Pound-Dollar Forecasts Upgraded as Fading Undervaluation Puts 1.50+ On Horizon

- Written by: James Skinner

- GBP/USD forecasts upgraded as undervaluation dissipating.

- Vaccine backstops recovery, BoE's stance turns less 'dovish'.

- GBP/USD seen at 1.53 by year-end, 1.40 possible near-term.

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3644

- Bank transfer rate (indicative guide): 1.3275-1.3380

- FX specialist providers (indicative guide): 1.3450-1.3545

- More information on FX specialist rates here

The Pound-to-Dollar rate fell amid a widespread rebound in U.S. exchange rates on Tuesday, although upgraded forecasts from ING suggest substantial further upside ahead later in 2021 as its post-referendum undervaluation fades, which is seen lifting GBP/USD back above 1.50 before year-end.

Pound Sterling was on course for a hat-trick of declines against a resurgent Dollar on Tuesday amid price action that was all the more notable for the large concurrent gains in global stock and commodity markets, which all suffered heavy losses last week but have since begun to recover.

Dollar gains saw Sterling cede to the U.S. currency its recently acquired position as the best performing major unit of 2021, although the Pound was still comfortably the second best performer of the fledgling year and is seen as having ample scope for recovery as well as further gains ahead.

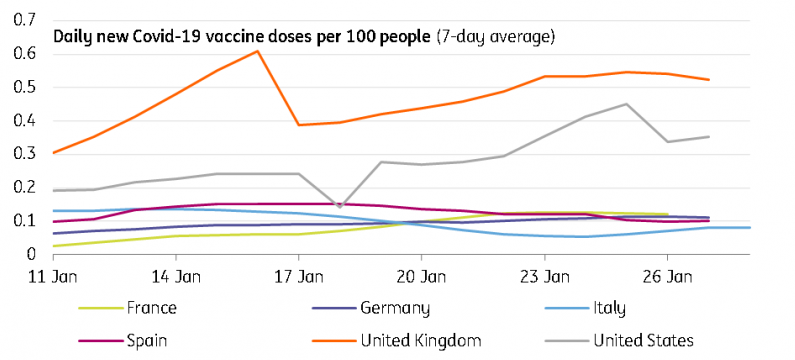

Source: ING.

"With GBP having suffered persistent Brexit-related undervaluation since 2016, the currency should now start the process of a gradual convergence towards its medium-term fair value," Krpata writes in a note accompanying upgrades to ING's Pound Sterling forecasts.

The UK has pulled ahead of other major economies including the U.S. in the race to vaccinate against the coronavirus, which has offered the economy a glimpse of a headstart in an eventual recovery. The government is aiming to have a substantial majority of the population provided with at least one dose of a vaccination before the summer is out and is said to be in with a shot at achieving it by the end of June. It's effectively bought more than 350 million jabs, more than five for each person in the country.

A mid-year attainment of herd immunity could enable the economy to reopen up to three months ahead of those over in mainland Europe which, although seemingly a miniscule difference in the grand scheme of things, is still likely to matter to the short-termist currency market. Especially with Sterling having lagged other major currencies in last year's rally against the greenback, many of which are now at stretched levels and are losing momentum.

"It's also not totally inconceivable that the majority of adults will have been offered their first dose by the end of the second quarter, particularly if other vaccines (e.g Johnson & Johnson) arrive in the UK earlier than currently planned. All of this potentially means the UK will achieve a slightly earlier reopening - though this will undoubtedly be a gradual process," Krpata says.

Above: Pound-to-Dollar rate shown at daily intervals with 55 & 200-day averages and EUR/USD (orange).

"As for GBP/USD, its gains should be even more pronounced as the pair will also benefit from the rising EUR/USD (we expect EUR/USD to move into the 1.25-1.30 area later this year -see FX Talking). GBP/USD should in turn breach the 1.50 level in 2021. The fact that GBP/USD remains one of the least overbought crosses in the G10 space in terms of speculative positioning (as reported by the CFTC) also points to further sterling upside," Krpata adds.

The tentative prospect of an imminent and sustained economic recovery means the Bank of England (BoE) will have less reason than otherwise to cut interest rates or further expand its quantitative easing program in the months ahead. As a result ING upgraded its forecasts for Sterling this week and now looks for the Pound-Dollar rate to rise to 1.39 by the end of March, before hitting 1.45 in June and going on to end the year at 1.53 - it's highest since late 2015.

June and year-end forecasts reflect upgrades from 1.42 and 1.48 respectively.

The BoE has been assessing the feasibility of a negative interest rate policy while blowing hot and cold on the perceived merits of one. Governor Andrew Bailey indicated last month that he and some of his colleagues are still not very enthusiastic about the idea, although the findings of the review and determination on feasibility are set to be announced this Thursday at 12:00.

"We expect the Bank of England (BoE) to make no policy changes on Thursday. Interestingly, the UK 1‑year OIS curve has fully priced‑in 10bps of policy rate cuts. Our base case scenario is for the BoE to keep rates on hold over the forecast horizon. Bottom line: the risk is GBP/USD edges up to 1.4000 as UK interest rate expectations adjust higher," says Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia.

Above: GBP/USD, weekly intervals, with Fibonacci retracements of 2018 fall, 55 & 200-week averages, EUR/USD (orange).

Along with the resurgent Dollar, this week's BoE meeting is another reason why GBP/USD might be found on the back foot on Wednesday and ahead of the event on Thursday, even as the medium-term valuation outlook brightens.

"The MPC won’t want to shut the door entirely to negative rates, as the present situation of “creative ambiguity” works well for them," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "Nonetheless, investors' patience will be tested by another meeting at which the MPC dithers and sounds lukewarm. Accordingly, we expect swap rates and gilt yields to rise modestly in the wake of the MPC’s meeting. And by the summer, we think that the Committee will settle on enhancing the Term Funding Scheme—by letting banks access four-year funds from it at a negative interest rate—as an alternative to reducing Bank Rate below zero."

Undervaluation, in a market where many central banks are complaining that their currencies have risen too far against the Dollar, is a potential boon for the Pound because in the short-term at least, it makes Sterling one of the few viable outlets for investors' expressions of bearish views on the greenback.

However, U.S. vaccine success has got some traders wondering if the Dollar too could be on the cusp of outperformance, making it a bit of a wild card.

"The strange combination of higher bonds, higher gold, higher stocks and higher dollar yesterday has led to a lot of head scratching. It is extremely rare to see the USD higher in such a positive, risk-parity loving environment," says Brent Donnelly, a spot FX trader at HSBC. "The two best-performing currencies in the past week have been the USD and GBP. Is it possible that superior vaccination rollout has triggered currency appreciation? As money flows out of Asia on concerns about China tightening, perhaps it flows to the places that have successfully vaccinated the most citizens? This could easily be a coincidence, but if it is, it’s an interesting one."

Above: U.S. Dollar Index shown at weekly intervals with Euro-to-Dollar rate (orange).