Pound-Dollar Week Ahead: Charts Warn of Reversal Lower as Analysts Look for Dollar Recovery

- Written by: James Skinner

- GBP on front foot Friday but is vulnerable to USD recovery.

- Markets drunk on virus optimism, risk assets are vulnerable.

- GBP fails to overcome key level for fourth consecutive week.

- Contained by key averages as 'shooting star' forms on charts.

Image © Adobe Images

- GBP/USD spot at time of writing: 1.2506

- Bank transfer rates (indicative): 1.2248-1.1227

- FX specialist rates (indicative): 1.2300-1.2376 >> More information

The Pound-Dollar rate was little changed last week despite a marked improvement in risk appetite among investors and is increasingly road-blocked to the upside by technical impediments on the charts, at a point when analysts looking for a bounce-back by the U.S. Dollar.

Sterling ended the week on its front foot against the greenback as the U.S. currency went out with a whimper after stock markets rallied in response to a strong performance by remdesivir, an antiviral drug produced by Gilead Sciences, in clinical trials ran by The University of Chicago Medicine.

That stoked optimism about a possible lessening of the human cost of the virus at a point when daily infection numbers are increasingly confirming that a peak has been reached for outbreaks in the major economies. However, some analysts have warned that markets are getting ahead of themselves and that a peak in major economy outbreaks does not necessarily mean that a return to normal life will come quickly.

Normalisation is expected to be staggered, potentially leading to a slow as well as uneven global economic recovery and a return of exchange rate volatility. Many also increasingly tip a fresh increase in demand for the Dollar, which would be bad for the Pound-Dollar rate, and more nuance to moves in exchange rates up ahead. Until Friday the currency market had been driven by binary changes in risk appetite and the resulting effect on demand for the ultimate safe-haven that is the big Dollar.

This Dollar-favourable outlook is augmented by American steps toward the lifting of lockdowns in states that feel able to, with even New York State Governor Andrew Cuomo having admitted at the weekend that his locality appears to be over the worst of its outbreak. New York state has by far the largest number of coronavirus infections in the U.S., with many of them centred in New York City, although daily numbers of new infections have plateued across the country.

Above: Pound-to-Dollar rate at hourly intervals.

Frustrated U.S. citizens in Ohio, Texas and Maryland protested at the weekend, seeking an accelerated lifting of lockdown measures. This is as the UK, one of the last in line to experience an outbreak, has offered no indication of when restrictions could be eased and due to the slow initial response to the national epidemic might be among the last to get it under control. That would indicate a more protracted period of economic pain for the UK.

"There are risks aplenty that could serve to dent this optimism in the coming weeks. Emerging markets remain vulnerable, especially if COVID-19 is to spread more aggressively in EM countries that have generally escaped the worst until now. Falling crude oil prices is another risk that could unsettle financial markets while the underwhelming policy response in Europe could unsettle periphery bond markets further after selling this week. The good news is that any renewed risk-off trading conditions will likely be contained given the ‘do whatever it takes’ stance of the Federal Reserve," says Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. "Still, over the short-term, we see prospects for renewed dollar strength despite the selling evident today as risk sentiment remains positive."

The Dollar favourable outlook comes after the Pound-Dollar rate failed to overcome the 61.8% Fibonacci retracement of its 2020 downtrend for a fourth consecutive week, leaving Sterling contained at the open of the new week by that resistance barrier as well as the 55 and 200-day moving-averages of prices. Technical analysts are bearish in their outlooks or at the very least, sceptical of the notion that there's much upside for Sterling from current levels.

Above: Pound-to-Dollar rate at daily intervals with Fibonacci retracements of 2020 downtrend marked out.

"It’s back to reality for the GBP after its apparent bullish breakout early in the week as it bobs around in between the low 1.24s and the low 1.25s with no clear price signals that it may make a move above 1.26 in the near term. The 1.24 level will nevertheless act to heavily curtail GBP declines while (soft) resistance stands at 1.2515/30 to be followed by the 50-day MA at 1.2551," says Juan Manuel Herrera, a strategist at Scotiabank.

Last week's price action has left the 200-day moving average at 1.2652 firmly intact and expected by many to still act as tough resistance, and that's only if Sterling can make it across the kay fault line that is the 61.8% Fibonacci retracement of the 2020 downtrend at 1.2514. Sterling will start the week with that level offering resistance and as fundamental as well as technical analysts look for the greenback to recover from Friday's selling.

"GBP/USD's outlook stays negative, the market has rallied to and so far failed at the 200 day ma at 1.2652. We look for a slide back to the 20 day ma at 1.2307. Failure here will target the 1.2163 7 th April low. Below here is needed to alleviate upside pressure and refocus attention on 1.1491, the 2016 low and last week’s low at 1.1409," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Above: Pound-to-Dollar rate at weekly intervals. Latest candle appears to be 'shooting star' pictured at bottom of page.

Scotiabank doubts the upside for Sterling while Commerzbank's Jones is betting on a decline in the Pound-Dollar rate from 1.2608 having entered a 'short' trade against it earlier in April. She tips the exchange rate to fall to 1.1409 over the next three weeks or so and has a three-month outlook that envisages a decline all the way down to a fresh 1985 low of 1.0463.

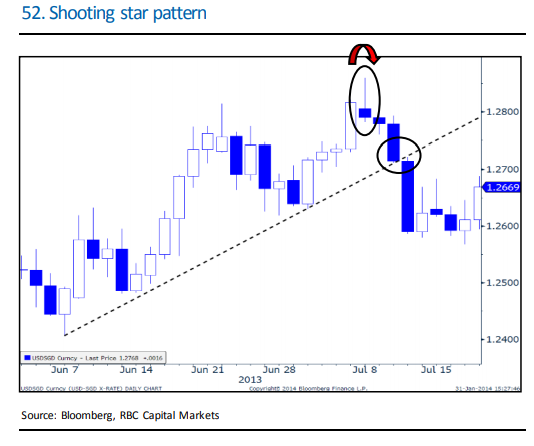

This is at a time when the weekly charts are also turning increasingly bearish for the British currency following the formation of a 'shooting star' reversal pattern last week, which indicates a reversal of the mid-March uptrend could be in the pipeline. Technical analysts at RBC Capital Markets say the following about this pattern in a brochure that explains key technical concepts to clients.

"A candle pattern that develops after an uptrend and features a long upper shadow along with a small (or no) lower shadow. The pattern is also comprised of a very small real body that forms near the low for that time period. Implications: The sharp rejection of a new cyclical high and the close near the bottom end of the trading range indicates that a shift in market sentiment has taken place," writes George Davis, chief technical strategist at RBC.

Above: RBC Capital Markets graph shows 'shooting star' pattern.