U.S. Dollar's Path Lower Intact after Fed’s Taper Talk Falls Flat

- Written by: James Skinner

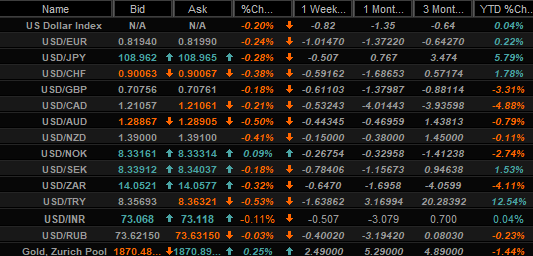

- USD in renewed declines as Fed taper fears fade

- USD falls with yields as QE cutback seen far off

- EUR, AUD, NZD, PLN leading advance Vs USD

Above: File image of Fed Chairman Jerome Powell. Image © Federal Reserve.

- GBP/USD reference rates at publication:

- Spot: 1.4154

- Bank transfers (indicative guide): 1.3753-1.3850

- Money transfer specialist rates (indicative): 1.3916-1.4050

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Dollar losses renewed heading toward the final session of the week with European and commodity currencies outperforming as investors looked past the latest volatility-inducing developments in the Federal Reserve policy conversation.

Dollars were sold in exchange for almost all other major currencies again on Thursday following a mid-week surge that reached a crescendo shortly after minutes from the Federal Reserve's (Fed) April monetary policy meeting hit the market.

Wednesday’s minutes showed a small minority of Federal Open Market Committee (FOMC) members thought it would likely be necessary at some points during the next handful of months to begin discussing the appropriate timing of separate talks about the future of the bank’s $120bn per month quantitative easing programme.

“The Fed’s actions speak louder than its words, and while some members are concerned that the overshoot in inflation could persist, the committee’s primary focus is still broad and inclusive full employment. That’s a long way off, as total jobs trail pre-pandemic levels by more than 8 million,” says Nema Ramkhelawan-Bhana, head of research at Rand Merchant Bank.

Above: U.S. Dollar quotes and performances over selected horizons.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The acknowledgement revealed nothing to the market that wasn’t already known or couldn’t already be inferred, although it did play to lingering expectations in some parts that rising inflation will eventually panic the bank into packing away some of its economically supportive policy tools in a decision that would inevitably lift American bond yields and revive the Dollar.

The Dollar surged in the hours after the minutes were released, building further on gains wracked up earlier when stock and commodity markets tumbled across the globe, but was quick to lose steam overnight before seeing widespread losses on Thursday.

“We have a lot of sympathy with USD bears who look at last night’s minutes and wonder why the fuss. If 10% nominal GDP growth, booming asset prices from housing to equities, a backdrop of huge fiscal easing, rampant speculation in alternative assets, are together not enough to start discussing a taper plan, one would wonder what is,” says Elsa Lignos, global head of FX strategy at RBC Capital Markets.

“The initial USD reaction seems to have been more a function of short-term positioning than any shift in Fed view,” she adds.

Above: Pound-Dollar rate shown at hourly intervals with EUR/USD.

The U.S. economy is expected to recover strongly this year, aided by trillions in financial assistance for households from Washington and making the country a major driver of global growth for 2021, which has periodically lifted U.S. bond yields in recent months and driven bouts of strength in the Dollar.

However, each time the greenback has deflated after bond yields top out, in each instance leading to dip-buying in European currencies that were among the outperformers on Thursday.

“As long as the Fed is talking about talking about tapering, Treasuries are likely to remain stuck in their range and the dollar's path of least resistance is to go on falling, albeit slowly,” says Kit Juckes, chief FX strategist at Societe Generale.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Current levels of U.S. economic momentum would be a powerful stimulant for almost any currency although combining it with the present monetary policy settings of the Fed has had a corrosive effect on the inflation-adjusted returns offered by U.S. assets and proven a noxious mixture for the Dollar.

The Fed says its QE programme will continue at least until “substantial further progress” has been made toward returning the job market to full employment and that interest rates will stay near to zero until inflation has risen above the 2% target for long enough that it then averages the target over time.

“We continue to recommend investors fade the risk the FOMC will prematurely reduce policy support because the US economy is still a long way from the Fed’s employment and inflation goals,” says Elias Haddad, a strategist at Commonwealth Bank of Australia.

Above: U.S. Dollar Index shown at 4-hour intervals with 10-year U.S. bond yield.

Reaching the Fed’s goals is expected to take an extended period of time during which other central banks would likely have an opportunity to wind down their crisis era programmes or even begin lifting their own interest rates first, which further darkens the Dollar’s outlook.

“The Dollar Index will see periodic taper talk-driven upside, but with substantial progress on the economy unlikely to be apparent until the back-end of 2021, sustained DXY upside is likely to prove elusive,” says Richard Franulovich, head of FX strategy at Westpac.

Dollars were sold in exchange for all major currencies on Thursday though with demand flowing most to the Euro and Polish Zloty, which have benefited this week from a reopening of major Eurozone economies and are the only two currencies Pound Sterling has declined against over the last five days.

The Pound-to-Dollar exchange rate held above 1.41 throughout however, while the Australian and New Zealand Dollars advanced alongside the Euro.

“GBP/USD has pushed towards the Feb highs of 1.4235-40 and a break could flip its recent 1.37-1.42 range to the upside,” says Tim Riddell, a Westpac colleague of Franulovich.

Above: Pound-Dollar rate shown at daily intervals with U.S. Dollar Index.