U.S. Dollar Forecast to Fall Based on a Trio of Factors

Image © Andrey Popov, Adobe Images

- Julius Baer see downside from global growth catch-up

- Reuters analyst sees bond yield curve dynamics weighing

- Technical evidence also provides compelling case

The Dollar Index - a measure of overall U.S. Dollar performance based on a basket of Dollar exchange rates - is trading just below its 2019 highs at 97.94 at the moment, can it push higher and break into fresh air and start printing multi-year highs?

No, argue a number of analysts we follow.

We set out the arguments made by three of them here.

1) U.S. Economic Growth Outperformance to Fade

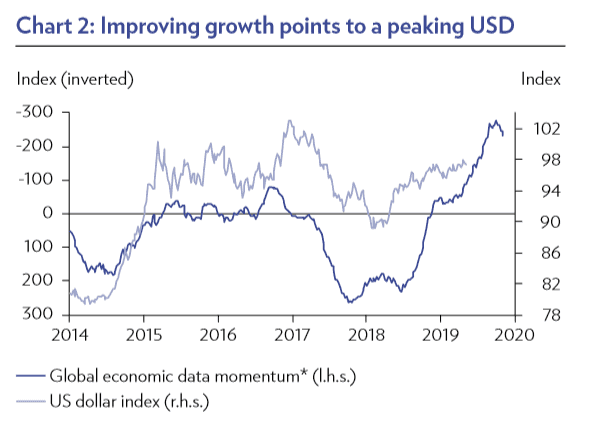

David Kohl, an analyst with Swiss investment bank Julius Baer says the Dollar’s reign will soon come to end as the growth superiority of the U.S. economy fades.

His theory is that as the global growth cycle will start to turn higher in 2019 and as it does so the gap between the U.S. and the rest of the world will diminish.

Along with it, the performance gap between the U.S. Dollar and other currencies will also narrow.

“We expect an improving global cyclical backdrop in the second half of 2019 to play a decisive role in the peaking of the USD, boosting the prospects for currencies with a high cyclical exposure,” says Kohl.

Image courtesy of Julius Baer.

Those currencies which are expected to gain the most are the Canadian Dollar, Norwegian Krone, Swedish Krona and Brazilian Real.

Kohl sees upside potential for GBP/USD “as the decreasing risk of a hard Brexit allows for a reduction of the discount at which the GBP has been trading since the Brexit referendum in June 2016.”

Those hoping EUR/USD will surge higher may be disappointed, however, as the Euro offers the “lowest cyclical exposure” and remains pressured by negative interest rates.

Those currencies not expected to outperform against the Greenback are the Australian Dollar, the New Zealand Dollar and the Euro, because their respective central banks are in the process of cutting interest rates.

Lower interest rates are a drag on currencies as they tend to lower net foreign capital inflows.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

2) Bond Market Waving Red Flags

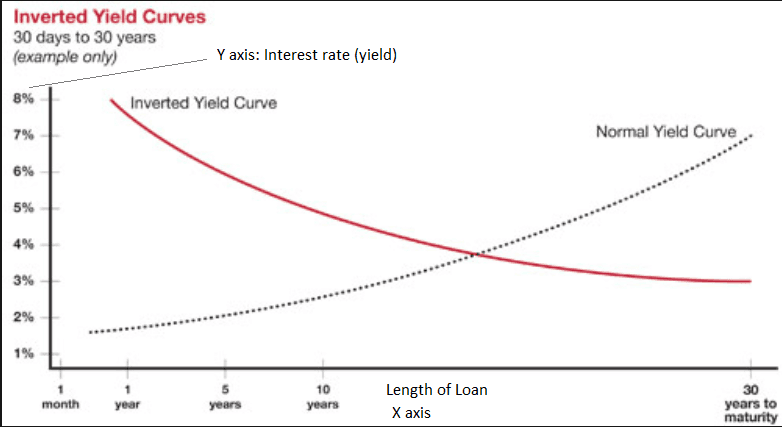

The U.S. Dollar is likely to weaken as a result of an inversion - or near inversion - of the U.S. yield curve, says Paul Spirgel, an analyst at Thomson Reuters.

The yield curve is a chart which plots interest rates on different lengths of loans (also known as U.S. Treasury Bonds), from very short (1-3 months) to long (10-30 years).

In normal market conditions, the yield curve describes a gentle upcurve as interest rates rise, the longer the duration of the loan. This is in order to protect investors from the ravages of inflation.

Currently, however, 10-year yields are falling quicker than 2-year yields as investors see the same moribund rate of growth stretching out into the horizon, and with it perpetually subdued inflation.

This, says Spirgel, is threatening an inversion of the curve and a fall in the Dollar.

“UST yields have moved considerably lower, with the 10-year dipping to 1-1/2-yr lows at 2.28%. The widely followed 2-10yr spread is nearing trend lows hit in March around +13bps, and thus flirting with an inversion that would raise worries of a U.S. recession.”

Interest rates are falling because the market is pessimistic about U.S. growth. Although the central bank is not as pessimistic it could change its views at subsequent meetings.

“Markets project falling rates – in contrast to Fed officials, who expect to hold steady this year and deliver a small hike 2020. It is worth remembering that the last protracted dip in the UST 2-10 spread, in December 2018, was followed by the Fed's decision to halt its rate normalisation programme, causing the Dollar to weaken,” says Spirgel.

Although a mass exit out of Dollar appears unlikely because most other currencies’ central banks are also lowering interest rates, “it will likely be some time before the dollar makes new highs,” says the analyst.

3) Technicals: The Dollar Chart Looks Bearish

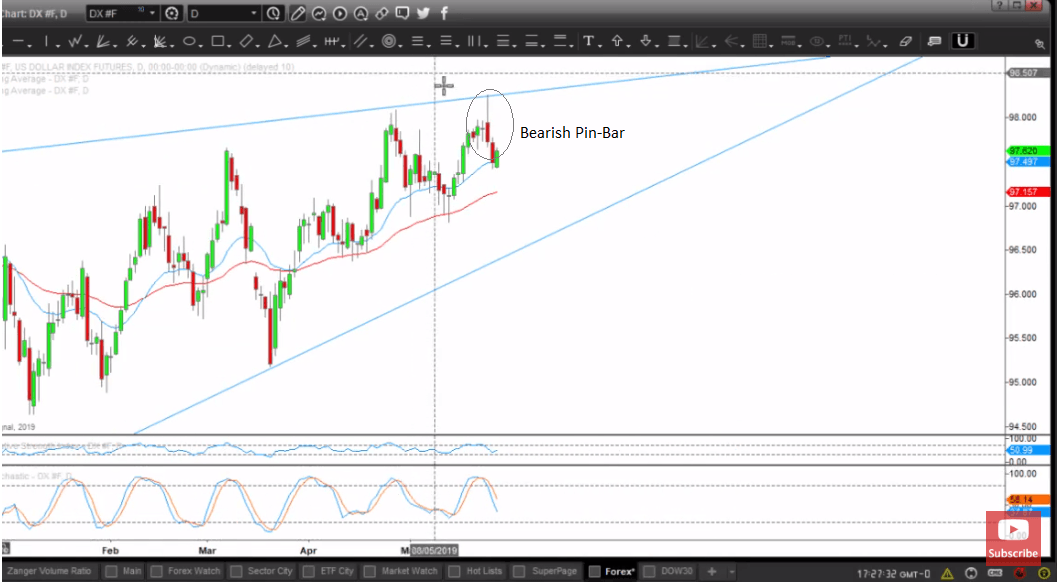

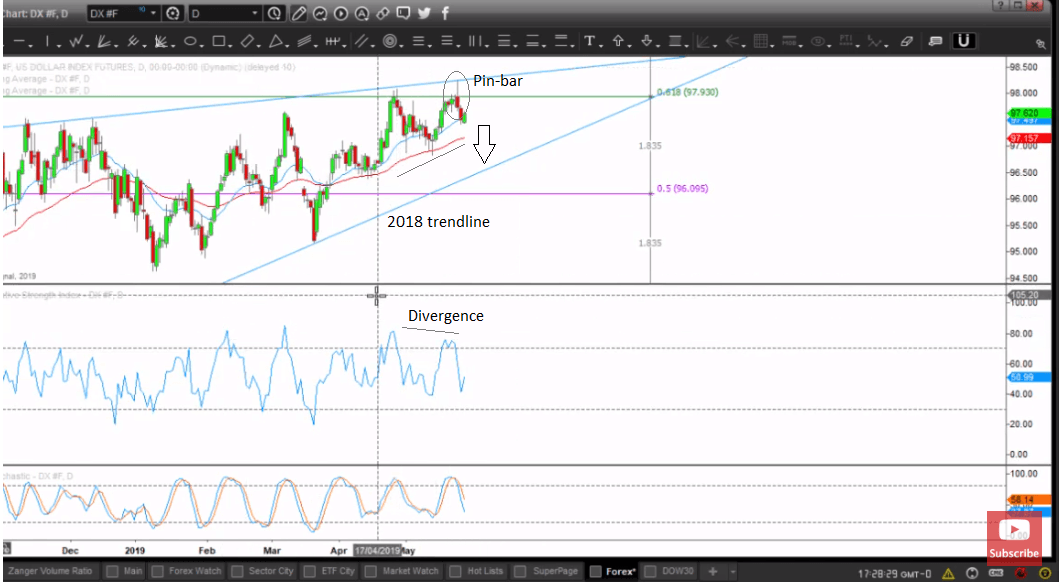

The chart of the U.S. Dollar Index is showing so bearish indications which have increased the risk of a reversal, says Rob Colville founder, mentor and trader at Lazy Trader.

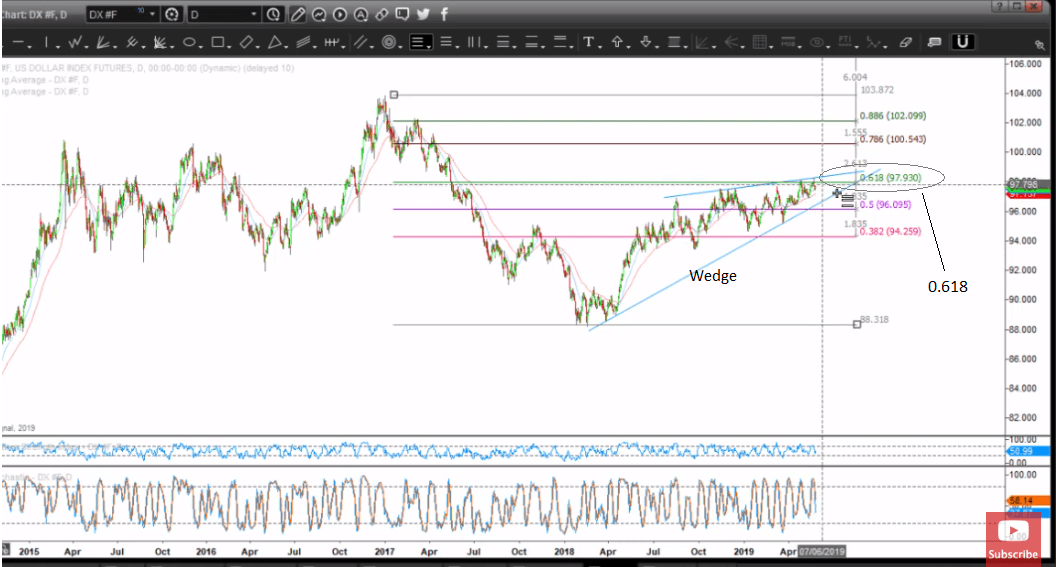

The Index has formed a bearish pin-bar reversal pattern at last Thursday’s yearly highs, whilst at the same time touching the upper border of a rising wedge pattern, which is eventually seen as at risk of breaking down.

Bearish pin-bars occur when price action peaks and then turns lower all in the same period. This leads to a long range compared to the body which is the difference between the open and close. The body has to be at the bottom of the range, as well. When this occurs at market highs and is accompanied by other bearish indications it is a negative sign.

The top of the pin-bar highs and the 2019 highs are also at the same level as the 61.8% retracement level of the major decline from the 2016 highs, a key reversal point and resistance level on charts where prices have a higher propensity to reverse.

Another sign the pair could reverse comes from the RSI momentum indicator which is diverging bearishly with price.

“If we look at RSI setting 6 we see that we do have bearish reversal divergence where we have a lower high, yet price has made a higher high. This is where we get a slight disagreement between price which is making a higher high which we have seen happening towards the end of April and the end of May, yet the RSI setting 6 has made a lower high. This says that the bears are creeping into the market,” says Colville.

Seasonality is also against the USD since June and July have historically been pretty bad for the U.S. Dollar.

Colville sees the Index falling to 97.05 initially, followed by 96.48 subject to a break below the trendline drawn from the 2018 lows.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement