Pound-to-Dollar Rate Retreats on U.S. GDP Growth Surprise

- Written by: James Skinner

© Adobe Stock

- GBP/USD eases from highs as USD celebrates upside GDP surprise.

- But the U.S. economy is slowing and a USD turn lower is still not far off.

- Timing of USD decline at beck and call of a struggling global economy.

The Pound-to-Dollar rate retreated further from recent multi-month highs after official data showed the U.S. GDP growing faster than was expected during the final-quarter of 2018, potentially tempering fears of an imminent slowdown in the world's largest economy.

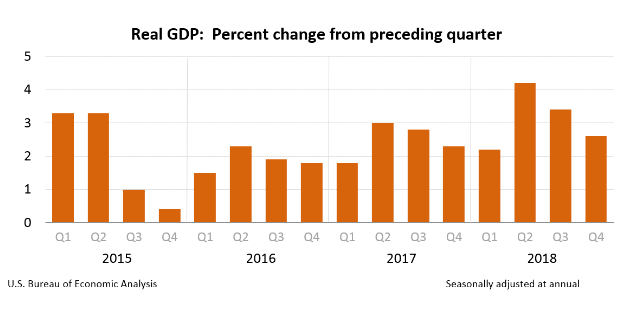

The U.S. economy grew at an annualised pace of 2.6% in the final quarter, less than the downwardly-revised 3.4% pace of growth seen in the previous period but substantially ahead of the consensus for growth of just 2.2%.

GDP rose by 2.9% for 2018 as whole, up from 2.2% in 2017, although this result came in a year when the economy received substantial support from President Donald Trump's mammoth package of corporate and personal tax cuts.

"US Q4 GDP was not bad, not bad at all, considering all the fretting about a slowdown that dominated the news flow during the quarter. The 2.6% annualized pace was about a half point above our forecast and the consensus, helped by a firmer reading than we expected on business investment spending," says Avery Shenfeld, chief economist at CIBC Capital Markets.

Above: U.S. quarterly GDP growth rates. Source Bureau of Economic Analysis.

There was abnormally high uncertainty ahead of Thursday's release given trade balance data released Wednesday and retail sales figures out earlier this month had both pointed toward a particularly weak finish to the year.

Dollar exchange rates turned higher following the release, with the greenback rebounding firmly against the G10 currency bloc, which has helped drive the Pound-to-Dollar rate back from the six-month highs seen earlier in the week.

Above: Pound-to-Dollar rate at hourly intervals. GBP has been buoyed by Brexit developments of late.

"The Dollar pared declines after growth last quarter proved better than expected. The world’s biggest economy grew at an annual rate of 2.6% during the final three months of 2018 which topped forecasts of 2.3%. For 2018, the economy stopped short of 3% growth that had been expected, coming in at 2.9%, the quickest in three years. While the economy entered 2019 with a bit more momentum that expected, recent data suggest it lost further growth in the first quarter. The data, consequently, affirmed the Fed’s patient stance for interest rates, keeping higher rates off the table over the foreseeable future," says Joe Manimbo, a foreign exchange analyst with Western Union.

The Pound-to-Dollar rate was -0.23% lower at 1.3287 but has risen 4.29% in 2019 while the Euro-to-Dollar rate was 0.06% higher at 1.1385 after trading at 1.1405 before the release. The Dollar index was quoted --0.04% lower at 96.06 following the result after having recovered from 95.90 before the data was out.

"The stronger outturn in Q4 will be a negative for fixed income markets today, and supportive for the US dollar and cyclical equities," says CIBC's Shenfeld.

Above: Euro-to-Dollar rate at hourly intervals.

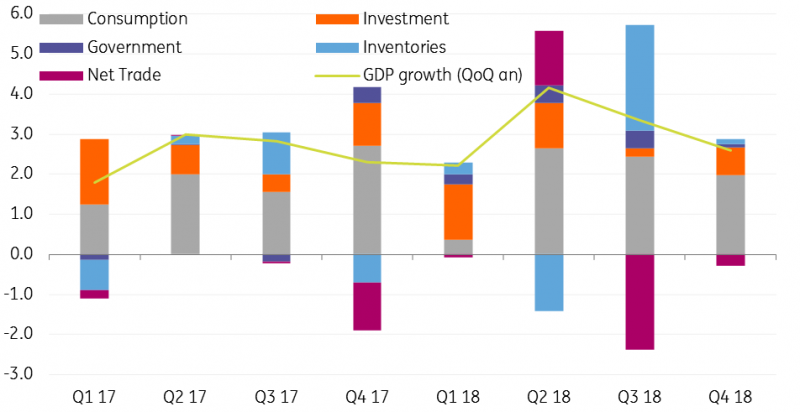

Consumer spending, busines investment, exports, inventory investment and federal government spending all made positive contributions to growth during the final quarter, according to the Bureau of Economic Analysis.

Positive contributions from the above areas were partially offset by a pick-up in imports, which are a subtraction in the calculation of GDP, as well as falls in residential investment and local government spending.

Currency markets care about the GDP data because it reflects rising and falling demand within the US economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

"The US economy slowed by less than feared in 4Q18 with investment picking up some of the slack. With the government shutdown over and a better backdrop regarding financial markets and trade, we suspect activity in 1Q19 can perform well, too," says James Knightley, chief economist at ING Group.

Above: Contributions to U.S. GDP growth by category. Source: ING Group.

The Federal Reserve (Fed) has raised interest rates nine times since the end of 2015, and on four occasions in 2018, taking the Fed Funds range to between 2.25% and 2.5%. That rate was once expected to hit 3.25% by the end of 2019.

However, the deteriorating condition of the global economy late last year forced the Fed to hit the pause button on its rate hiking cycle this January and markets are now unsure as to whether and when it might move again.

"Growth overshot expectations because investment in intellectual property rocketed at a 13.1% rate, nearly double the underlying trend pace. These numbers are volatile and a much smaller gain is likely in Q1. Consumption, which accounts for nearly 70% of GDP, was a bit weaker than we expected," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics.

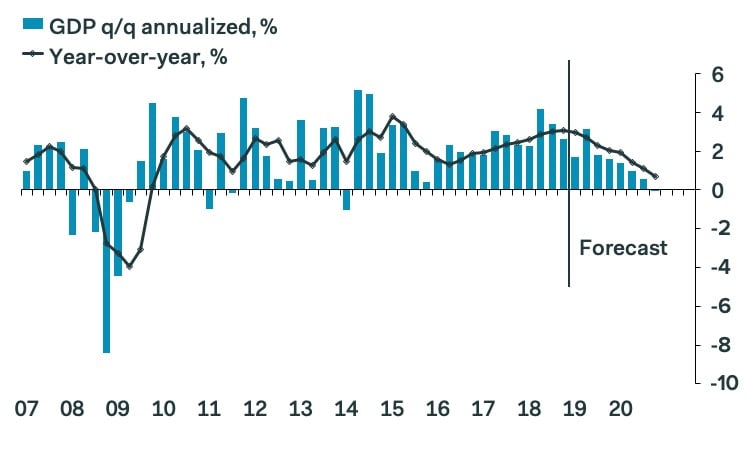

Above: U.S. GDP growth on quarterly and annual basis. Source: Pantheon Macreconomics.

"Growth had to slow as the boost from the tax cuts faded, though the transition was eased by the plunge in gas prices. Q1, however, faces real headwinds. Gas prices are no longer falling, the government shutdown likely caused at least some unrecovered hit to consumption, business capex is softening and global growth is weaker," Shepherdson adds.

Shepherdson and the Pantheon team say U.S. growth has now peaked but that the end of the cycle, in other words a recession, is still quite some way off. They say it could be 2021 before the U.S. economy enters a downturn.

Thursday's data comes as investors view the G10 currency complex as a bit of an ugly contest. If the U.S. economy slows notably and in a sustained manner at the same time as Europe, the Antipodean countries and China continue to slow, then it could lead to inertia in currency markets.

Traders bid the Dollar higher last year, driving the Dollar index from a -4% loss in the first quarter to a near-5% gain by year-end, because U.S. economic growth picked up sharply after President Donald Trump's tax cuts were implemented at a time when other economies were slowing.

That led investors to anticipate that the Federal Reserve would go on lifting its interest rate as other central banks sat on their hands. But in recent months analysts have increasingly advised that those roles are close to reversing.

"As the stimulus fades and the lagged impact of past monetary tightening continues to feed through, we expect GDP growth to slow to 2.2% this year and only 1.2% in 2020. Under those circumstances, we don’t expect the Fed to hike rates again and we anticipate 75bp of rate cuts in 2020," says Paul Ashworth, chief U.S. economist at Capital Economics.

So far the big Dollar reversal hasn't happened because economies in Europe and other parts of the world have slowed even further but most still say judgement day is continuing to edge close for the Dollar.

For now, familiar ranges for Dollar exchange rates are holding but it would only take a handful of signs that an economic recovery is on the way in Europe for the greenback to turn lower.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement