U.S. Dollar to Remain Resilient Even in the Face of Dwindling Safe-Haven Flows: ING’s Krpata

Image © Goodpics, Adobe Stock

- Trade deal rhetoric weighing on USD

- Weakness temporary due to rate-differentials

- No sign of change in G10 rates on horizon

The U.S. Dollar is likely to trade lower if a trade agreement emerges between the U.S. and China as its safe-haven credentials overshadow any upside from the economic benefits of a return to a more frictionless trade relationship.

However, the still-positive yield differential of the U.S. Dollar compared to the other G10 currencies will keep losses minimal and the currency ultimately supported says Petr Krpata, chief EMEA FX and FI strategist at ING Bank in London.

The Dollar index has traded lower since the start of April despite a step-change in trade deal rhetoric and frequent reports that the two superpowers are inching towards an accord. The main reason for this underperformance is the safe-haven status of the Dollar which means an improving backdrop is actually negative for it.

The weakness is unlikely to last, however, because the other main driver of the currency - the interest rate differential - is likely to drive the Dollar back up again.

Although the U.S. Federal Reserve (Fed) is now not expected to raise interest rates in 2019 it has already raised them substantially higher than the rest of G10 and this carry advantage is a major boost for the Dollar.

Interest rates impact on currencies because they drive capital flows. The higher the relative interest rate in a country the greater the volume of foreign capital inflows it is likely to attract (and keep) - all other things being the equal - and the greater the demand for the currency.

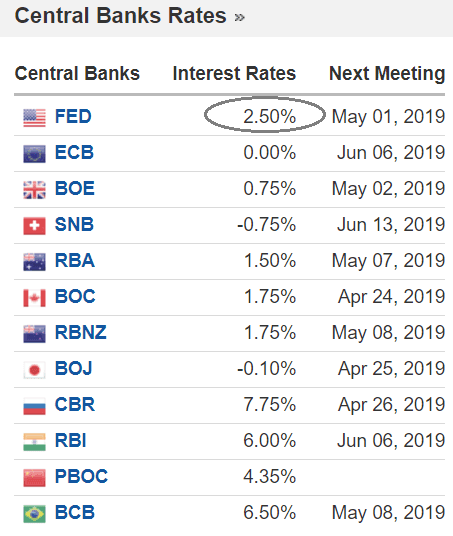

The U.S. has a base interest rate of 2.50% which is higher than all the other major developed economies. Only emerging market economies such as Russia, India and Brazil can boast higher returns on offer for investors, but these carry significant risks because they are still not developed economies.

This makes the U.S. the pick of the bunch for investors searching for somewhere safe to park their cash.

“While the recovery in risk appetite is a negative for the Dollar, we expect its downside to remain for a while (mainly against G10 FX) given its attractive yield - relative to other currencies in the G10 FX space,” says Krpata.

The current differential is unlikely to change any time soon either. None of the major developed central banks look even close to raising interest rates.

The ECB has pushed back the date at which it expects to be able to start raising interest rates; the BOE is waiting for Brexit to conclude before it makes a move; the BOJ remains under pressure to push up inflation which has languished at ultra-low levels for years with no signs of improvement; the RBA (Reserve Bank of Australia) is neutral-to-dovish, suggesting a still-present risk of a rate cut; the RBNZ (Reserve Bank of New Zealand) is now expected to cut rates, some think as soon as May due to the recent steep drop in inflation..and the list goes on.

The rate advantage is likely to remain with the Dollar for some time.

“The limited scope for a material move in the USD-G10 FX interest rate differential against USD (as other central banks also stroke a more neutral or dovish bias – like the Fed) and the lack of a meaningful growth convergence of the rest of world to the US,” means the Dollar should remain supported, adds ING’s Krpata.

Relatively-speaking U.S. data could be characterised as resilient despite a recent downturn.

Unlike the Eurozone, U.S. PMI’s remain well above the contraction/expansion 50 level. GDP is above 2.0% which compares favourably to most other G10 nations where it is below 2.0%. Unemployment remains at historic lows much like most other developed nations. The scare which followed the 20k payrolls release in February was rectified in March when payrolls once again rose (by 196k) back up to their long-term average.

Thus the chances are that the differential benefiting the Dollar will remain in place and will continue underpinning the currency with solid strength in the medium-term.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement