Dollar Strength Depends on U.S. Growth and Economists are Turning Pessimistic in their Outlook

Image © Adobe Images

Image © Adobe Images

- USD needs superior growth for support

- UBS pessimistic about economic outlook

- Economic risks stacking up into year-end.

The Dollar is holding up well despite a dramatic fall in U.S interest rate expectations but commentary from economists at UBS suggests it might only be a matter of time before the greenback succumbs to a bearish market.

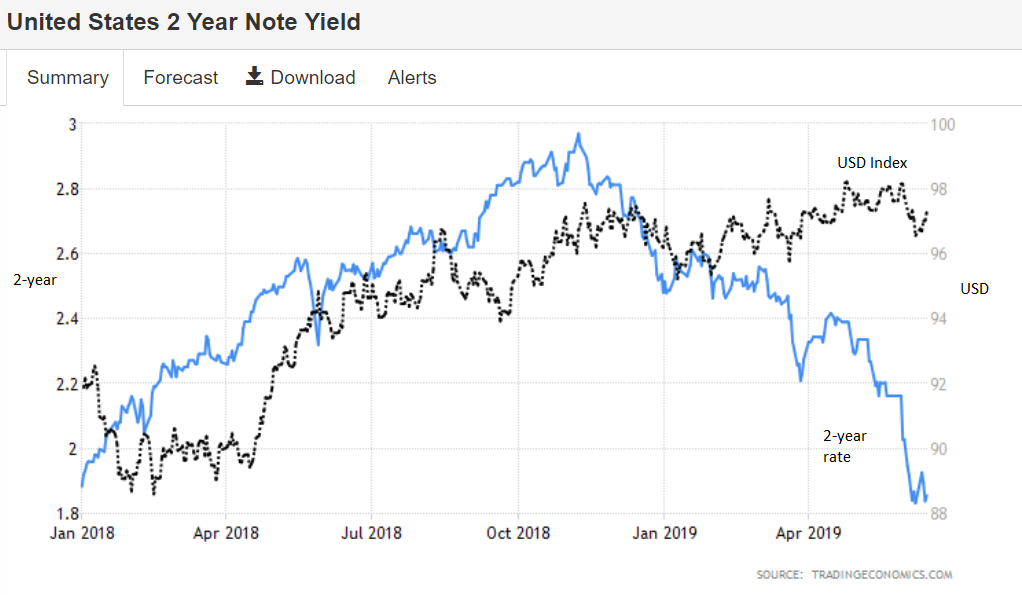

Usually the Dollar, bond yields and interest rate expectations are positively correlated but lately there's been a decoupling between them. What’s behind the divergence?

"The reason the Dollar is diverging is because U.S. growth keeps surprising to the upside, says Kit Juckes an analyst at Societe Generale. “The challenge facing those who want a weaker Dollar, is that it is holding up so well in the face of falling US rates."

The Dollar has declined only a modest amount in recent weeks, which reflects relatively upbeat views about the economic outlook, whereas bond yields have fallen much more sharply due to a range of factors including concerns about the economic outlook.

For example, the International Monetary Fund (IMF) its U.S. growth forecast from 2.3% to 2.6% for 2019 and the market consensus has moved from 2.4% to 2.5%. The opposite is true for global growth forecasts, which the IMF recently revised down from 3.5% to 3.3% for 2019.

Given the sharp divergence between U.S. and global growth forecasts, it's no wonder the Dollar is proving resilient given the forecast divergence demonstrates continued U.S. outperformance and exceptionality.

This begs the question of why interest rates are falling at all. If growth is so strong shouldn't they be higher too?

Above: U.S. Dollar index alongside two-year bond yield.

Part of the reason is the surge in demand for U.S. Treasury bonds as a safe haven asset amid elevated geopolitical risk and fears over trade wars as well as the outlook for U.S. stock markets.

The recent volatility in the U.S. stock market has led to a surge in demand for ‘safer’ U.S. Treasury bonds, which has also helped underpin the Treasury market. That explains part of the decline in yields, which always falls as the prices of bonds rise.

Another reason is subdued U.S inflation, increases of which have lagged the pickup in economic growth and corporate earnings. Are investors being overly pessimistic about U.S. growth? Could this explain the divergence?

Swiss investment bank UBS is pessimistic about U.S growth, which it says will fall for a variety of reasons. UBS' main argument is that the U.S. economy is at a very late stage of the business cycle and the GDP growth rate is likely to slow to only 2.0% before long.

“The longest recovery in US history started in April 1991 and lasted 120 months. The current recovery began in July 2009, and assuming it lasts for at least a couple of more months, will set a new record for durability,” says Brian Rose, an economist at UBS.

Rose argues U.S. growth won’t be able to sustain its current trajectory because the boost from Republican tax cuts that helped stimulate the expansion in 2018 will fade during 2019, and even more so in 2020.

Above: Pound-to-Dollar rate shown at daily intervals, alongside the Dollar Index (yellow line, left axis).

The manufacturing industry is slowing the most according to recent data, although the jobs market still remains in good condition despite poor numbers for the month of May, according to UBS.

The main threat to U.S. growth comes from trade policy, the bank says. The possibility of a new 25% tariff being imposed on the remaining 300bn of outstanding Chinese exports to the U.S. is seen as something that could bring about a U.S. recession.

A rise in tariffs on goods from Europe and Japan is also a risk for year-end because the decision has merely been delayed until November. A government shutdown over the debt limit is also a further risk to the economy.

“Another policy risk is the government budget for fiscal year 2020, which begins on 1 October. If a deal isn't reached, the government will either shut down, or spending will drop sharply,” says Rose.

If UBS is right to be concerned about the outlook for the economy then growth will soon fall and in the process, vindicate investors for having flooded into the safe-haven bond market in recent weeks. That would almost certainly result in a weaker Dollar.

Alternatively, if UBS is wrong and the optimists are right, then U.S. bond yields might soon increase once again and the outlook become less riddled with uncertainty, which could mean a more stable Dollar.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement