U.S. Dollar Vulnerable to Growing Gap Between Fed and 'Hawkish' Market Expectations

- Written by: James Skinner

- USD on front foot amid shifting outlook for Fed's policy

- But Fed-market disconnect growing risk to USD outlook

- As market majority eyes 2022 lift-off for interest rates

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3810

- Bank transfers (indicative guide): 1.3420-1.3523

- Money transfer specialist rates (indicative): 1.3686-1.3713

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The currency market turned on its head following June's shift in policy guidance from the Federal Reserve but follow-on commentary from bank officials suggests there's now an even larger disconnect between expectations of those who set interest rates, and those who invest in them, which is a potential vulnerability for the Dollar.

Dollars were bought against most currencies at the opening of July as well as throughout a June month in which new economic forecasts and policy assumptions from the Fed prompted investors to revise bets on when the bank is likely to begin lifting its interest rates in favour of action that comes sooner rather than later.

But the greenback’s rally so far, as large as it has been, still belies the extent to which the currency, bond and derivative markets have turned outright ‘hawkish’ in their implied views about the outlook for Fed policy.

“A significant minority expect to increase the Funds rate in 2022,” says Carol Kong, a strategist at Commonwealth Bank of Australia. “USD posted its strongest monthly gain in 2021 because of the FOMC’s hawkish tilt."

Pricing in derivative markets suggests investors now think U.S. interest rates could begin rising in the latter part of next year, and that the Fed Funds rate range could be lifted to 1% by the end of 2023, while these implied assumptions were more-than supported by the results of a survey carried out this week by Goldman Sachs.

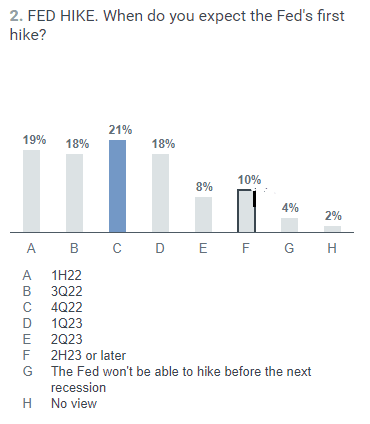

Above: Goldman Sachs' survey results.

A survey with more than 1,100 participants found that a full 58% of them expect the Fed to begin lifting its interest rate in the final quarter of next year or sooner, rather than in late 2023 as the bank’s dot-plot recently suggested.

While some 21% of respondents anticipated ‘lift-off’ for interest rates in the final months of 2022, around 18% of them saw a move in the third quarter next year as most likely, and around 19% thought the Fed Funds range of between 0% and 0.25% is actually likely to rise before even the middle of next year.

The Fed previously faced increasingly widespread suggestions that it was effectively falling asleep at the wheel after inflation rose to more than five percent in the first half of 2021, due in part to disruption of goods and services supplies following the closure and reopening of economies, as well as amid what is widely expected to be a period of rapid growth as normalising activity levels are bolstered by record levels of government spending.

June’s changes to guidance about the possible level of interest rates in the years ahead was, if nothing else, an almost inevitable response to that and a necessary recognition of upside risks to U.S. inflation outlook. It would also be the beginning of a steady but sustained pivot by the bank if investors are reading it correctly, although remarks by a number of the bank’s rate setters in the weeks since suggest this is not necessarily the case.

“The unemployment rate would have to drop fairly substantially, or inflation would have to really continue at a very high rate, before we would take seriously a rate hike in 2022, but I’m not ruling it out,” says Christopher Waller, a member of the Fed's board of governors, in an interview with Bloomberg TV on Tuesday.

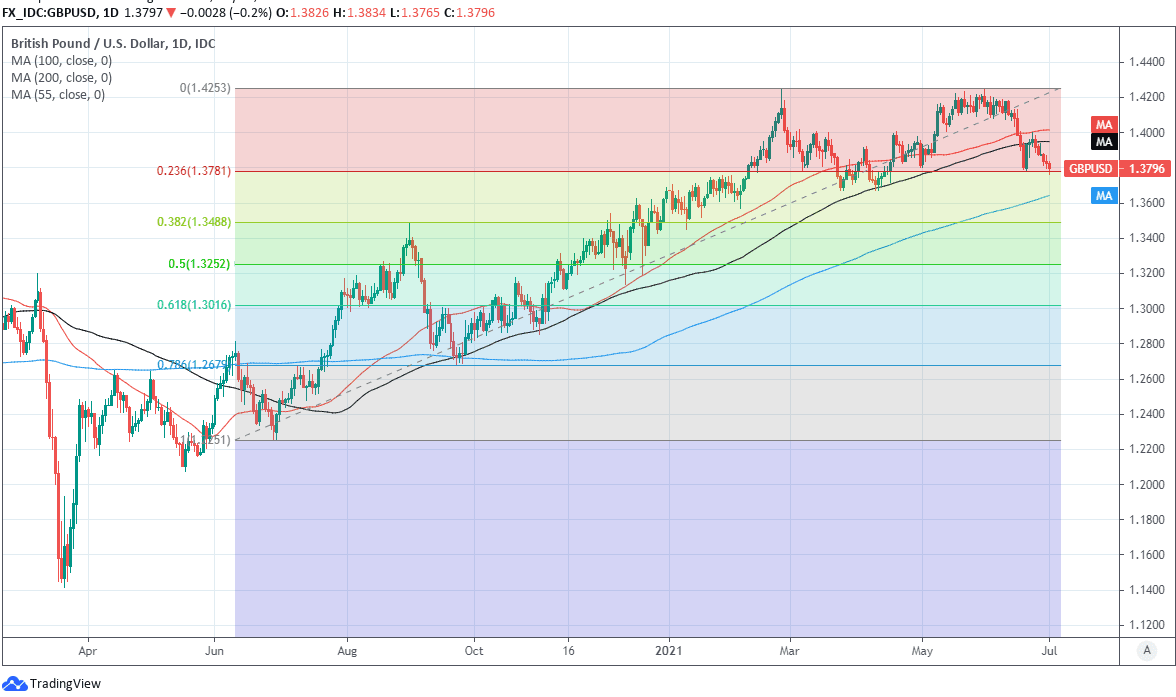

Above: Pound-Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of June 2020's extended recovery rally.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Waller, who's also a 2021 voter on the FOMC rate setting committee, joined other senior committee members including Chairman Jerome Powell and Federal Reserve Bank of New York President John Williams this week in expressing scepticism about the market’s expectations.

"There have only been six previous FOMC dot plot updates since their 2012 inception where the median projection matched or exceeded the June FOMC dots for their "hawkishness", i.e. two hikes added over the forecast horizon," says Richard Franulovich, head of FX strategy at Westpac.

"When we average out the daily price action in the Dollar Index and 2yr yields in the wake of these six hawkish Fed dot plot updates we observe an unmistakable trend shift higher that extends for a good month," Franulovich adds.

Implied by the increasingly 'hawkish' market's assumptions is the belief that America’s job market will be quickly returned to ‘full employment’ over the coming quarters, and that current high levels of inflation will have longevity rather than being simply “transitory” as central bankers have so far imagined.

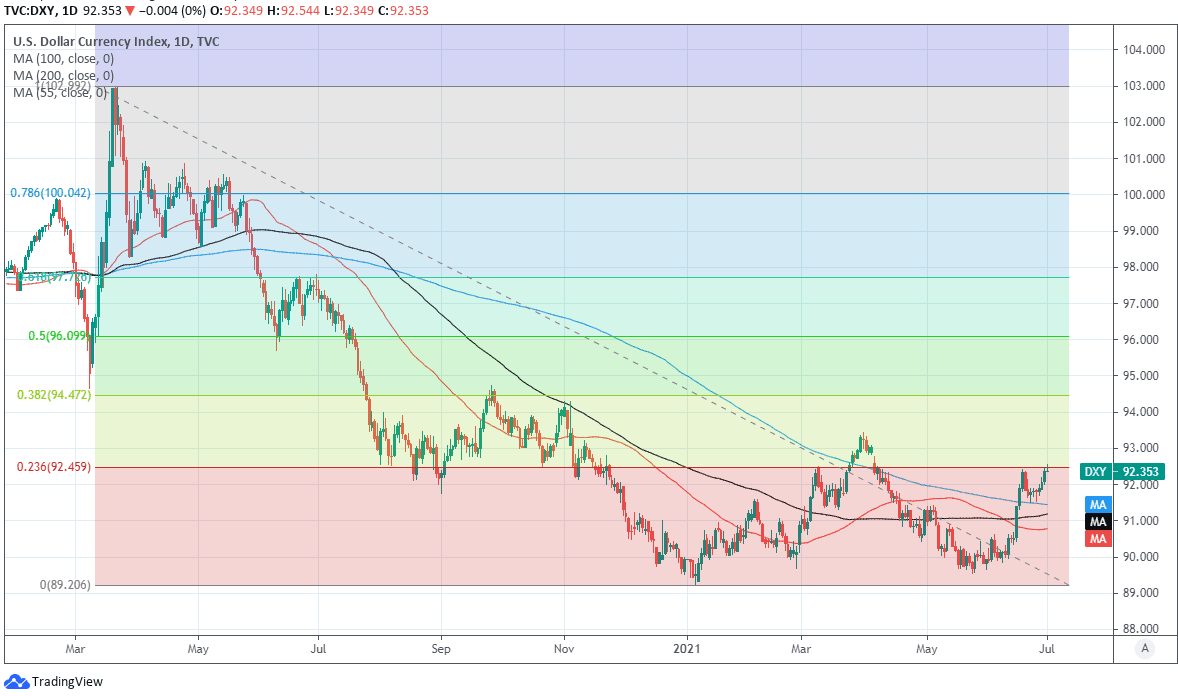

Above: U.S. Dollar Index shown at daily intervals with selected moving-averages and Fibonacci retracements of 2020 decline.

"We're not behind the curve," said Randall Quarles, another member of the Fed’s board of governors and FOMC rate setting committee, in a Monday address at the Utah Banking Convention, according to a Reuters report.

The Fed is seeking to generate a return to pre-pandemic levels of employment and then some with its low interest rate policy, as well as to attain its 2%-average inflation target sustainably over time having pledged that o it won’t lift borrowing costs until both of those conditions are met.

The bank has also said it intends to continue buying $120bn of bonds per month until “substantial further progress” has been made in repairing the job market.

"Once the recovery is more complete and the economy is in a very good place, then we can take back the low interest rates and get them back to more normal levels," says Federal Reserve Bank of New York President John Williams last Tuesday, during a virtual conversation hosted by the College of Staten Island. "It's not the time now because the economy is still far from maximum employment."

Above: Westpac graph showing market expectations for percentage point changes in major central bank interest rates.

Meanwhile, Federal Reserve Bank of Boston President Eric Rosengren, who will be a voting participant at FOMC meetings next year, said in a National Association of Corporate Directors event last Friday that it will take time for the bank to figure out how much “slack” there is in the job market.

The rub for the more hawkish members of the Fed's committee and parts of the market is that there were still some 9.3 million unemployed in the U.S. last month, far more than the 5.7 million officially classed as unemployed in the U.S. in February 2020, and enough to leave much work left to do before the bank could be satisfied.

It would take more than eight months and at least until January 2022 for the size of the unemployed population to return to its pre-pandemic size even in a possibly-unlikely scenario where the U.S. labour market continues to create or recover from the coronavirus the same 433k average number of jobs reported in the monthly non-farm payrolls survey over the five months to the end of May.

It's not clear that such a rate of repair is sustainable.

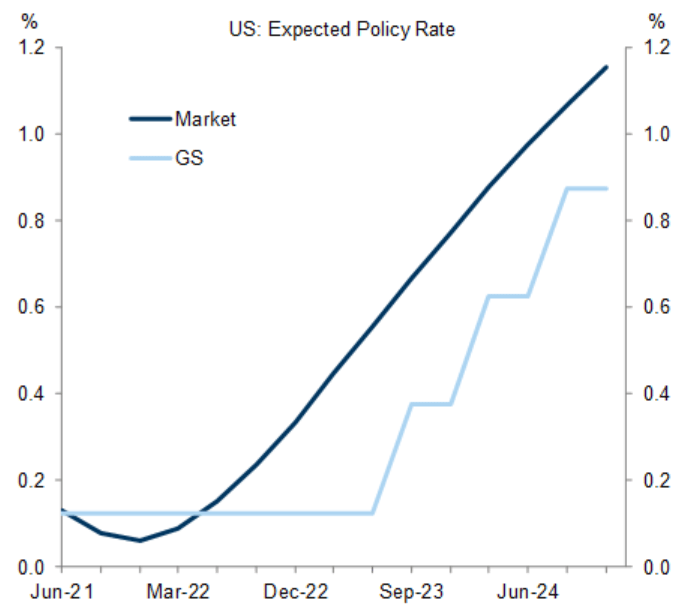

Above: Goldman Sachs forecasts for U.S. interest rates alongside market implied expectations.

“Our own funds rate forecasts are well below market pricing, and it’s important to recognize that US growth and inflation should peak relatively soon (on a quarterly basis, core PCE inflation peaks in Q2 and real GDP peaks in Q3 on our forecasts),” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

Investors and financial markets have so-far gone even further than the Fed’s optimistic dot-plot when pricing-in a return to pre-pandemic monetary policy settings in the U.S., which potentially leaves the Dollar vulnerable to disappointment and especially so if senior members of the Fed's rate setting committee continue in the weeks and months ahead to undermine popular thinking about the outlook for borrowing costs.

And with the market being where it is, and FOMC member seemingly so far away from a united front, economic numbers like this week's PMI surveys and Friday’s non-farm payrolls will be of enhanced importance to Dollar exchange rates up ahead because perceptions of the job market’s recovery and degree to which recent inflation is likely to remain elevated up ahead will both have a direct impact on expectations of the Fed.

"We would caution against extrapolating the hawkish Fed signal too far, ahead of the substantial deceleration we expect into 2022,“ Pandl says. "For now, we stay on the sidelines in G10 vs USD, and keep open our recommendation to go short USD vs BRL and RUB in EM.”