Pound-Dollar Rate Breaks to 8-Month High as Jackson Hole Froth Evaporates to Reveal Exposed Dollar

- USD down across the board

- Fed policy shift opens door to further USD weakness

- GBP/USD resistance at 1.3265 might stymie Sterling

Image © Adobe Images

- GBP/USD spot rate at time of publication: 1.3317

- Bank transfer rates (indicative guide): 1.2950-1.3044

- FX specialist rates (indicative guide): 1.3117-1.3197

- Please see here for more information on why some rates are better than others

The Pound-to-Dollar exchange rate has broken to a fresh 8-month high at 1.3290 ahead of the weekend, the move coming courtesy of a sizeable adjustment in the U.S. Dollar following Thursday's important policy briefing form the U.S. Federal Reserve at the Jackson Hole Symposium.

The Fed said it would adopt a policy that would allow inflation to overshoot 2.0% in coming months and years in order to guarantee economic growth; the market's take is that this is a strong signal that the good times of easy money are here to stay for a good while longer.

The flip-side of the easier-for-longer monetary policy is that the Dollar would tend to be weaker because 1) the Dollar tends to fall when investors are confident and 2) the additional supply of dollars by the Fed lowers the value of the Greenback.

To be sure, the market's initial response to the Fed's Jackson Hole statement was counterintuitive in that the Dollar went higher. However, the market does tend to need some time to settle after such important developments and Friday sees a more textbook reaction underway.

One potential reason for the Dollar's counterintuitive strength in the wake of the statement's release was a distinct lack of concrete information as to the mechanics that might be deployed to achieve its new policy objective.

"The lack of information on that disappointed the market and hence the reversal of the initial USD sell-off," says Derek Halpenny, Head of Research at MUFG in London.

Halpenny says the Fed's statement has nevertheless left the door open to delivering more detailed guidance at the September 16 policy meeting,

"So while the Fed disappointed market expectations to some degree yesterday, the prospect of action in September will help to limit the scale of any renewed USD buying," says Halpenny.

MUFG have long argued the Fed is ultimately heading toward some element of Yield Curve Control and this view has not changed following Jackson Hole.

The Pound-to-Dollar exchange rate has expressed the Dollar's weakness by going higher 1.3291, which is its highest level since December 2019. (If you have Dollar-based payments you might want to secure today's rates for future use, thereby protecting your budget if you are not quite ready to transact. Likewise, you could look at setting up an order to buy your ideal rate when it hits find out more here).

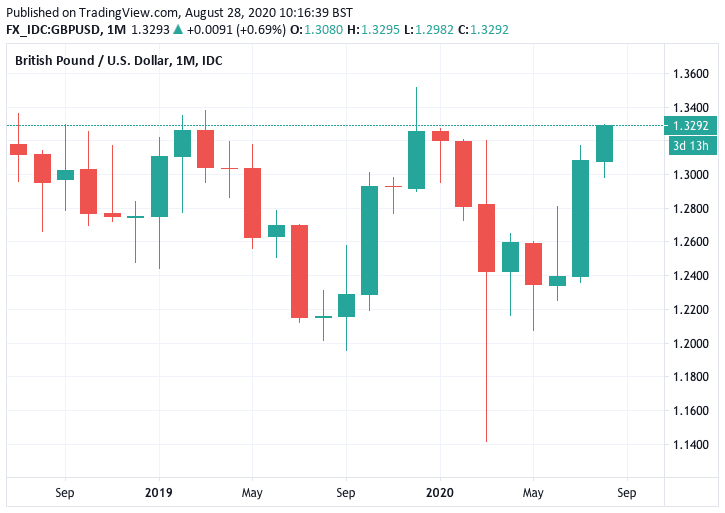

Above: Monthly GBP/USD chart.

"The bulls are on the brink of a breakout again. Elevated volatility during yesterday’s session left a somewhat neutral looking candle with potential bull failure. However the bulls have dusted themselves down and come back in this morning to pull the market higher once more and to test the resistance around 1.3265," says Richard Perry, an analyst with Hantec Markets.

The Euro-to-Dollar exchange rate has meanwhile leapt to 1.1919 at the time of writing, which takes the pair back to mid-August highs. The 2020 high is located at 1.1965.

"Daily momentum is beginning to pick up and if the market can begin to close above 1.1880 it would be a sign of growing confidence that the bulls are regaining control again," says Perry.

"We’ve been bearish on the USD against overseas majors, and while a lot of the available ground is now behind us, there’s still room for a further adjustment in the quarters ahead," says Avery Shenfeld, analyst at CIBC Markets. "This is, after all, a correction for a currency that was overvalued on trade fundamentals vs. Europe and Asia, and which no longer has the support it once had from a divergent central bank policy."

The Fed will now target an average 2.0% rate of inflation while introducing an emphasis on broad and inclusive employment. The move to an average inflation rate implies that the Fed will not rush to raise interest rates in the future on signs inflation is heating up thereby putting a handbrake on the economy. Typically a central bank will look to raise interest rates when inflation starts to run too hot, with the threshold for such a judgement being the 2.0% level.

However, raising interest rates can restrict the supply of money to the economy and slow down economic expansion. It is clear the Fed is keen to avoid choking off economic growth in coming months in the event of rising inflation, particularly if the jobs market has not recovered.

"In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time," read a statement from the Federal Reserve, detailing the new policy.

Markets are reading the decision as a signal that the Fed will pursue a loose monetary policy of 'lower for longer' interest rates and generous quantitative easing, whereby it issues new money in order to buy government and corporate bonds.

"The Jay Powell Fed was far more aggressive in its response to a global dollar shortage in March than previous FOMCs have been. Relative real, nominal, long and short-term rates have moved sharply against the dollar and longer-term growth expectations have too," says Kit Juckes, a foreign exchange analyst at Société Générale. "All good reasons to be bearish of a dollar which, in both real and nominal terms, is very stretched and indeed, has corrected relatively little so far."