The U.S. Dollar is Tipped for Losses as Investors Hold Out for Trade War Fix

- Written by: James Skinner

© The White House

- USD tipped to weaken as market clings to Trump's contested claims.

- Hope of trade war progress lingers even after China says none made.

- TD says sentiment shift could favour GBP, AUD, NZD and the EUR.

- But true fix to tariff conflict to remain elusive, risks USD recovering.

The Dollar put in a mixed performance Tuesday as investors responded positively to economic data and President Donald Trump's earlier claims that progress is being made in trade talks with China, which have prompted analysts at TD Securities to tip the U.S. currency for weakeness up ahead.

Risk assets like stocks and commodities were higher at the beginning of a holiday-shortened UK week Tuesday as investors celebrated claims by President Trump that suggest China is seeking a deal to end the trade war between the two countries, with Trump having said Monday that China contacted the U.S. overnight with a request to resume negotiations. But China has disputed the claim that it reached out.

"Markets are back in repair mode again after policymakers played nice at the G7. We still think this backdrop relies on sentiment and positioning than any real progress in the trade wars," says Mark McCormick, head of FX strategy at TD Securities. "That said, while our [risk] barometer sits in risk-off territory, it has reached the point where fading the scare factor offers tactical opportunities."

Above: Pound-to-Dollar rate shown at daily intervals, alongside NZD/USD rate (orange line, left axis).

Monday's claims about trade talks came just days after Chinese officials surprised the market by announcing new tariffs on $75 bn of annual imports from the U.S., in retaliation against an earlier decision by Trump to impose levies on all of China's annual exports to the U.S. not yet covered by duties. From December 15, all of China's $550 bn goods shipped off to America will now be subject to either a 15% or 30% tariff.

McCormick says he has little hope of seeing a genuine resolution to the trade conflict, which has been raging for more than a year now and has already slowed the global economy. However, he does forecast that a brief recovery of risk appetite among investors could enable currencies like the Pound, Euro and New Zealand as well as Australian Dollars do well in the short term. Some those have been among the hardest hit thus far in the trade war.

"NZD screens at a massive discount, which against current levels sits around 3.5%. In other words, NZDUSD should be trading around 0.66, making it the cheapest currency in the G10. GBP runs next. It's trading at a 2.5%, and we finally see some scope to reduce this risk premium if Brexit headlines sound a bit more constructive this week. Still, we think rallies should get capped ahead of 1.25," McCormick writes, in a note to clients.

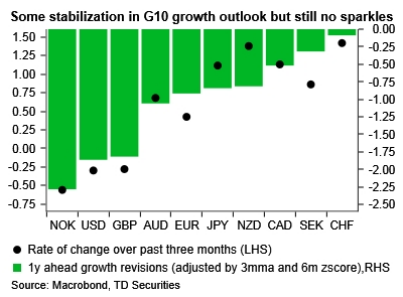

Above: TD Securities graph showing currency returns (black dots) Vs growth forecast revisions.

Most G10 currencies have ceded ground to the greenback in the last 18 months or more as investors flocked to the high-yielding Dollar, as well as safe-havens like the Swiss Franc and Japanese Yen, as the trade war escalated. But with calm returning to most markets this week, McCormick is tipping a reversal of the recent trend. He says the 'risk premium' that's been built into many of those currencies during recent months could now begin to fade.

The idea behind the earlier exodus from 'risky' currencies like the Aussie, Sterling and Kiwi was that the trade war would also hurt their economies too, leading the respective central banks to reduce interest rates from already-lower levels and further reduce the attractiveness of those currencies in the eyes of investors. So anything that leads the market to believe that an end to the conflict is near, could also help to drive a recovery.

"For the USD, our growth signal turned short in July, and it continues to worsen for the buck," McCormick says. "Notably, all the G10 holds downside growth momentum - all the z-scores sit below zero. That said, there are a few pockets of stabilization, with the EUR signal improving the past few months...NZD data surprises also look good, which is a nice combo with a 3.5% discount to boot."

Above: Dollar Index at daily intervals, annotated for recent events.

Last week's tit-for-tat exchange of new tariffs stoked increased fears for the health of the global economy and dealt a blow to the Dollar, but the greenback has been inconsistent in its responses to bouts of increased tension. Sometimes it's done well off the back of new tariff announcements seemingly due to its safe-haven appeal and the fact U.S. interest rates are the highest in the developed world, but other occasions have seen it crumble.

The Dollar Index was down Tuesday but the greenback higher against most rivals after losses to the Japanese Yen more than offset increases over other rivals. Gains came after the Conference Board measure of U.S. consumer confidence surprised on the upside for the month of August.

The U.S. confidence index fell from 135.8 to 135.1 in August, when markets were looking for it to drop to 129.3. That could suggest U.S. households are unfazed by the trade war with China, which would be a positive sign for the economy and Dollar.

"The Global Macro Risk Index message suggests that mean reversion trades may benefit in the very short-run, reflecting the reduction of stress. It is a very short-term signal, especially as GMRI has been in risk-off territory since early August," McCormick warns.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement