Pound-Dollar Rate Closes in on January Low as Credit Suisse Reiterates Bearish Outlook

- Written by: James Skinner

© Robert Cicchetti, Adobe Stock

- GBP on course for January low of 1.25 says Credit Suisee.

- Tory leadership ballot to weigh, raises risk of general election.

- 'No deal' Brexit views to dominate race to become next UK PM.

- Threat of Corbyn government, WTO exit mean further GBP losses.

The Pound-to-Dollar rate fell Thursday and was closing in on its January 2019 low after the U.S. greenback bested its major rivals in noon trading, but there is more pain ahead for the British currency according to analysts at Credit Suisse.

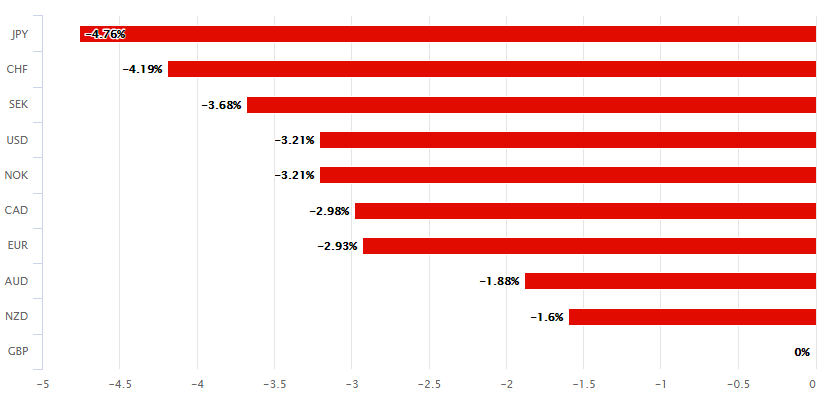

Sterling has retreated further from its February highs in recent weeks and is down 3.3% against the Dollar in May alone, because the political situation in London has gone from bad to worse.

Now, analyst predictions of a return to January's rare and very low levels are an almost daily occurence, with many also opining on the likely fate of the British currency in the event that a 'no deal' Brexit takes place on October 31.

Many say an exit from the EU without any formal agreement on future relations would send the Pound-to-Dollar rate down to 1.15 as a minimum, which would leave it trading at levels not seen since the early 1980s.

"The outcome of the EU Parliament election also gives us little reason to deviate from our outstanding bearish GBP views. Our rationale throughout the now multi-month stretch of bearishness has been that we see scope for political tension to escalate further, undermining the market’s effectively default view that a “reasonable” Brexit outcome is likely to prevail. Some of these dynamics were visibly at work last week," says Alvise Marino, a strategist at Credit Suisse.

Above: Pound Sterling's performance Vs G10 rivals in May. Source: Pound Sterling Live.

Nigel Farage's Brexit Party, barely more than six weeks old, emerged from May's European parliament election as the UK's most popular after capturing more than 30% of the national vote. It's now campaigning in Peterborough, where it hopes to win its first parliamentary seat in a byelection on June 06.

The insurgent has sprung from the political ether and captured votes that had previously gone to both the Labour and Conservative Parties.

It's now demanding a place at the UK-EU negotiating table and has urged government to walk away from the EU on October 31 if UK demands in relation to Brexit are not met. This is already impacting on the Conservative Party leadership contest.

"The outperformance of Nigel Farage’s Brexit Party suggests that the No Deal Brexit option will likely be the defining feature of the Tory leadership contest, as opposed to a leverage tool to be used primarily to extract better conditions in negotiations with the EU," Marino writes, to Credit Suisse clients this week.

Above: Pound-to-Dollar rate at daily intervals.

Westminster is now playing host to a Conservative Party leadership contest after Prime Minister Theresa May offered her resignation when it became clear she might not be able to pass her EU withdrawal agreement through parliament ahead of an October 31 deadline.

That perceived threat of failure stoked market fears of a general election, which might install opposition leader Jeremy Corbyn in 10 Downing Street, as well as fears of a 'no deal' Brexit and was the impetus for May's resignation.

Corbyn's socialist economic policies and doubtful commitment to private property rights are feared by the market. And a 'no deal' EU exit would end the subordination of UK institutions to those of the European Union but mean defaulting to doing business with the bloc on World Trade Organization terms.

"This possibility becomes more urgently negative for GBP and for UK assets if one expects, as our economists do, that Boris Johnson may be inclined as a newly minted PM to call for new elections, aiming to create a parliamentary arithmetic that does not preclude a No Deal outcome," Marino warns.

Above: Pound-to-Dollar rate shown at weekly intervals.

There are some 13 leadership candidates although only a handful that have numbers among Conservative MPs that are necessary for them to make it into the grassroots membership ballot that pits the two most popular in the anti-Brexit parliamentary party against eachother.

The Conservative Party grassroots were heavily in favour of leaving the European Union in June 2016 and a majority of them have favoured a 'no deal' exit when given a choice between that and Prime Minister Theresa May's EU withdrawal agreement in polls carried out by conservativehome.com.

Boris Johnson, the former foreign secretary who is reviled by many parliamentary colleagues for his role in the referendum campaign to leave, is most popular among the party grassroots.

"We think that markets might be underprepared for the possibility of general elections being called ahead of the October Brexit deadline. As such, we think the risks for GBP remain to the downside, with 1.25 as our key near-term GBPUSD target," Marino warns.

Above: Pound-to-Dollar rate shown at monthly intervals.

It's far from clear what the outcome of any general election would be not least of all because European parliament elections outcomes are ordinarily a poor guide to general election performances but also because the fortune of the governing Conservative Party depends in part on the identity of its next leader.

Both the Conservative and opposition Labour Party received a drubbing in the EU election, while the Brexit Party achieved first place with 30.5% of the vote but was followed by the anti-Brexit Liberal Democrats who gained 19.6%.

No party carries enough support in polls of general election voting intentions for it to secure a majority, but coalition-building might be more difficult than it would appear at first glance.

A coalition between the Conservative and Labour parties would be unprecedented as well as unthinkable to grassroots members of both parties. The viability of a coalition of Brexit and Conservative parties would depend heavily in the identity and platform of the next Conservative leader.

Meanwhile, a marriage of Labour and the Liberal Democrats might be impossible given one has pledged to "respect the result of the referendum" and the other to "stop Brexit". In short, nobody has a majority and there is not yet an obvious coalition to be formed.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement