U.S. Dollar Comeback Extends, Helped by Chinese Yuan

- Written by: James Skinner, Additional Editing by Gary Howes

Image © Adobe Images

- GBP/USD spot rate at time of writing: 13297

- Bank transfer rate (indicative guide): 1.2934-1.3028

- FX specialist providers (indicative guide): 1.3101-1.3180

- More information on FX specialist rates here

The Dollar has endured a strong recovery over the past 48 hours, pushing the Pound-Dollar rate back to 1.33 on Thursday, the Euro-Dollar back to 1.18 and the Australian Dollar-U.S. Dollar to 0.7305.

The Dollar index - a measure of broader Dollar performance based on a basket of Dollar exchange rates - is meanwhile looking to record a third consecutive day of advances, having recovered to 93.0 from Monday's 27 week low at 91.75.

The Dollar's gains might had as much to do with a rally in Chinese exchange rates as it did anything else.

"We've seen numerous accounts which have blamed today's rally in the USD on profit taking after a stronger US PMI reading on Tuesday. Perhaps during a non-farm payrolls week, that argument carries a bit more weight than it otherwise would. But the weakness in this narrative is that it doesn't fully line up with recent history," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "Instead, we're minded to put more weight on today's 540 pip decline in EUR/CNH."

Dollars were bought widely on Wednesday, breaking a three-day cycle of back-to-back losses for the U.S. unit although uniform price action in the currency space came alongside a more mixed picture elsewhere in the markets.

Precious metal prices were lower alongside oil and major economy bond yields outside of North America although stock markets including those in the U.S. were higher in what marked a break in the negative correlation between the greenback and the S&P 500.

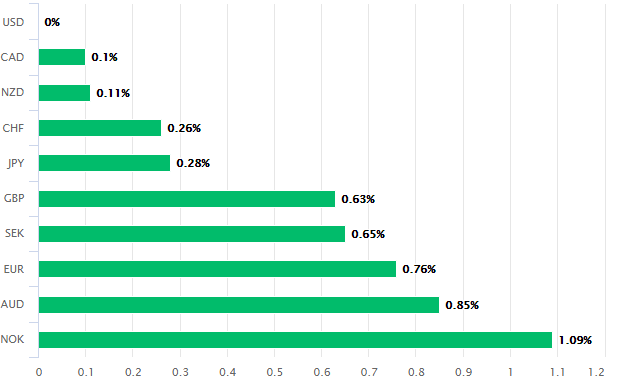

Above: U.S. Dollar performance against major currencies on Wednesday. Source: Pound Sterling Live.

There are many competing explanations for Wednesday's price action although divergence between the Dollar Index and S&P 500 rules out a simplistic risk-on-risk-off narrative while gains arising in the wake of Tuesday's PMI survey petered out not long after that day's London close.

BMO's Gallo has flagged the Chinese currency as a prominent driver behind the EUR/USD declines that did most of the heavy lifting for the Dollar Index, which is more than 50% comprised of the Euro. The Yuan has risen by more than 2% against the Dollar in the last week although Gallo calculates that China's rough equivalent of the Dollar Index rose by a full percent on Wednesday alone, with a meaningful portion of that resulting from a -540 point fall in EUR/CNH.

EUR/CNH has fallen sharply in recent days but had previously been trading at its highest level since early 2014 despite simultaneous strong gains for the Yuan relative to the greenback illustrated by losses in USD/CNH.

This is because EUR/USD rose much further and faster than USD/CNH fell, generating an automatic and mechanical uplift in EUR/CNH that facilitated Dollar depreciation while laying the economic costs of trade-weighted currency appreciation at the feet of the European Central Bank.

Above: USD/CNH shown at hourly intervals alongside EUR/CNH (black line, left axis).

"The broader price dynamic in the currency suggests it would be trading even firmer if the PBoC were to fully step aside, leading us to believe that a combination of both USD weakness and 'real flow' are providing support to the RMB right now," Gallo says. "The consequence for the broader FX space is that more orderly appreciation of the RMB takes some upward pressure off other nonUSD currencies as the USD weakens."

A meaningful if-not substantial part of the all the above price action has been as much about facilitating an exodus of capital from Dollar exchange rates as it has anything else. The Dollar has gone from hero to zero this year alongside the approval rating of President Donald Trump although investors have been short of sufficiently large and meritable alternatives to invest themselves in.

Capital has evidently been shepherded toward the Chinese Yuan, perhaps on account of its size and headstart in recovering from the coronavirus, before targeting the Euro following May's proposal for a coronavirus recovery fund that's like balm for the Eurozone outlook. But currency strength is rarely welcomed by central banks, particularly those in big exporting countries and especially amid global economic disruption of historic proportions.

"What strikes us is how divergent the EUR's broad rally is with the economic backdrop in the Eurozone. While the markets might be ignoring this for now, at some point, it will matter and the dissonance will be deafening," says Dominic Bunning, a strategist at HSBC in a research note. "In an economy deep in recession and facing deflationary pressures, the EUR's strength is creating much tighter financial conditions than would otherwise be in place. The market may not care about this disconnect for now, but it creates a big headache for the ECB. Through analysing the raw text of ECB communication we see that the ECB is referring to financial conditions more than ever before."

Above: USD/CNH shown at daily intervals alongside EUR/CNH (black line, left axis).

Rising exchange rates disadvantage a country's exports by making them more expensive to buy while complicating the work of inflation targeting central banks given that stronger currencies reduce import costs and eventually, inflation.

"Herein is the main point: the USD is still in a depreciation cycle despite the pullback in EURUSD, and we have to continue looking to the PBoC for signals about the pace of USD depreciation - and where the USD weakness is likely to be concentrated," Gallo says.

Both of the above sideffects are a big part of why the European Central Bank drew a Euro-to-Dollar themed line in the sand around 1.20 this week, which has left investors and the market in a bind.

"The ECB's references to the exchange rate increased significantly after the last round of notable EUR strength in 2017. By early 2018, the ECB was placing much more importance on the exchange rate. This coincided with a reversal in growth dynamics, growing expectations for further ECB easing and a fall in the EUR. In the current environment, where EUR strength is much less justified by the economic backdrop than it was in 2017-18, we believe the ECB's rhetoric on FX is likely to ramp up and further easing is likely. Such a shift by the central bank should curtail further strength in the EUR, in our view," Bunning says.

Above: Pound-to-Dollar rate shown at weekly intervals alongside EUR/USD (black line, left axis).

Investors who don't want Dollars will need a currency in which they can park cash while preserving value, but Gallo sees the Peoples' Bank of China frustrating or otherwise slowing any increase in the Yuan and the ECB effectively began closing its own doors to the market Tuesday. This leaves investors in need of a new outlet for Dollar depreciation pressures. Sterling is one of a limited number of candidates. The Japanese Yen is another.

If investors can't stomach holding either the Brexit-battered Pound Sterling or Japanese Yen that's currently subject to a changing of the guard in Tokyo, then they might be left with little choice other than to just lump it with the U.S. Dollar.

This would mean Wednesday's rally in the greenback is sign of things to come and that the Pound-to-Dollar rate has already seen its best days. Only time will tell which side of the fence the market comes down on.

Should the British, Japanese and other smaller currencies be preferable for investors then among the first and foremost places where such a preference would reveal itself is in a stronger GBP/USD rate and a lower USD/JPY, followed by a higher GBP/EUR and a lower EUR/JPY.

Above: Dollar Index shown at weekly intervals alongside GBP/USD (blue line, left axis) and EUR/USD (black line, left axis).