Pound-to-Dollar Rate in the Week Ahead: Potential For New Uptrend to Emerge

Image © Adobe Images

- GBP/USD has shown strength in previous week

- Suggests possibility of continuation higher

- Pound to be moved by Brexit developments; U.S. Dollar by inflation and retail sales

The GBP/USD exchange rate is trading at 1.2288 at the start of the new week after rising 1.05% in the week before, and our latest technical studies of the charts suggest that the pair has a more bullish outlook after recent gains.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair bottomed at the 1.1958 September 3 lows and from there started a new uptrend.

Although the exchange rate has pulled back since peaking at 1.2353 highs the pull-back has been gentle so far and this suggests a good chance the uptrend will eventually resume.

A break above the 1.2353 highs would probably lead to a move up to a target at 1.2500, a key milestone figure for the pair, where traders are more likely to take profit on their positions.

The daily chart shows how the pair bottomed last week, formed a hammer reversal candlestick and then made a strong recovery over the last 4 days.

It has risen up and encountered resistance from the 50-day moving average (MA) from where it has started pulling back.

This pull-back looks temporary and we expect a resumption higher eventually. Last week’s new uptrend was so sharp we expect it to continue. A break above the September 5 highs would probably confirm more upside to a target at 1.2600.

The daily chart is used to analyse the medium-term trend, which is the next week to month of price action.

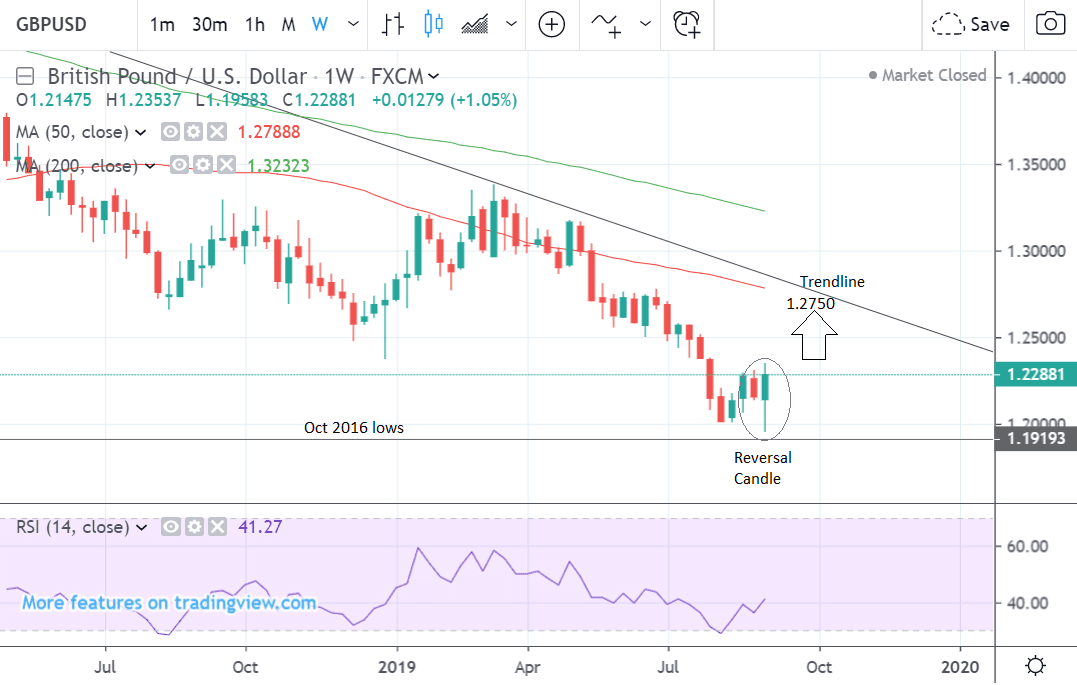

The weekly chart shows the pair appearing to bottom and reverse the long-term downtrend and start moving higher at the October 2016 lows.

The pair formed a reversal looking candlestick last week which looks a little like a hammer but is not exactly - nevertheless it looks quite bullish.

The RSI momentum indicator is looking constructive after rising relatively strongly out of the oversold zone.

The pair is showing the potential to continue its recovery up to a possible target at a major trendline and a target at around the 1.2750 level.

The weekly chart is used to give an idea of the longer-term outlook, which includes the next few months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound: What to Watch

Brexit is expected to continue to overshadow economic data as the main factor driving the Pound in the week ahead.

Boris Johnson will probably seek another vote of approval from Parliament for an early general election but he needs two-thirds of the vote to be successful and it seems highly unlikely he will get it.

If Johnson fails to secure an election before October 31 then we would suggest the chances of a 'no deal' Brexit in 2019 will have been materially reduced, and this development will surely provide support for Sterling.

What is certain, that while Brexit will have been delayed by recent developments, a 2019 General Election is almost a certainty, and it is here where market focus will fall.

Expect markets to try and weigh up the implications of the various outcomes: what would a Conservative majority mean, what would a Labour majority mean? What would the messy 'in-betweens' i.e. coalition and confidence-and-supply governments mean?

The range of potential outcomes are large in this time of Brexit, and therefore we would expect the uncertainty posed by the vote to keep a lid on Sterling and limit its full recovery potential.

On the data front, UK monthly GDP for July, industrial production, and employment data are the highlights.

GDP is expected to show a 0.0% rise in July like it did in June when it is released at 9.30 BST on Monday.

GDP showed a contraction of -0.2% in the second quarter of the year. Data out next week will show the 3-month rolling rate of GDP to July, which is expected to be -0.1%.

If the negative trend continues all through the 3rd quarter, i.e. in August and September, the country will have met the criteria for qualifying for being in a technical recession - two consecutive quarters of negative growth.

Although the Pound may decline if GDP comes out lower-than-expected next week loses may be short-lived if the Brexit news is positive for Sterling, as is widely expected.

“An overall expected downbeat set of data will not be able to stop the pound from bursting higher if Prime Minister Boris Johnson fails again in his bid to call a snap election,” says Raffi Boyadijian, an investment analyst at forex broker XM.com.

Employment data is expected to be broadly positive and show a continued rise in wages of 3.7%, an employment rate of 3.9%, and an increase in jobs of 43k in July, when the data is released at 9.30 on Tuesday.

Industrial and manufacturing production are forecast to show a -0.1% decline in growth in July when figures are released on Monday at 9.30.

The U.S. Dollar: What to Watch

The two main data releases for the U.S. Dollar in the coming week are inflation data on Thursday and retail sales on Friday.

Inflation data is forecast to show a rise of 0.1% a month in August, and 3.30% a year, when it is released at 13.30 BST on Thursday, September 12.

Core inflation is expected to show a 0.2% rise month-on-month and a 2.3% yearly rise.

Inflation data affects interest rates which impact on the U.S. Dollar. Higher inflation tends to lift interest rates which is positive for the Dollar and vice versa for lower interest rates.

Inflation has been rising quite strongly over recent months but should ease marginally in August according to some analysts.

“Core CPI inflation has ripped higher over the past two months, registering back-to-back gains of 0.3%. The prior two months’ strength was helped by catch-up in apparel and used autos prices, with July getting an extra boost from the volatile hotel and airfare components. We expect to see those effects fade in August, but for core prices to still eke out a 0.2% gain. Including food and energy, we expect the CPI to rise only 0.1% due to lower gas prices last month,” says U.S. lender Wells Fargo in a preview note to clients.

Despite recent strong gains in inflation, analysts at Wells Fargo do not expect the Federal Reserve (Fed) to drop their bias towards easing and cutting interest rates.

“Another surprisingly strong reading on core inflation is unlikely to sway the FOMC’s easing bias. We believe the Fed has grown more tolerant of 2%+ inflation as it desires to raise levels of inflation expectations,” says the bank.

Higher inflation could be a result, in part, to rising tariffs on inports - an influence the Fed is likely to ‘look through’.

Retail sales data is forecast to show a 0.2% monthly rise in August (0.1% for core sales), which is slower than the 0.7% result in July.

The U.S. consumer has remained relatively resilient despite the recent slowdown in manufacturing and the release will provide insight as to whether that is still the case.

“On Friday, retail sales and the University of Michigan’s preliminary reading of the consumer sentiment index will be closely watched too for proof that US consumers are still spending generously. In July, retail sales jumped by a stronger-than-expected 0.7% month-on-month. They’re forecast to have moderated somewhat to 0.3% in August,” says Raffi Bopyadijian, an investment analyst at FX broker XM.com.

The report could be key in relation to the Fed’s assessment of monetary conditions.

“The August retail sales report will be poured over to gauge how consumer spending is faring in the wake of recent tariff threats and volatility in financial markets. Another solid report will be taken by the Fed as a signal that consumer spending is holding up in the face of global headwinds, and that the economy is not in much need of additional policy accommodation at this time. A big miss, however, would raise concerns that consumer spending cannot sufficiently offset the headwinds from slower global growth and trade uncertainty, and add urgency for the Fed to ease policy further,” says Wells Fargo.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement