Renminbi in Focus after 6.40 Melts and PBoC Warns On "One-sided Expectations"

- Written by: James Skinner

- USD/CNH forecasts falling as RMB crosses key level

- Amid USD’s decline & PBoC’s pushback on inflation

- China in domestic inflation & deleveraging battle

Image © Adobe Images

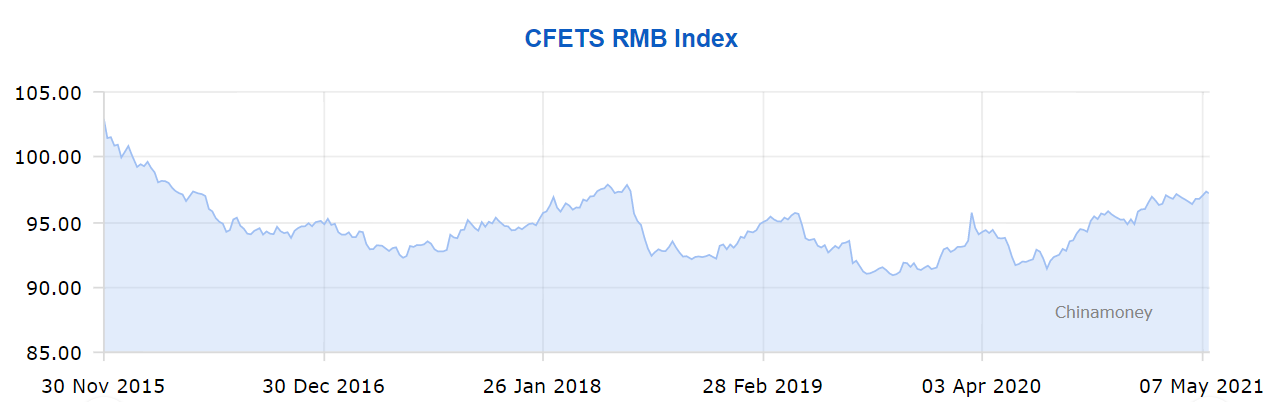

The Renminbi stood tall against the Dollar and other China Foreign Exchange Trade System (CFETS) currencies on Friday including the Pound after a key level of USD/CNH began to melt steadily away, prompting analysts to set out or in some cases look anew at their forecasts for the world’s second largest currency.

The Renminbi, or Yuan as it’s otherwise known, has made headlines this week with an erosion of the Rubicon-like 6.40 level in the main Chinese exchange rate USD/CNH, which was still trading lower on Friday even as the Dollar itself turned higher before the release of key U.S. economic figures.

China’s offshore Renminbi remained elevated ahead of the weekend with USD/CNH still below the landmark 6.40 level having made six consecutive advances against a Dollar which had been retreating broadly from other currencies until the mid-week session on Wednesday.

“A PBOC statement about the yuan's exchange rate overnight has not cooled the bullish ardour on the spot rate following the break of the USD/CNY 6.40 level on Wednesday. However, risk reversals through the 1-year tenor have perked up,” says Alvin Tan, head of Asia FX strategy at RBC Capital Markets.

“The statement warned against "one-sided expectations" on the exchange rate,” Tan adds.

This was after Peoples’ Bank of China (PBoC) policymakers set the fixing rate or midpoint of the permissible trading band for the onshore Yuan - which trades under the currency code USD/CNY - beneath 6.40 for the first time on Friday albeit that the distance below was a lesser one than that anticipated in China.

Above: USD/CNH shown at weekly intervals alongside CNH/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The latter detail of Friday’s fixing could be a signal from the PBoC that if the Renminbi’s appreciation continues at all; it would only be likely to do so in a measured way and with plenty of the two-way price risks often warned of by the bank in the past as well as over the last week.

The Renminbi has moved higher against a great many other components of the CFETS basket this week, while the move below 6.40 took many in the market by surprise and has this week prompted analysts to reconsider or reiterate earlier forecasts for the Renminbi in the months ahead.

The move matters not only for China but also for all other currencies out there in the market and in order to aid readers as they build understanding; a handful of forecasts and commentaries from analysts and firms followed by Pound Sterling Live are set out below.

“The moves have been orderly with little signs of either ‘smoothing’ or comment from officials on the undesirability of the move. Our view is that economic fundamentals support yuan appreciation. Further, and of recent discussions and messaging around commodity prices, the stronger yuan can help to offset pressures on domestic price pressures. Another reason for a lack of discouragement,” says Patrick Bennett, head of Asia FX strategy at CIBC Capital Markets.

Above: Renminbi Vs China Foreign Exchange Trade System (CFETS) basket of currencies.

CIBC Capital Markets’ year-end USD/CNH forecast of 6.20 is pertinent in light of China’s recent concerns about the impact that rising Dollar-denominated commodity prices are having on the production costs of firms, and the implications they could have elsewhere in the economy.

Currencies and foreign exchange market participants had been watching the Renminbi closely after it was suggested by a senior PBoC researcher in one of the bank’s many magazines last Friday that policymakers collectively consider a decision to “appropriately appreciate the exchange rate and resist import price effects.”

China’s producer price index rose by 6.8% in April, reflecting both Dollar-denominated commodity price inflation as well as statistical base effects in an outcome which caused widespread consternation at the time, though the average increase in producer prices over the first four months of the year has been a lesser 3.3%.

USD/CNH would fully offset the 3.3% four-month average increase in producer prices if it reaches 6.20, having ended last week just above 6.44.

“There is a small case to be made for RMB appreciation to act as an import cost buffer. But annual underlying CPI inflation in China is still below 1.0%, and in any case, the CCP's 'Dual Circulation' strategy has been implemented with a goal of reducing China's import dependency (so regulators will probably clamp down on a forthcoming rise in import volumes owing to a stronger RMB),” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: GBP/CNH, USD/CNH and EUR/CNH shown at weekly intervals.

“With a very mixed picture for RMB fundamentals, and domestic reflation, monitoring USDCNH for signs of the PBoC's reaction function is becoming increasingly important. We would remain short of the pair and look to trim again at 6.35,” Gallo adds.

Gallo noted on Thursday how the growth rate of industrial operating income at Chinese companies had slipped from 28.7% to 21.8% in the very same April month during which producer prices rose at their strongest levels, which has boosted profits for miners but squeezed end users of raw materials in the manufacturing process.

He also says “balance of payment factors and financial stability risks,” could also playing a role in the currency’s rise, which comes after a months-long period in which China’s policymakers and regulators have made myriad attempts to not only reduce commodity inflation, but to also prevent or otherwise reduce the frothy financial market rallies seen elsewhere in the world and especially in Western markets.

“The move today, while it is well managed and in part reflects USD developments more broadly, can also feed into broader downside pressure for the dollar. The increased integration of China in global trade means the CNY has a greater and greater weighting in other currencies’ trade-weighted indices and hence the CNY move will reduce fears of further currency gains on a trade-weighted basis,” says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG.

“This break in USD/CNY is therefore important and does open up the potential for broader USD weakness and at the margin means a little less concern from the ECB over EUR appreciation.”