Pound-to-Dollar Week Ahead Forecast: Recovery in Doubt

Image © Adobe Images

- Recent GBP/USD weakness throws young uptrend into doubt

- Pair neutral now with more direction needed for bias

- Pound to be moved by Brexit developments; U.S. Dollar by employment data

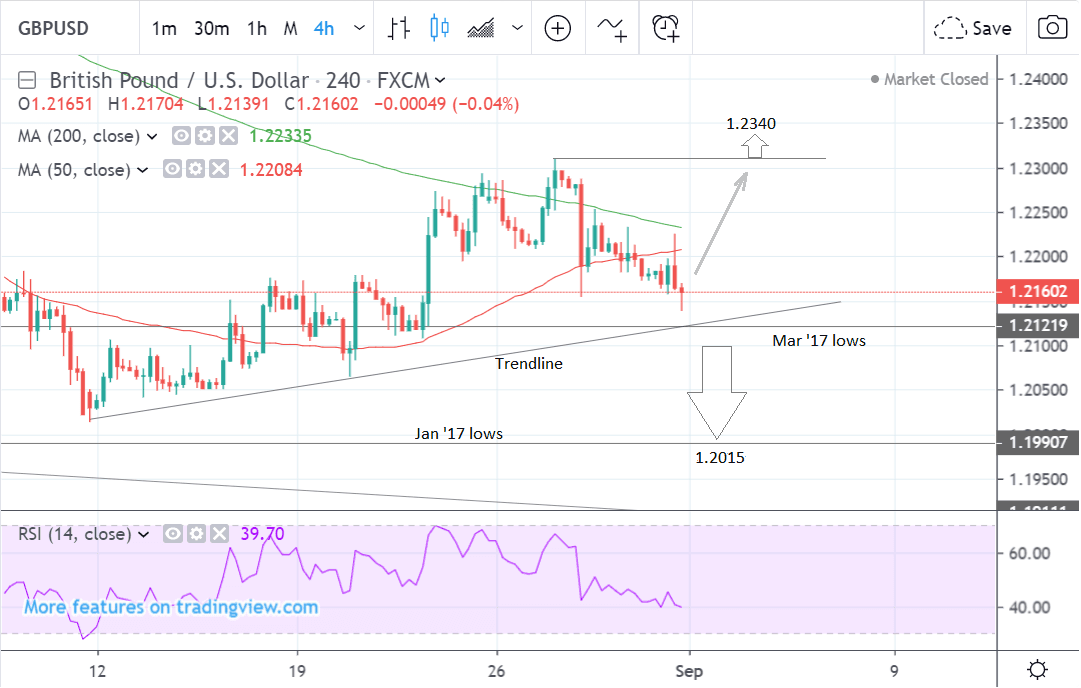

The GBP/USD exchange rate is trading at 1.2160 at the start of the new week after falling by 1.00% in the week before and studies of the charts suggest that the pair has a neutral outlook and would need to break clearly above or below key confirmation levels to develop a more directional bias.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair was in an established uptrend but then started to decline after peaking at the August 27 highs and has since fallen quite steeply to its current level.

The direction of the short-term trend is now debatable. Although the rally from the August 11 lows began a new uptrend the recent decline which was combined with strong bearish momentum suggest the possibility the uptrend may have reversed and turned bearish.

As such we would require a break above the August 27 highs at 1.2310 to reaffirm more upside to a probable target at 1.2340, where it is likely to encounter tough resistance.

Alternatively, a break below the March ‘17 lows and 1.2100 would provide bearish confirmation for a move down to a target at the 1.2015 lows.

The daily chart shows how the pair was in a downtrend which corrected back up to above 1.2300 during August and has since started to weaken.

Over the last three days, the pair has started falling again and there is a possibility the bigger downtrend could be resuming and could take the exchange rate back down to a target at 1.2015, after which it is likely to bounce and may start going sideways for the rest of the forecast period.

Alternatively, the pair could also recover and continue going higher. For confirmation of this, however, we would ideally wish to see a break above the 50-day MA and 1.2375. Such a move would then probably indicate a continuation up to a target at 1.2550.

The daily chart is used to analyse the medium-term trend, which is the next week to month of price action.

The weekly chart - used to give an idea of the longer-term outlook, which includes the next few months - also shows mixed signals.

The pair formed a harami reversal Japanese candlestick pattern a few weeks ago (circled), followed by a bullish candle last week, which reinforced the original signal and suggested more upside on the horizon. This wasn't to be last week, however, which saw a 1.00% decline eventually.

Whilst it is still possible the pair could start going higher again despite last week’s losses there is also an increased risk it could recapitulate.

The RSI momentum indicator is looking constructive. It recently exited the oversold region giving a ‘buy’ signal and last week’s decline was marginal.

The possibility remains that the pair could rally up to a long-term target at 1.2600 and the underside of a falling trendline after which it will probably go sideways underneath the resistance for a time.

Alternatively, the pair could fall below the early August lows to a target at 1.1850 potentially, after which it may well also go sideways for a time.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Pound: Political Fireworks

September 03 sees the UK parliament sit once more, and the return of MPs should herald what is potentially going to be the most explosive week of parliamentary politics of our generation.

We fully expect Sterling to react to developments in parliament, and therefore warn readers that volatility is likely to be elevated.

MPs return to a shortened parliamentary session owing to the decision by Prime Minister Boris Johnson to suspend parliament from September 12 to October 14. The move has galvanised those MPs in the House opposed to Brexit into accelerating the passing of legislation designed to frustrate the Prime Minister and remove the option of a 'no deal' Brexit taking place on October 31.

Reports out late last week suggest MPs have agreed the form of legislation they would want to present.

If markets deem the legislation as having the potential to pass, and block a 'no deal' then there is a decent chance Sterling can extend higher.

However, we are of the firm belief that the best possible outcome for those wanting a stronger Pound would be for a Brexit deal to be struck. We believe that removing 'no deal' from the equation lessens the incentive for European negotiators to offer the substantive changes on the Northern Irish border backstop that Johnson is seeking.

It also materially lessens the incentive for MPs in the House to vote for a deal.

Johnson is looking to strike a fresh agreement with the EU and see it passing through the House on the back of the votes of MPs who have no option but to vote for a deal if they want to avoid a 'no deal' outcome.

Keep in mind that it is also possible opposition leader Jeremy Corbyn calls a vote of no-confidence when parliament.

A vote of no confidence has a fairly good chance of being successful given the large number of rebel Conservative MPs who are against a hard Brexit.

Press reports out on the weekend suggests Johnson will look for those MPs who vote against the government to be expelled from the party. This could shrink the scale of the Conservative rebellion against him.

It could however free up a number of MPs to vote against their ex-leader.

We view a no-confidence vote as offering up fresh uncertainty, and therefore potential downside for Sterling.

However, highlighting just how difficult it is to judge the landscape, some analyst believe a no-confidence vote could in fact be good for the Pound.

“If we have that vote of no confidence, whilst it is uncertain what the outcome would be, the Pound would go up on that headline alone. So that is why I think there is a shimmer of hope for a tactical long trade,” says Jordan Rochester, an analyst at Nomura.

There is a risk the Pound could also gain a boost from a legal challenge mounted by the anti-Brexit campaigner Gina Miller, who is attempting to prevent the proroguing of Parliament in the high courts.

Miller's argument is that a proroguing of this length of time is unprecedented. That the Queen was ill-advised and that it is unlawful as it was undertaken precisely to prevent parliament from doing its job of scrutinising the executive.

Opponents claim parliament typically does not sit at this time of year anyway, to allow for party conferences and that it is not within the remit of the courts, as it is a solely political matter.

“The Johnson hijackers are saying that the prorogation of parliament ahead of a Queen’s speech is what always happens – and that it is no more than a normal convention and precedent in our unwritten constitution. But there is no convention or precedent for a five-week prorogation. In the last 40 years, parliament has never been prorogued for longer than three weeks. In most cases it has been prorogued for only a week or less, for example for 3 days in 2015, 5 days in 2016 and 6 days in 2017,” says Miller.

The court hearing for Miller’s case has been set for Thursday, September 5. If she is successful Sterling will almost certainly rally.

On the economic data front, the main releases are manufacturing, construction and services PMI data on Monday, Tuesday and Wednesday respectively.

These could impact the Pound since PMI’s are seen as fairly reliable leading indicators of economic growth, and a better-than-expected result is likely to lead to a rise in Sterling, whilst vice versa for a lower-than-forecast result.

Manufacturing PMI for August is forecast to show a rise to 48.4 from 48.0 when it is released on Monday at 9.30 BST.

Construction PMI is expected to show a rise to 45.5 from 45.3 when it is released on Tuesday at 9.30.

Services PMI is estimated to have fallen to 51.4 in August from 51.0 previously when it is released at the same time on Wednesday.

The U.S. Dollar: Focus Rests on Labour Market

The main releases for the U.S. Dollar in the week ahead are the U.S. labour report on Friday, the ISM manufacturing PMI on Tuesday and the trade balance on Wednesday.

The labour report includes non-farm payrolls, which are forecast to have risen by 159k in August, little changed from the 164k in July, and relatively strong. The unemployment rate is forecast to remain at a historically low level of 3.7%.

The report also includes average earnings, which are forecast to show a rise of 3.1% in August when the data is released at 13.30 BST on Friday. This would be marginally below July’s 3.2%.

Since labour market data is seen as the most sensitive to the state of the economy any dramatic swings higher or lower will impact on the U.S. Dollar. Higher payrolls or wages will strengthen the currency and vice versa if they are lower.

The ISM manufacturing PMI is expected to show a fall to 51.0 from 51.2 when it is released at 15.00 on Tuesday. The metric is seen as a key gauge of the country’s economic well-being so a higher-than-expected result would be likely to support the Dollar and the opposite if the result is lower.

The trade balance is the third major release and it is forecast to show a $-53.5bn deficit in July when the data is published at 13.30 on Wednesday. This would represent a narrowing of the trade deficit from the -55.2bn of June.

The trade data will be of interest to investors as it provides clues as to how the trade war is impacting on the U.S. Part of the rationale for raising tariffs on Chinese goods was to reduce the trade deficit, which has not happened.

This suggests the U.S. is highly unlikely to remove tariffs yet. Without a removal of tariffs it is unlikely the Chinese will agree to a trade deal and tensions are likely to continue between the two superpowers.

A deep trade deficit tends to put pressure on the currency both because it needs to fall to right the imbalance in trade and because it impacts negatively on economic growth.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement