Pound-to-Dollar Rate in the Week Ahead: Studies Suggest More Declines Possible

Image © Nazli Sart, Adobe Stock

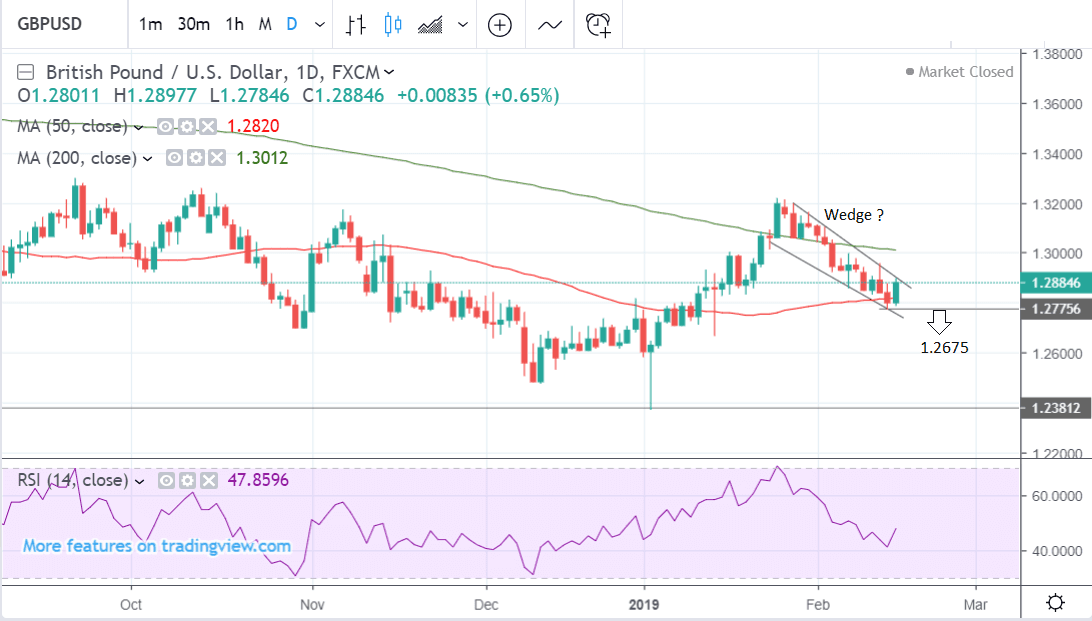

- GBP/USD in short-term downtrend which is forecast to continue

- Some bullish signs suggest risk of a reversal higher

- Brexit news, wages data key for Sterling

- Trump call on import tariffs on EU-made cars key for Dollar

Pound Sterling is in a short-term downtrend against the U.S. Dollar which leads us to suggest more of the same is possible near-term but we are conscious that weekend news on a potential softening on France's Brexit stance could benefit the currency early on.

The Pound-to-Dollar exchange rate will be trading at 1.2885 when markets open, 0.4% lower than the week before.

From a technical perspective, the pair is in a short-term downtrend which is forecast to continue on the condition that the pair can break to a new low. As such, a move below the 14 February 1.2773 lows would probably result in a continuation down to a target at the 15 January 1.2675 lows.

Although the pair has risen up to the top border of the falling channel it is in at 1.2900 it has not broken out from the channel and could easily pull back down to the lows, and continue its steep descent.

There are also signs which suggest the risk of a bullish reversal of the entrenched short-term downtrend. These include the formation of a possible bullish wedge pattern during the decline since the January 25 highs. This suggests the potential for substantial upside should the pair manage to break out of its channel.

The pair has also formed a bullish key reversal pattern on the monthly chart - a further sign it could extend higher eventually.

Key reversals occur at the end of trends when the exchange rate moves to a new low and then rises up and closes above the previous period’s high. The strong turnaround in the space of a month is seen as indicative of a major trend-changing shift in sentiment.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Dollar: What to Watch this Week

Image © The White House

Donald Trump will be key for the Dollar next week. We saw some market impact on the Trump's announcement on Friday that he was declaring a national emergency in order to secure funding for the building of a wall on the country's southern border.

Market attention now turns to the question of whether he will impose import tariffs on European vehicles.

"Auto tariffs are looming as the brand new report on the matter from the Commerce Department calls car imports a security threat according to several sources. This leaves Donald Trump with a three-month window to call an executive order that imposes a 25% tariff on car imports," says Andreas Steno Larsen at Nordea Markets.

Nordea Markets believe the Dollar has benefited on these expectations, and therefore we would expect the currency to benefit further if the Commerce Department do indeed confirm expectations and Trump signals an intention to impose tariffs. "What if the talk of auto-tariffs re-emerges over the next three months on the heels of the report released this weekend? Then the USD could prove stronger for longer," says Larsen.

The minutes to the Federal Reserve's most recent policy meeting will catch market attention at 19.00 GMT on Wednesday, February 20.

The Fed sets interest rates, the moves of which are a major driver of the U.S. Dollar. When rates rise - or are expected to rise in the future - it attracts greater inflows of foreign capital driving up demand for the currency in the process. A fall in rates has the opposite effect and can lead to outflows.

The Fed has adopted a more neutral stance on interest rates recently after fears U.S. economic growth has peaked. The Fed has been engaged in both interest rate increases and the process of ‘quantitative tightening’ (QT) whereby it stops reinvesting principal from expiring bonds into new bonds, and this is seen as having had a dampening effect on inflation and the economy.

The minutes will present a detailed account of the deliberations of the members of the Fed’s policy committee in relation to these concerns as well as the right Fed policy response.

It could also reveal whether they are likely to continue with a neutral stance or not. If the minutes suggest they will - as seems most likely - the Dollar could continue to trend with a subdued tone.

“Another risk for the Dollar are the FOMC minutes of the January meeting. The Federal Reserve surprised many when it seemingly ruled out a rate hike in the near term and flagged potential changes to its balance sheet unwinding plans. Should the minutes corroborate the dovish shift, the dollar could face some increased downside pressure,” says Raffi Boyadijian, currency analyst at broker XM.com.

Thursday, February 20, could also be an important day for U.S. data as it will see the release of the IHS Markit PMI sentiment surveys for manufacturing and services, existing home sales and U.S. durable goods orders.

Manufacturing PMI for February is out on Thursday at 14.45 and is forecast to show a slowdown to 54.7 from 54.9. Services, out at the same time is forecast to show a slight rise to 54.3 from 54.2.

PMIs are fairly reliable leading indicators for the economy so any surprise fluctuations could impact the outlook and the Dollar.

Durable Goods (ex. big ticket transport orders) in December, out at 13.30, is forecast to rise 0.3% from -0.3% previously.

Given recent poor data showing a slowdown in the U.S housing market, existing home sales, on Thursday at 15.00 could also be a key indicator. Currently, analysts expect a 2.2% rise after the quite severe -6.6% slump in the previous month of December.

The Pound: What to Watch this Week

Image © Number 10 Downing Street

Brexit developments will likely remain the main driver for the Pound over coming days.

Over the weekend news reports suggest French President Emmanuel Macron "and other European countries are ready to give Britain legally binding assurances that the Irish backstop is temporary".

"President Macron of France has softened his line in recent weeks to aid a last-ditch attempt by the EU to help get the withdrawal agreement across the line next month," says Bruno Waterfield, Brussels Editor at The Times.

UK Prime Minister Theresa May is currently engaged in negotiations with the EU to win changes to the Irish backstop mechanism: that piece of the Brexit Withdrawal Agreement that could ultimately see the UK locked into the EU's single market and customs if ever triggered.

Legislators in the UK parliament in January rejected the Brexit deal and asked the Prime Minister to deliver substantial changes to the Irish backstop if they were to pass the deal.

For Sterling, the passing of a deal is seen as a best-case scenario as it eliminates a 'no deal' will simultaneously provides at least two years of legislative stability for UK and EU businesses.

"Macron to the Pound’s rescue," says Viraj Patel, foreign exchange strategist with Arkera. "GBP has been broadly stuck in a 1.27-1.32 range since Sep (breaking out only at extreme times of Brexit pessimism/optimism). At 1.28-1.29 we’re in the pessimistic-neutral state, so news like this will on the margin lift."

Looking at the data calendar, the key release for the Pound will probably be employment and wage data out on Tuesday at 9.30 GMT.

The figures come out against a backdrop of falling inflation and broadly waning growth which have brought into question expectations that the Bank of England (BOE) will start raising interest rates as soon as the fog of uncertainty around Brexit has cleared.

“After the worrying GDP numbers for December, a weak set of jobs figures could spark more concerns that the never-ending Brexit saga is starting to have a more profound impact on the UK economy,” says XM.com's Boyadijian.

The unemployment rate remains at historic lows so the key market focus will shift to average weekly earnings in December. If these have increased to 3.5% year-on-year, as forecast, it could push up the Pound. Higher earnings would probably push up interest rate expectations and higher interest rates tend to have a supportive effect on the currency because they attract greater inflows of foreign capital.

“The jobless rate is predicted to have held at 4.0% in the three months to December, while average weekly earnings are forecast to have increased by 3.5 y/y during the same period, accelerating slightly from the prior 3.4%. Faster wage growth could be seen as offsetting some of the negative effects of lower oil prices on the consumer price index, which fell to 1.8% y/y in January,” says Boyadijian.

Another key data releases is the CBI Industrial Trends survey, which can provide a leading indicator for the economy. It is forecast to show a fall to -5 in February from -1 previously.

Public Sector Net Borrowing for the UK in January is out on Thursday at 9.30, and is followed by a speech from BOE’s chief economist Andy Haldane.

The CBI Distributive Trades survey in February is out at 11.00 on Thursday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement