Pound-to-Dollar 5 Day Forecast: Supportive Technicals, Eyes on Democratic National Convention

- GBP/USD near 1.31 at start of new week

- Brexit trade talks continue this week

- Eyes on U.S. politics as Democrats meet to endorse Biden

Above: Kamala Harris, Joe Biden. Photo by Adam Schultz / Biden for President

Pound Sterling starts the new week relatively flat against the U.S. Dollar with the GBP/USD exchange rate respecting a range above 1.30 that has been in place since the start of the month, however a volatile week for Sterling lies ahead given Brexit trade negotiations commence once more while the release of flash PMI data at the end of the week will be eagerly anticipated for a foreign exchange market obsessed with the speed of the post-covid economic recovery.

For the Dollar, the Democratic National Convention and the release of the minutes from the July Federal Reserve policy meeting will be of interest.

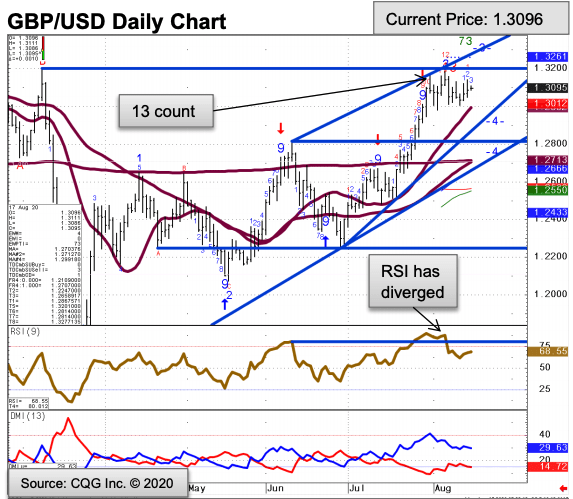

The Pound-to-Dollar exchange rate is quoted at 1.3104 at the time of writing with one analyst telling us that Sterling is being frustrated by some significant overhead resistance that looks likely to remain in place for some time.

"GBP/USD continues to hold sideways and is now neutralising. The market is currently sidelined below the 1.3186 high charted last week," says Karen Jones, Team Head of FICC Technical Analysis Research at Commerzbank. "Dips lower are expected to find initial support at the 1.2814 June high ahead of 200 day ma at 1.2713 and remain contained by the 1.2659 support line. It is facing tough resistance at the 1.3186 recent high and the 1.3201 March 2020 high."

Image courtesy of Commerzbank

Should the exchange rate go above the February high at 1.3213 the market will then potentially target the 1.3500/15 area which is the December 2019 high / January 2009 low.

However, should the exchange rate slip below the May low at 1.2072 a more negative outlook is introduced and a slide back to the 1.1409 March low becomes possible.

How the Pound ends the week will likely depend on Friday's briefing from EU and UK negotiators following this week's trade negotiations. The two sides meet on Tuesday in Brussels and are expected to attempt to iron out further differences between the two sides.

We don't expect any breakthrough on the major issues but instead the two sides to make further progress towards such an outcome. However, any unexpected successes or obvious break down in tone would likely inject some volatility into the pair.

For now, markets continue to assume a deal will be reached, which should ultimately keep Sterling somewhat supported.

Irish premier Micheál Martin said last week that Prime Minister Boris Johnson had shown a "genuine desire" to finalise a trade deal, and that the did not want to compound the coronavirus crisis with a "no deal" economic shock.

"Driven mostly by risk sentiment recently, the Pound enjoyed a wave of increased demand ... following optimistic comments by Ireland’s PM, Micheál Martin, regarding a Brexit deal after a meeting with UK PM Boris Johnson," says George Vessey, UK Currency Strategist at Western Union Business Solutions.

Martin added both the EU and UK had identified a "landing zone" for a deal to be agreed.

"This sparked a rush of demand for Sterling. Brexit talks resume (this) week and have the potential to increase Sterling volatility. If progress is made and hints of an agreement are unveiled, then sterling should strengthen, and this might be the catalyst to drive GBP/USD towards and beyond $1.32 and GBP/EUR towards €1.12," says Vessey.

UK chief negotiator David Frost meanwhile said last Thursday that a Brexit agreement can be reached with the European Union in September.

The suggestion by Frost that a deal is possible by September suggests the UK are looking to maintain pressure on the EU this week. However, most Brussels watchers are seeing a trade deal as only being likely in October as this is when the next scheduled European Council meeting of European leaders takes place.

The EU are notorious for tending to only reach big decisions at such summits, and hence why October is widely held to be the likely deadline for progress.

"The negotiations for a post-Brexit deal have apparently been more successful behind closed doors than on the main stage. Markets seem, however, quite relaxed for the time being. We do currently not see any Brexit obstacles on the horizon that could derail the GBP," says Thomas Flury, Strategist at UBS.

However, Vessey warns if talks breakdown and the deadlock persists, :then sterling traders may take profit on the recent GBP/USD ascent, which could drag the pair back under the $1.30 handle, with $1.2960 being the next key support, which would then open the door to $1.27. GBP/EUR could tumble under €1.10."

Concerning headlines on Monday come in the form of a piece in The Sun where, Harry Cole, Political Editor at The Sun, says "there are growing whispers that the EU’s demand of so-called “level playing-field rules” — in reality, continued red tape and Britain bound to Brussels law for ever — could be too much to overcome."

He adds there is "rising talk of shelving trade deal hopes for now. But that’s better than being bounced into a deal that will stop Britain bouncing back."

We expect these kind of stories where anonymous officials are quoted, to become increasingly common over coming weeks as focus returns to the trade negotiations. While unofficial briefings can often be way off the mark, they can also carry some truth and report such as that from the Sun will serve as a firm reminder to markets that caution remains warranted.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Flash PMIs will be Key UK Event this Week

The main data release for the Pound in the week ahead ahead are the flash PMIs for August which will give a sense of how the recovery in the UK is progressing.

"Activity likely rose gradually through August as most countries continued to ease up COVID restrictions (local shutdowns excepted). We see upside risks and expect small gains across most key PMI measures, indicating recovery, but still at a relatively subdued pace," says a note from TD Securities.

The UK PMIs are out at 09:30 on Friday 21 and with relative economic performance being an increasingly important factor for foreign exchange markets to consider, a beat or miss of consensus forecasts could influence direction in the Euro and Pound.

The UK Services PMI is forecast at 57, up from the previous month's 56.5 while the Manufacturing PMI is forecast at 53.6, up from July's 53.3. The Composite PMI is expected at 56.6, down on the previous month's 57.

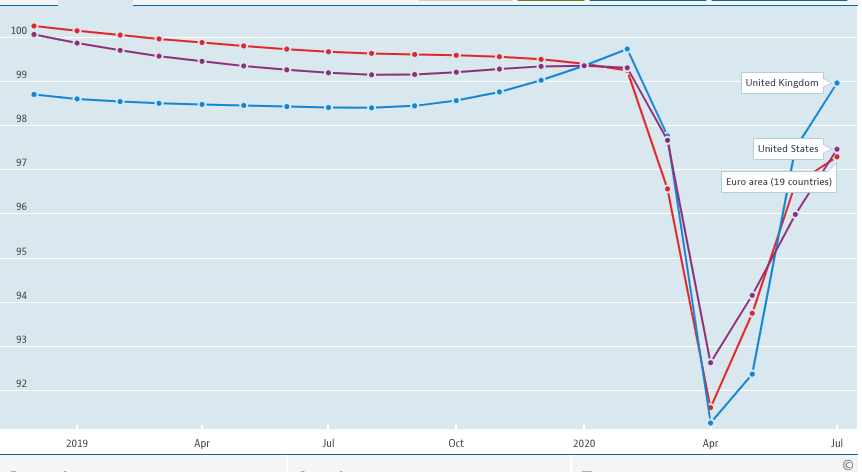

How the UK recovery compares to the recoveries of other economies matters when it comes to exchange rates, as we are in a world where economic outperformance is beginning to matter again.

The OECD gathers timely economic data from the world's largest economies and compiles it into its Composite Leading Indicator which gives a view of major turning points in an economic cycle and allows us to see how economies are performing relative to each other. The below shoes the Composite Leading Indicators for the UK, US and Eurozone:

The immediate takeaway is the UK economic recovery has started to outperform that of the Eurozone and the U.S., and should this be picked up by official data in coming weeks and months we could well see this translate into more sustained Sterling advances.

U.S. Dollar Week Ahead: Politics and the Fed

The data calendar for the U.S. this week is distinctly uneventful, allowing the market to focus on politics and Federal Reserve policy.

The Democratic National Convention will kick off the 2020 presidential election season, with the party officially selecting Joe Biden and Kamala Harris as its nominees for president and vice president.

What matters for markets are hints at where economic policy under a Biden presidency will go, indeed we noted in a piece out earlier this month that expectations for a Biden victory could have been a driving force behind a weaker U.S. Dollar.

"Given that Trump administration policymaking has promoted a stronger USD in recent years, markets are likely to associate a potential changeover to Biden with a weaker USD. It is early days to venture forecasts about such changes, but these are certainly important factors to watch," says UBS' Flury.

According to Crédit Agricole research, U.S. Dollar losses were more pronounced when the incumbent was heading for defeat.

"Market concerns that such a scenario may materialise could lead to renewed USD losses in the coming months," says Valentin Marinov, Head of G10 FX Research & Strategy at Crédit Agricole.

A change in guard would naturally go some way in overturning Trump's policies that were ultimately supportive of the Dollar.

According to Crédit Agricole, there are five reasons why a Democrat president could be less supportive of the U.S. Dollar:

- Fiscal austerity measures (including higher taxes) may be needed to address the significant deterioration in the US fiscal deficit and accommodate calls for an overhaul of the healthcare system

- Less aggressive protectionist policies especially against NATO allies in Europe

- More regulation for energy and financial companies

- The White House ‘influence’ over the independent Fed could ease

- Producing a potentially weaker growth outcome than if President Trump is re-elected

The Democratic National Convention is expected to provide some details as to where their economic policy will land come November.

The main economic event on the calendar for the U.S. Dollar this week will be the release of the minutes from the Federal Reserve's July policy meeting.

"At the July FOMC meeting the Committee did not initiate any new policy actions and changes to the statement were minor. While the Fed chairman did not provide any major details on the review, or forward guidance, he did suggest that the review will "wrap up… in the near future." We expect the minutes to provide additional colour on how those discussions are evolving," says a note from TD Securities.

The general rule of thumb in foreign exchange markets is that when a central bank eases policy, the currency it issues tends to fall in value. The Fed has this year embarked on an unprecedented policy of easing, by lowering interest rates, boosting quantitative easing and introducing numerous programmes aimed at assisting the U.S. economy.

The announcement of further easing measures in anticipation of a weaker economic outlook would naturally weigh on the Dollar.

"Minutes of the July FOMC meeting are released on Wednesday and any suggestion of impending Average Inflation Targeting (AIT) or Yield Curve Control (YCC) would be a dollar negative. On balance we would prefer to back the latter story next week, meaning that the DXY could make a new low," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank.