JP Morgan: Coronacrisis Recession to be Worse than the Great Financial Crisis, Dollar Not Yet Done

- Markets rally into month end

- Recession to be worse than that of 2008 say JP Morgan

- "New benchmark for extreme economic disruption"

- Dollar tipped to strengthen further

Image © Adobe Images

- GBP/USD spot at time of publication: 1.2339

- Bank transfer rates (indicative): 1.20-1.21

- FX specialist rates (indicative): 1.22-1.2230 >> More information

Global stock markets are rallying into the end of what has been a tortuous month for investors, suggesting a growing confidence in the market that the worst of the coronacrisis has now come to pass.

However, the improvement in investor sentiment belies the fact that no vaccine for Covid-19 has yet been found while it remains far from likely that a sustainable 'herd immunity' in the world's population is close at hand. The recent financial meltdown is a result of a medical crisis, yet no medical solutions are available.

Furthermore, the full economic impact of the crisis remains difficult for investors to adequately comprehend considering the scant data available that covers the March period and the prospect for negative economic surprises over coming weeks is therefore elevated.

"The unfolding global contraction is poised to supplant the Great Financial Crisis (GFC) as the new benchmark for extreme economic disruption – the current collapse in economic activity is much deeper within individual economies and is enveloping a much broader range of economies concurrently than was the case in the 2008 crash," says Daniel P Hui, a strategist at JP Morgan.

U.S. economists at JP Morgan last week more than doubled their expected quarterly contraction for the U.S. economy in the second quarter and they now expect the economy to be 10% smaller by mid-year.

Giving a flavour as to the scale of the contraction was the release last week of U.S. jobless claims for March which suggest U.S. unemployment surged 2.0% in a single week, confirming suspicions that the speed of the current downturn is unprecedented, "and that the extent and duration of the downturn remains difficult to pin down," says Hui.

According to JP Morgan, the peak contraction in developing market economies in the first half of 2020 is now forecast to be almost twice as severe as during the GFC, moreover this is occurring over only two quarters compared to the 1.5 years during the GFC.

JP Morgan warn that unlike during 2008 and subsequent years, China will not be able to buffer global growth unlike in 2008, indeed economists at the investment bank forecast China to contract 10% in the first quarter of 2020.

"China’s shutdown in 1Q underscores the much more synchronised nature of the current downturn compared to 2008 when global growth as a whole didn’t contract until 3Q08 after Lehman’s," says Hui.

Above: Percentage of countries contracting per quarter. The downturn is also much more synchronised and immediate than 2008, which took longer to gather speed and affect other economies despite the US starting to contract by Jan 2008 say JP Morgan.

Investors appear to be willing to buy into stock markets believing the significant support offered by central banks and governments has put a backstop under equity valuations.

Of note, the U.S. fiscal rescue package announced on March 25 would make available more than $2TRN in spending and tax breaks, aimed at softening the impact of the coronavirus outbreak on the U.S. economy.

However, Hui says, "the newly-agreed U.S. fiscal package, despite being a landmark for its sheer scale, is unlikely to be the catalyst to turnaround market dynamics and establish a lasting base in risk markets, nor therefore a lasting top in the USD cycle."

Nevertheless, the analyst does concede that the programme is an important backstop to prevent even more severe and lasting economic damage.

"Since this economic and financial crisis is at its core a health crisis, economic policy measures can only ameliorate the economic and financial consequences. Markets will bottom and the dollar will top only when there is public health resolution," says Hui.

More Dollar Gains

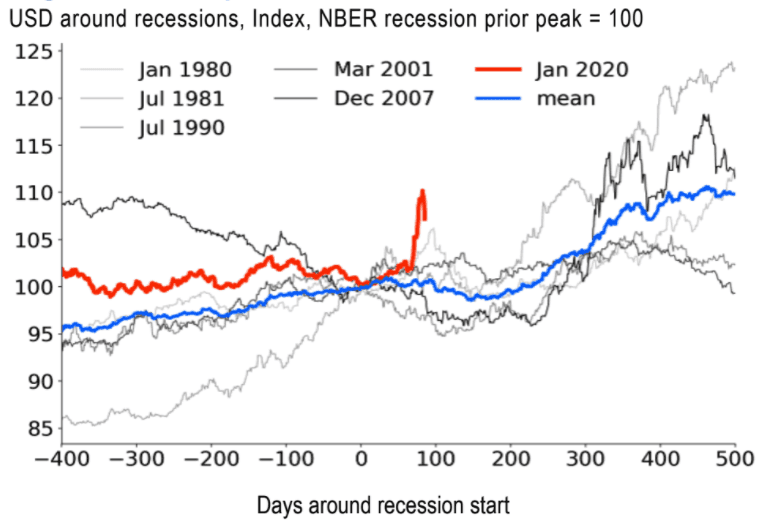

Looking at the currency market, JP Morgan say that the surge in the value of the U.S. Dollar since the onset of the coronacrisis has been notable, but it is not without precedent when compared to previous recessions.

What the above graph shows us that the Dollar has reacted earlier, understandable considering the sharp pain from the crisis was almost immediately felt by the whole world, whereas in previous episodes of stress the feedback into the Dollar has been more drawn out.

"The appreciation in USD and sell-off in high-beta currencies is unprecedented this early in a recession. But that doesn’t necessarily imply that FX markets are overreacting, certainly not as the pace and spread of this global recession itself is unprecedented," says Hui.

Crucially, what the graph does also suggest is there remains scope for further USD gains.

"The magnitude of the USD rally (as much as 10%) still comes up short compared to the recessionary episodes in 1980 (12%), 1981 (24%), and of course 2008 (18%)," says Hui.