U.S. Dollar Treads Water as G20 Summit Gets Underway and GDP Data Disappoints

- Written by: James Skinner

Image © Adobe Images

- USD treads water after GDP data, as market watches G20 in Japan.

- No upgrade to Q1 growth, but business investment revised higher.

- Data is positive for Fed outlook, but everything rests on G20 talks.

The Dollar was treading water Thursday as financial markets wait with baited breath for news of talks between Presidents Donald Trump and Xi Jingping at the G20 summit in Osaka, Japan, and after official data failed to reveal an anticipated upward revision to U.S. first quarter GDP growth.

U.S. GDP growth was 3.1% for the first-quarter, according to the third and final estimate from the Bureau of Economic Analysis, although financial markets had looked for it to be revised higher to 3.2%. The marginal difference may have disappointed the market but the details of the report were not all bad.

Private consumption growth was revised down from 1.3% to 0.9% for the quarter but growth of business investment in fixed assets was revised higher from 2.3% to 4.4%. Meanwhile, growth in spending on intellectual property was revised up from 7.2% to 12% and investment in business structures was revised from 1.7% to 4.3%.

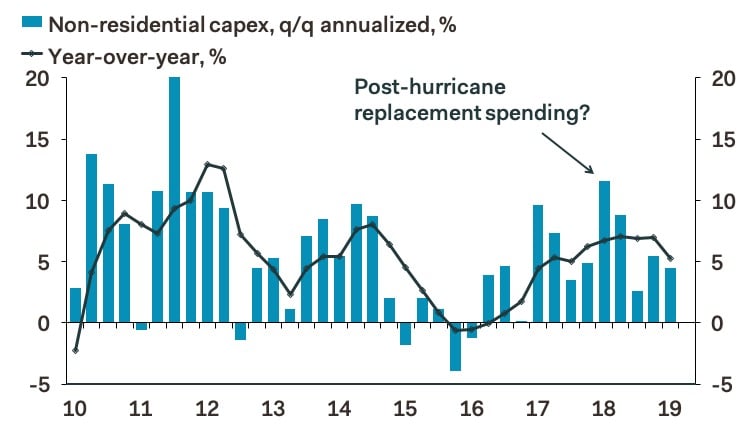

"Overall these are encouraging numbers for a Fed which has been fretting over the slowdown in business capex," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics. "Business capex rose at a decent q/q pace in the first quarter; the dip in the y/y rate is due to an adverse base effect, because spending jumped sharply in Q1 2018, after Hurricane Harvey forced firms to replace lost or damaged assets."

Above: Business capital expenditure, 3-month and annual rates. Source: Pantheon Macroeconomics.

Currency markets care about the GDP data because it reflects rising and falling demand within the US economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

The data is especially important to the outlook for Dollar exchange rates in the current market environment, which has seen investors bet increasingly the Federal Reserve (Fed) will cut its interest rate from a post-crisis high of 2.5% this summer, to 2% or lower before the year is out.

Concerns over the impact that President Trump's trade war is having on the global economy and more recently, the U.S. economy too, are behind the market's wagers and recent signals from the Federal Reserve that it's gearing up for a landmark shift in its interest rate policy.

"The broad value of the USD is trading little changed versus its prior close," says Stephen Gallo at BMO Capital Markets. "Economic data has continued (and will continue) to take a back seat to G20 headlines."

President Trump has been threatening to impose a 25% tariff on the remaining $300bn of China's annual exports to the U.S. if his counterpart does not agree to sign up to a deal that Chinese negotiators previously backed out of. He already lifted from 10% to 25% the tariff charged on $200 bn of China's exports back in May, after Chinese negotiators backed away from an agreement they'd spent some five months drafting with the U.S.

U.S. and Chinese leaders are set to meet at that G20 summit that got underway in Osaka, Japan, Thursday to discuss the latter's "unfair" trade policies but scepticism about the prospects of a detente is high. Uncertainty relating to the outcome, which will impact the outlook for the entire global economy, could be what's supporting the safe-haven Dollar in the noon session this Thursday.

Above: Dollar Index shown at daily intervals.

The Dollar index was 0.01% higher at 96.22 during the noon session Wednesday and is now up just 0.2% for 2019 after declining 1.8% since the final weeks of May.

The Pound-to-Dollar rate was 0.02% lower at 1.2689 and has now fallen 0.4% for 2019 after steadily handing back to the U.S. currency what was, in late February, a 5% 2019 gain for the British currency.

The Euro-to-Dollar rate was 0.12% lower at 1.1360 and is down 0.92% for 2019 after recently paring back a 2% 2019 loss.

Above: Pound-Dollar rate shown at daily intervals, alongside Euro-to-Dollar rate (yellow line, left axis).

"As global growth heads into a questionable phase, the Fed looks set to take precautionary measures to weather the economic storm," says Anthony Kurugy, a sales trader at Foenix Partners.

The Federal Reserve raised interest rates nine times between the end of 2015 and the end of 2018, including on four occasions last year, but inflation has since begun to decline and the Fed's preferred measure of consumer prices has been retreating further from the 2% target all through 2019.

Changes in rates are only normally made in response to movements in inflation, which is sensitive to economic growth, but impact currencies because of the influence they have on capital flows and their allure for short-term speculators.

Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

"What is a much more important is the question as to why the Fed is cutting interest rates at all," says Ulrich Leuchtmann, head of FX strategy at Commerzbank. "It is mainly the Fed-bashing tweets from the White House that are driving the Fed to cut interest rates. Yesterday Powell defended his independence much more explicitly than before. That too is likely to be a reason for the slight USD recovery."

Leuchtmann says there are very few reasons for the Fed to actually want to cut its interest rate other than pressure from the White House as well as the financial markets. He suggests independent central banks should not respond to political pressure to move interest rates in one direction or the other and that the market's desire to see rates lowered is based on flawed reasoning.

"Sure, inflation has not been at the levels the Fed would like to see, but that's kind of normal and didn't prevent the Fed from hiking. The only reason for rate cuts would be that the financial market expects such cuts (for irrational reasons?!) and the Fed has to deliver to prevent stress on the financial markets," Leuchtmann writes, in a note to clients.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement