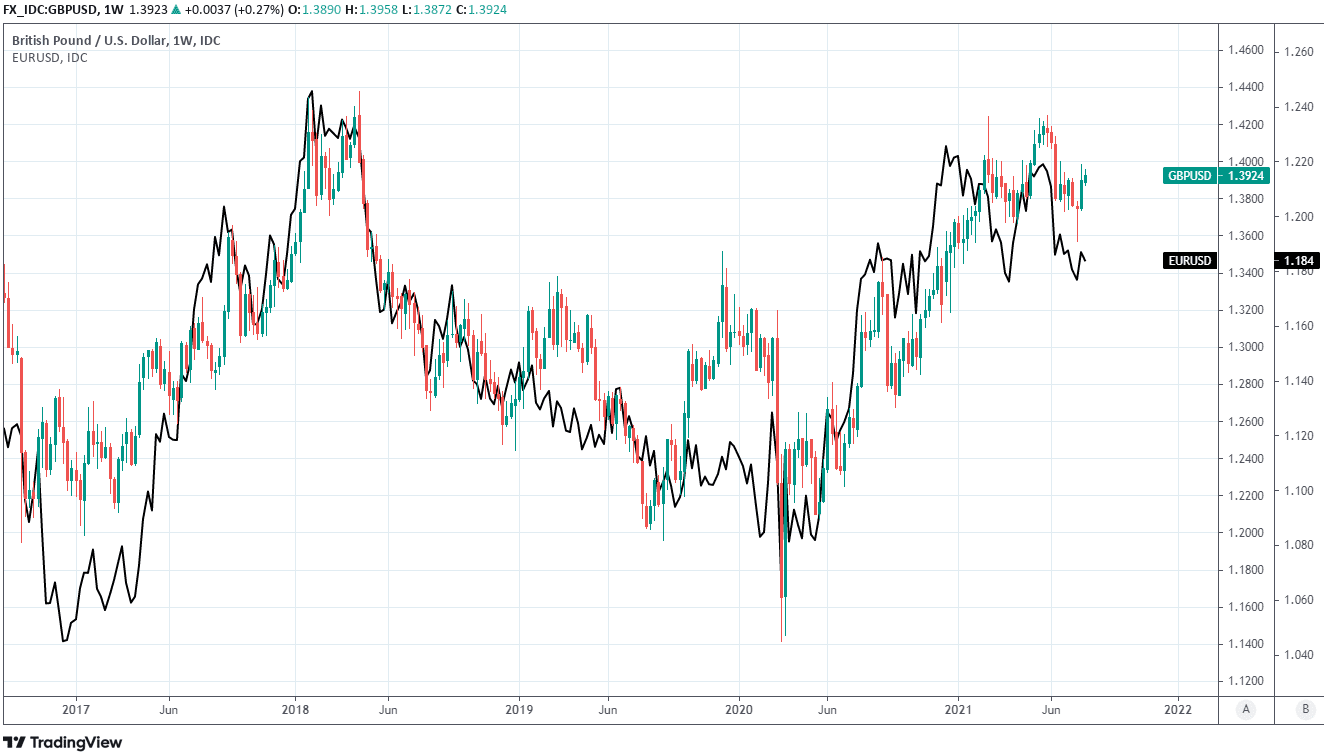

Above: Pound-to-Dollar rate shown at weekly intervals alongside Euro-Dollar rate.