U.S. Dollar Looks for Short-term Stabilisation after Republicans Routed from Congress

- Written by: James Skinner

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3540

- Bank transfer rate (indicative guide): 1.3211-1.3307

- FX specialist providers (indicative guide): 1.3383-1.3492

- More information on FX specialist rates here

U.S. exchange rates saw widespread losses on Wednesday as Georgia State's runoff election appeared to vindicate a downbeat outlook for the currency in 2021, although a lack of upside for many major rivals is a prospective curveball that could offer short-term support to the Dollar Index in the weeks ahead.

One of two incumbent Republican senators in the state of Georgia appeared to have lost a runoff election on Wednesday as local media declared the Democratic Party candidate Raphael Warnock the winner over Kelly Loeffler.

Meanwhile, the other Republican David Perdue had all but conceded defeat to the Democratic Party's Jon Ossoff in a hardfought race that may eventually be decided by a recount due to the razor thin margin between the two candidates.

"This does not mean, though, that Democrats will now be able to enact President-Elect Biden’s entire Build Back Better Agenda, because the plan involves a substantial net increase in spending over the next 10 years, and therefore needs 60 votes," says Ian Shepherdson, chief economist at Pantheon Macroeconomics. "But to be clear, the balance of power, influence, and agenda-setting in DC has just shifted dramatically."

Above: Dollar Index shown at daily intervals.

The still-tentative results will see control over the Senate, the upper chamber of Congress, shift to the Democratic Party and will mean the Republican Party has been routed from a once-dominant position in Washington.

Republicans will then be a minority in both chambers of Congress with Democrats wielding an absolute majority that affords the incoming administration of President Elect Joe Biden broad legislative freedom.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

Democrats will fall short of the super majority required in the Senate to make certain programmes law without having to indulge at least some Republican senators, not to mention any so-called moderates in the Democratic Party, although a less thrifty approach to spending and a more onerous regulatory hand are still practically assured.

"We presume that the USD index decline we have already seen this week largely prices in the blue sweep (for at least a few weeks) so a surprise reversal of that expectation would probably bring a quick USD rally of about 1% or so," says Greg Anderson, global head of FX strategy at BMO Capital Markets.

Above: Dollar Index shown at monthly intervals.

A spendthrift fiscal impulse and long-lived concerns about America's 'twin deficits,' comprising both a budget deficit and current account deficit, have been key pillars of the bearish outlook widely held for the Dollar this year.

Observations of widening deficits have long dogged the U.S. and were often cited during the term of President Donald Trump as grounds for Dollar declines.

However, and the rub for the greenback is that even if these concerns go unfounded again, this week's election results are still a potentially bearish omen for the U.S. Dollar given the likely impact on American stock markets.

"An infrastructure spending boost can attract foreign direct investment flows to the US and underpin USD. But the possibility of lower foreign portfolio equity flows to the US and higher US inflation expectations will weigh on USD. President‑elect Joe Biden plans to raise corporate taxes and the minimum wage," says Elias Haddad, a strategist at Commonwealth Bank of Australia.

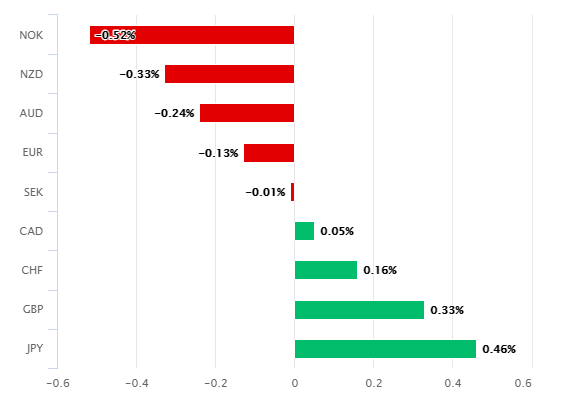

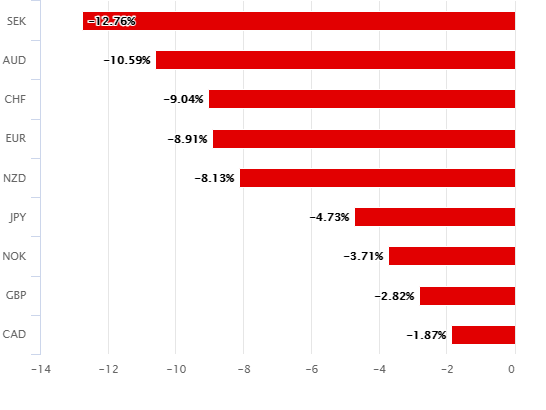

Above: Dollar performance against major currencies on Wednesday (left) and for 2020 year (right).

A wafer thin congressional majority could deprive the Democratic Party of an opportunity to move ahead the 'Build Back Better' intiative that was advocated by Joe Biden and other national leaders around the world last year but that hasn't stopped U.S. stock markets from underperforming peers this January.

Democratic Party legislative actions need not match the scale of the Build Back Better programme of industrial reform and reorientation in order to foster underperformance by U.S. stocks and exchange rates.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Joe Biden's pledges to raise corporate taxes, lift the minimum wage and impose other climate-related levies are enough to reduce expectations for profitability, which can in turn impact the relative outlook of international investors for American markets that outperformed during the Trump presidency.

The S&P 500 was down -0.01% for 2021 on Wednesday while European benchmarks like Germany's DAX index, Spain's IBEX and Britain's FTSE 100 were all in the green. The Dow Jones, a more directly comparably index, had risen 0.70% but had still underperformed European counterparts.

Above: Dow Jones Industrial Average shown at weekly intervals and alongside Germany's DAX Index (blue).

"While these probable victories raise the level of political uncertainty and certain sectors of the US equity market may under-perform (healthcare, tech for example), the macro implications of these election outcomes are clearly positive. There is now a chance of larger stimulus cheques for US households (USD 2,000 instead of USD 600) and an increased prospect of larger fiscal stimulus support in general going forward," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "We had not assumed Democrat victories in these elections and hence some revisions weaker to the extent of USD weakness we expect this year may be warranted. We currently tentatively are targeting 1.2800 for EUR/USD by year-end."

Lesser inflows into shares listed on the S&P 500 as well as other U.S. indices would reflect lower demand for the Dollar over the medium and long-term, although in the short-term at least there's a lack of major currency candidates for further increases against the greenback that could ultimately afford the Dollar Index a now-rare period of stability.

The Dollar Index is heavily influenced by moves the EUR/USD, USD/JPY and GBP/USD exchange rates, which collectively account for around three quarters of flows measured by the barometer, and there's a range of reasons for why those exchange rates could support the Dollar over the coming weeks.

USD/JPY is one of the few Dollar pairs hat could actually benefit from a Congress dominated by the Democratic Party, according to Commonwealth Bank of Australia, while the coronavirus and sheer scale of increases already notched up could act as short-term headwinds for GBP/USD and EUR/USD.

Above: USD/JPY shown at daily intervals and alongside EUR/USD (blue).

Europe's single currency had already risen almost 1% for 2021 on Wednesday, taking its gain for the calendar year to January 07 to 9.87% - a move that already drew frequent protest from the European Central Bank (ECB) last year.

Meanwhile, Sterling was scraping the bottom of the major currency barrel after all of the UK was placed into a 'lockdown' that could last until the end of March, despite the country having one of the world's largest order books for vaccines and the largest number of people who've been innoculated to date.

The Pound had fallen against even the U.S. Dollar for the period thus far in 2021 and some analysts were tipping it as well as the Euro for at least a short period of consolidation against the greenback.

"GBP/USD charted a key day reversal just ahead of the 1.3712 February 2018 low. We also have divergence of the daily RSI and would allow for losses to the 1.3540/1.3483 September and early December highs," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. "EUR/USD negative divergence of the daily RSI reflects a loss of upside momentum near term but we will need to see failure at 1.2210 the 31st December low. This should see losses to the 1.2130 21st December low and potentially 1.2058 the 9 th December low."

Above: GBP/USD shown at daily intervals and alongside USD/SEK (blue).