Gargantuan U.S. Debt Pile Could Keep Fed Interest Rates - and the Dollar - Perpetually Low

Image © Adobe Images

- U.S. debt pile now so big it could cap interest rates

- Such a scenario would have negative consequences for USD

- Both quantity and quality of corporate debt a concern

The gargantuan U.S. debt pile is likely to keep interest rates lower for longer suggest analysts we follow, ensuring a dynamic that will have negative implications for the Dollar.

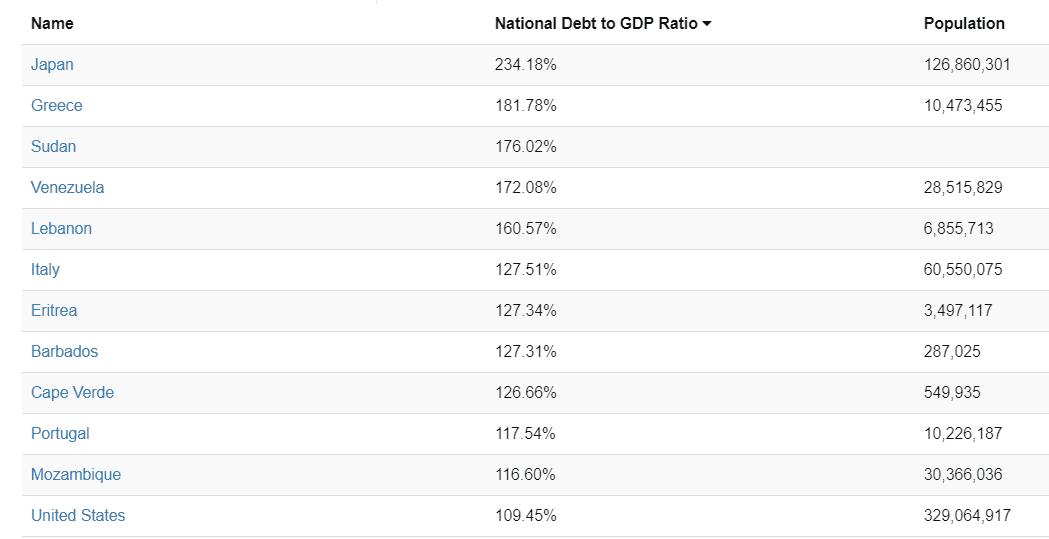

The U.S. has the highest gross public debt in the world at $19.23 trillion and the 12th highest debt as a percentage of GDP, at 109.45%.

Debt is set to rise too: the U.S. budget deficit - the shortfall between what it spends and earns - is set to rise from 2.4% currently to 4.0% in three decades, meaning even more borrowing will be required to plug the gap.

Interest repayments are set to rise at a similar rate. Noah Smith, a former professor of finance at Stony Brook University tells Bloomberg that as interest repayments rise they will eat further and further into revenues, and the Federal Reserve could reduce interest rates to zero in order to offset the financial stability risk of insolvency.

Smith argues that the U.S. could be headed for a future of zero interest rates "forever".

Zero interest rates would enable the U.S. to pay down the principal and finally get the debt pile down.

Such a strategy is called ‘fiscal dominance’: fiscal dominances describes how a country with a large government debt and deficit utilises monetary policy to keep the government from bankruptcy, as opposed to utilising monetary policy for the traditional targeting of inflation, growth and employment.

It may not be realistic to expect the U.S. government to reduce the deficit by means of fiscal austerity as austerity policies are unpopular and the government may increasingly find itself in a fiscal squeeze. On the one hand, spending requirements are more likely to rise whilst lower taxes may be necessary to keep growth on track.

The increasing political imperative for universal healthcare combined with medical and pharmaceutical cost inflation as well as expensive green policies to prevent global warming will increase government spending.

At the same time, the need to keep taxes down to maintain growth will limit revenue.

The result will be that the U.S. government will have to continue to borrow more and more to keep up its spending commitments. This, in turn, will lead to a rising debt pile and eventually the threat of default.

Corporate Debt Also At Record Levels

It is not only public debt which is rising to worrisome levels but also U.S. corporate debt.

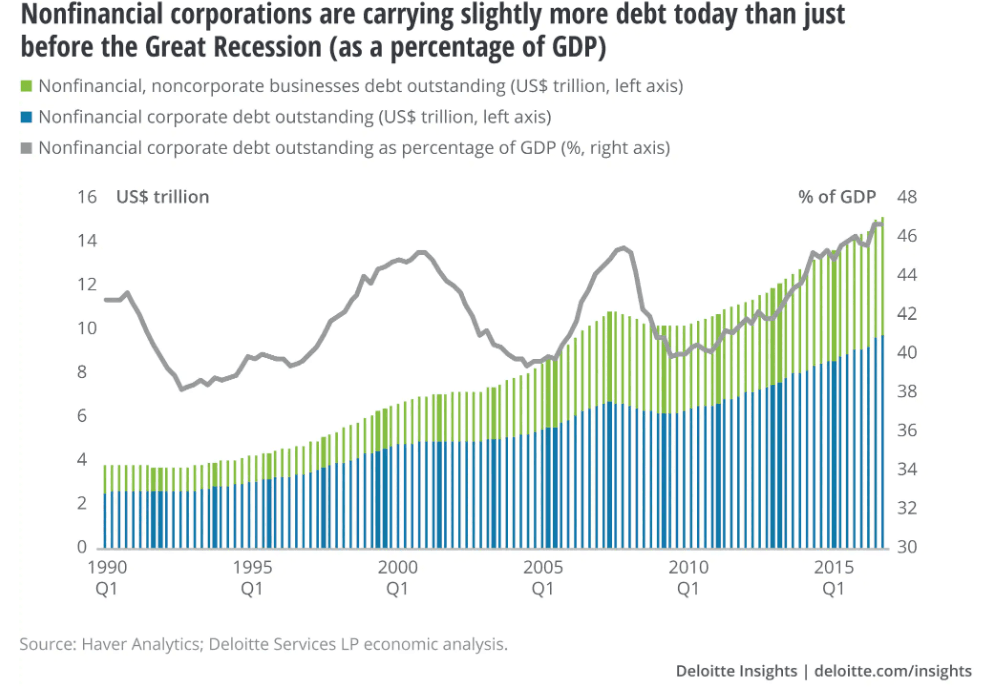

Corporate debt is at a record high, fuelled by a decade of cheap lending following the financial crisis. At the end of Q3 2018, it stood at an all-time high of just over 15 trillion which is 46.5% of GDP.

The rise in debt is a consequence of the ultra-easy monetary policy embraced by the Federal Reserve in the aftermath of the Great Financial Crisis of 2008 when it was trying to put the economy back together and encourage hiring.

In order to do this, the Fed embarked on a period of highly unorthodox monetary policy which combined ultra low-interest rates with quantitative easing (QE), a unique policy whereby central banks bought up debt from banks, financial companies and corporates.

The unorthodox methods appear to have worked - America survived the crisis and unemployment fell to record lows.

There was a consequence, however, and that was that non-financial corporations, which avoided the regulatory tightening of their financial brethren, were able to borrow at rock bottom rates for a decade, and as a result, they are now holders of mountains of debts.

The Fed itself has acknowledged the risks from the high level of corporate debt.

In its recent Financial Stability Report it noted:

“Although debt-financing costs are low, the elevated level of debt could leave the business sector vulnerable to a downturn in economic activity or a tightening in financial conditions.”

Fed Chairman Powell has said the mountain of U.S. debt poses a “moderate risk”. By which he means moderate in the current low interest rate environment - increase interest rates, however, and repayments would become unserviceable. Moderate would change to ‘considerable’. It simply won't happen.

In all likelihood the Fed will keep interest rates lower for longer not just to keep federal debt repayments low but also in order to avoid the financial stability risk posed by the mountain of corporate debt which has grown since the financial crisis.

As a consequence the U.S. Dollar is likely to struggle: interest rates are the food and drink of currencies - when they rise they increase foreign capital inflows drawn by the promise of higher returns. When they fall the opposite happens and money flows out.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

Decline in Quality

It is not only the aggregate amount of debt which is a worry but also the ‘quality’.

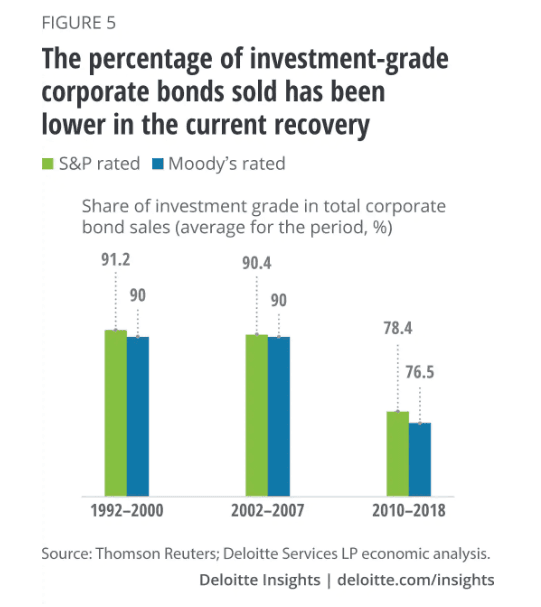

A recent report by Deloitte Services LP highlighted the worrying decline in quality of non-financial corporate debt.

“But what about the quality of the debt amassed by nonfinancial businesses this time around? Here, the news is not good. Standard & Poor’s (S&P) and Moody’s ratings data shows that the quality of debt issued during the current expansion is lower than in both prior recoveries,” says Dr. Patricia Buckly, Director, at Deloitte Services LP.

Whilst the rate at which debt has grown has not been exceptional compared to the previous recoveries, the quality of corporate debt is lower.

During the most recent recovery (2010–2018) the share of investment-grade bonds was 78.4%. This compares to 91.2% in 1992-2000 and 90.4% in the 2002-2007 recovery.

The quality is not the only problem. Firms ability to pay is also raising warning flags. High debt is not a problem as long as companies are earning good profits. They only become a risk when they cannot make the repayments.

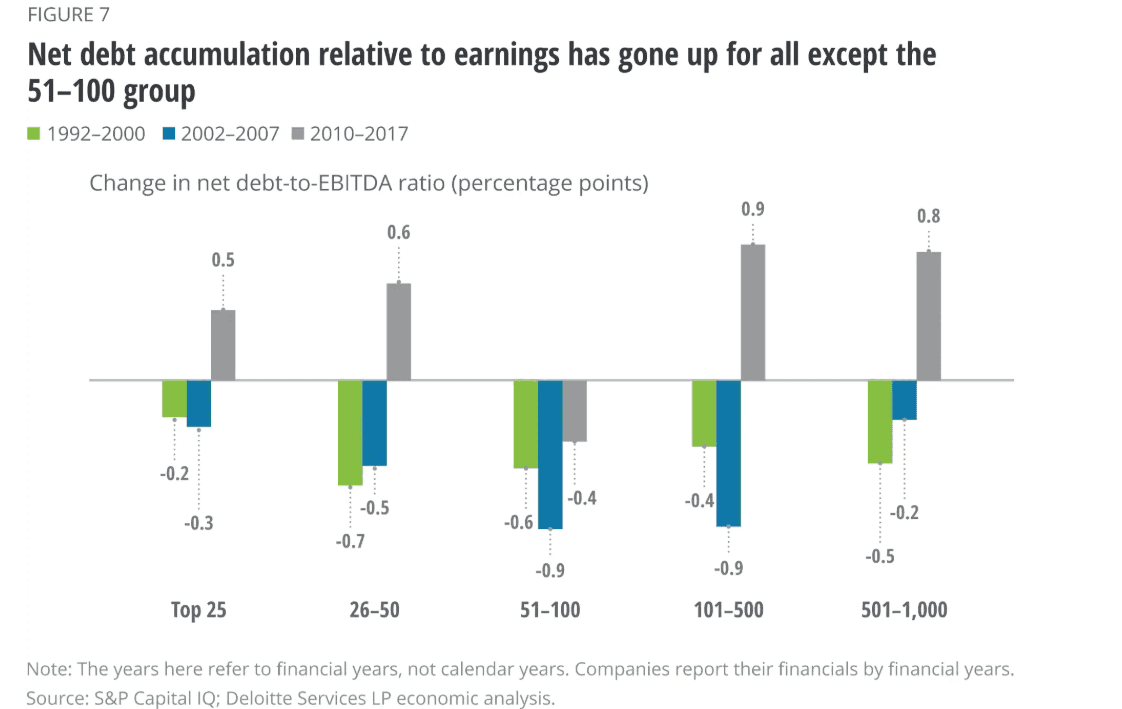

According to Deloitte's the level of debt as a ratio of earnings is rising and this is a risk.

This is highlighted in the debt-to-EBITDA ratio - EBITDA stands for ‘Earnings Before Interest Tax Depreciation and Amortization’ and is the standard metric for assessing a company's earnings by equity analysts.

The ratio has risen during the current recovery. Indeed it is the only recovery during which the ratio has risen - a worrying president.

Trump Tax Cuts

It is not fantastical to speculate that one of the main reasons why Donald Trump and the Republicans cut taxes in 2017 was to help mitigate the growing financial risk posed by U.S. corporate debt.

After all, the largest tax cut went to corporations, who saw their tax rate fall from 35% to 21% - a massive reduction, albeit from a relatively high level. This enabled corporate America to dodge the consequences of its decade long binge on cheap credit.

It also explains why Trump is so worried about rising interest rates - he can control fiscal policy but not monetary - and a rise in interest rates has the potential to burst the corporate debt bubble.

The June Fed Meeting

In the recent June Federal Reserve FOMC statement officials highlighted the ‘softening’ in fixed business investment, which they saw as a key concern.

Fixed business investment - the purchasing of plant and equipment - is capital intensive and usually requires debt.

This may be a sign businesses have reached their safe debt limit and are unwilling to risk borrowing more. Especially as rates are not as favourable as they once were.

What seems increasingly likely from a monetary policy perspective is that the U.S. could enter a period of more stagnant growth during which companies tighten their belts and try to pay down their debts.

During this time interest rates will remain low. There is even a risk of the U.S. ‘turning Japanese’ as lower rates become embedded into the fabric of the economy and deeply indebted corporations become ‘zombified’, unable to growth or take on more credit.

Such a scenario would take its toll on the Dollar, suggesting calls for peak Dollar may not be as far fetched as some have argued.

"The Fed's pivot has taken the wind out of the USD's sails. The race to the bottom is now in full force and the Fed has a considerable advantage with a much longer policy runway. Though the USD still retains a yield advantage over much of its peers in the G10, we think the USD, on balance, remains destined for a course correction lower," says Mark McCormick, a currency strategist with TD Securities.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement