Pound-to-Dollar Rate Spurned by Tough Resistance, Outlook Deteriorates

Image © Adobe Images

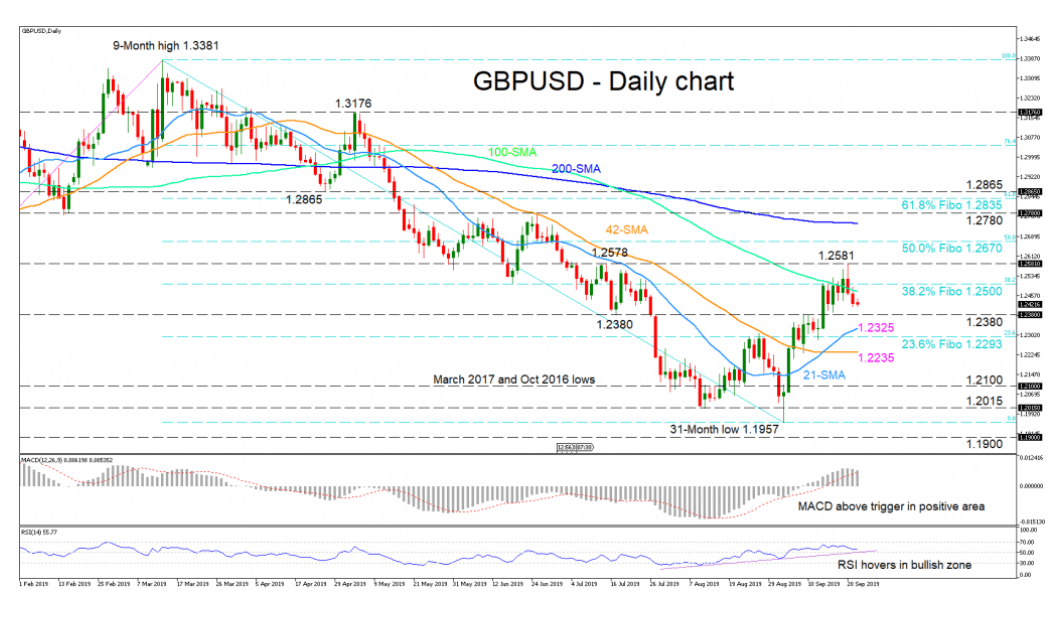

- GBP/USD rolls over after break above 1.25

- Short-term uptrend still intact but weakened

- Medium-term trend still bearish

The GBP/USD exchange rate is again trading with a bearish bias after it failed to conquer the old July high at 1.2578.

The pair temporarily broke above the July highs on September 20 but it failed to hold onto the gains and slipped back down underneath the 1.2500 hurdle soon after, where it languishes today at around 1.2444.

Momentum indicators such as the RSI and MACD in the lower chart panes are now turning down and supporting the recent weakness, increasing the risk that the short-term uptrend may become compromised.

A break below the 1.2380 support level would start to fall in line with the medium-term trend which “sustains a bearish outlook” says Anthony Charalambous an investment analyst at XM.com.

Yet it is still too early to write off the short-term uptrend altogether.

“Traders need to be aware though, of the still inclining 21-day SMA and the 42-day SMA, which has flattened, both still backing the short-term upside outlook,” says Charalambous.

A break below these MAs at 1.2325 and 1.2229 respectively would be required to really open up further downside to the 1.2100 handle.

How to reverse loses? A resumption of the bullish bias in the short-term would require a break above the 1.2581 ‘failure’ peak.

For the medium-term trend to turn bullish it would require a much higher move above 1.2780, where the 200-day MA is situated.

Along the way is resistance from the midpoint of the previous trend at 1.2670 whilst a move back over the key 1.2500 ‘rubicon’ could bring the 1.2581 peak back on the radar.

The British Pound's rally appears to have run out of steam, with foreign exchange markets appearing intent to await fundamental shifts in the Brexit saga.

The return of Parliament on Wednesday could well spark some short-term volatility but we doubt we will see any 'game changing' developments from a currency market perspective.

Many readers will argue that Tuesday's Supreme Court decision that found the Government unlawfully prorogued Parliament should be considered to be fundamentally significant, yet currency markets profoundly disagree.

In short, very little has changed: Parliament has successfully passed a law that outlaws the UK leaving the EU without a deal on October 31, and the Government continues to strive for a renegotiated Brexit deal to be struck at the October 17 European Council meeting.

Expect opposition parties to use their time in Parliament to frustrate the Government, but we are yet to hear of any plans that would ultimately alter the trajectory of Brexit.

"In my view principally nothing has changed for Sterling, and instead I fear that every day during which Parliament and the government are locked in conflict leading to yet another day passing without a Brexit solution being found is more likely to increase the risk of a disorderly Brexit," says Thu Lan Nguyen, a currency analyst with Commerzbank.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement