U.S. Dollar Flows are a Double-edged Sword that Could Soon Bite It says CIBC

- Written by: James Skinner

© Nazli Sart, Adobe Stock

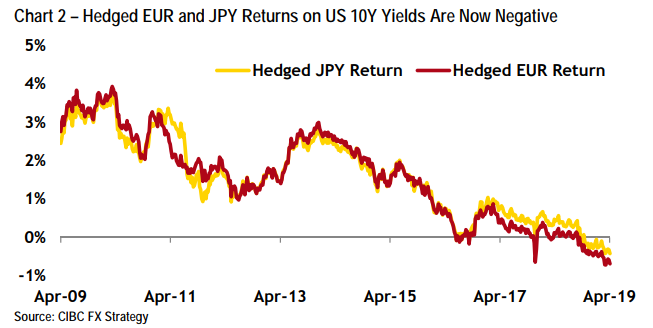

- Hedging costs hit 10-yr high, offer support to USD says CIBC.

- As Fed rates mean hedging renders U.S. investments loss-making.

- But this double-edged sword risks a stampede out of USD later on.

The Dollar is set to remain supported for a while yet because the prohibitive cost of protecting investments against falls in the greenback is discouraging fund managers from betting against the U.S. currency, according to CIBC Capital Markets, but those resulting 'unhedged flows' are a double-eged sword.

At 2.5% the Federal Reserve interest rate is the highest in the G10 universe by a country mile, which has seen fund managers in Europe and Japan who're buying U.S. assets increasingly doing so without protecting themselves from downward swings in the value of the U.S. Dollar.

This is because in order for investors to protect their portfolios against a lower greenback they must bet against it themselves. Selling the Dollar at the same time as investing in a U.S. asset would enable the fund manager to profit from currency losses on the exchange rate, which would then offset the reduction in value incurred by the portfolio asset when the original investment capital is translated back into Euros or Yen.

However, doing that has become much more expensive during the last year, thanks in no small part to four Federal Reserve rate hikes that lifted the Fed Funds rate by 1% to 2.5% in 2018. Analysts at CIBC Capital Markets say selling the Dollar will convert what are positive annual returns before hedging, into modest annual losses after hedging.

"The Eurozone and Japan have deep capital market pools so paring hedges on USD investments matter. For instance, the average inflow to US assets from Japan is around US$114bln per month – a hefty amount to be sure. We can extend this to European asset managers as well and ask what the incentive is to hedge FX risk given that it offsets your yield pickup," says Bipan Rai, head of North American FX strategy at CIBC.

Above: Dollar Index shown at daily intervals.

It costs money to sell the Dollar because when selling any exchange rate traders either pay, or receive, the interest rate differential depending upon which direction they're betting.

Somebody buying the Pound-to-Dollar rate, so betting on an increase, would have to pay something like the difference between the BoE base rate and the Fed's rate. That's 1.75% annualised.

Likewise, hedging against a rise in the Euro-to-Dollar rate costs more than 3% given the European Central Bank's record low interest rates and negative German bond yields.

"Right now, the implied cost of a 3m forward hedge for a Japanese investor (annualized) is roughly 2.90%. That means for an investor in Japan, you could earn 2.50% in US 10-year yields unhedged or -0.40% if you hedge. In the Eurozone, the return after hedging works out to -0.61%. This is the first time that hedging costs have been this expensive relative to US 10-year yields in over a decade," Rai says.

This is why many of them are no longer hedging their currency exposure, a decision which has contributed to a resilient performance from the greenback that's pushed the Dollar index up 2% in 2019 when many analysts had forecast, and still are, that the Dollar would reverse 2018's 4% gain this year.

Above: CIBC Capital Markets graph showing hedging costs for Japanese and Eurozone investors.

As a result, an already-reduced drip feed of sell orders is increasingly disappearing from the market and offering support to the Dollar in the process, even in the face of a consensus that says the U.S. economy will slow in 2019, ending the Federal Reserve rate hiking cycle and encouraging investors to bid for other currencies that are underwritten by authorities like the European Central Bank which may one day begin to lift its own interest rate.

"Of course, there’s a risk. The more the amount of under-hedged positions there are in the market, the more imbalances start to rise. An adverse move (in this case a USD decline) against investors that are under-hedged means that there’s a very good chance that assets are dumped," Rai warns. "We get that the USD is an expensive short, but that doesn’t mean that its invincible to shocks or not prone to declines. The market is still long, and a sizeable chunk of the market expects the greenback to fall at some point."

The upshot for the greenback is that, for now at least, it could continue to enjoy the kind of support that comes with being backed by interest rates that are a long way above those of the nearest competitor but the longer this goes on for, the more violent the eventual reversal in the Dollar exchange rates will be.

This is because when the Dollar does eventually begin to decline, it could do so rapidly, thereby sending all of those unhedged investors scrambling to bet against the greenback.

However, for now, Rai is advocating that CIBC's clients bet in favour of the Dollar on a tactical basis against Pound Sterling and the Canadian Dollar.

Above: Pound-to-Dollar rate shown at daily intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement