Pound-to-Dollar Rate to "Outperform" as Investors Jettison Greenback says Lloyds

- Written by: James Skinner

© Adobe Images

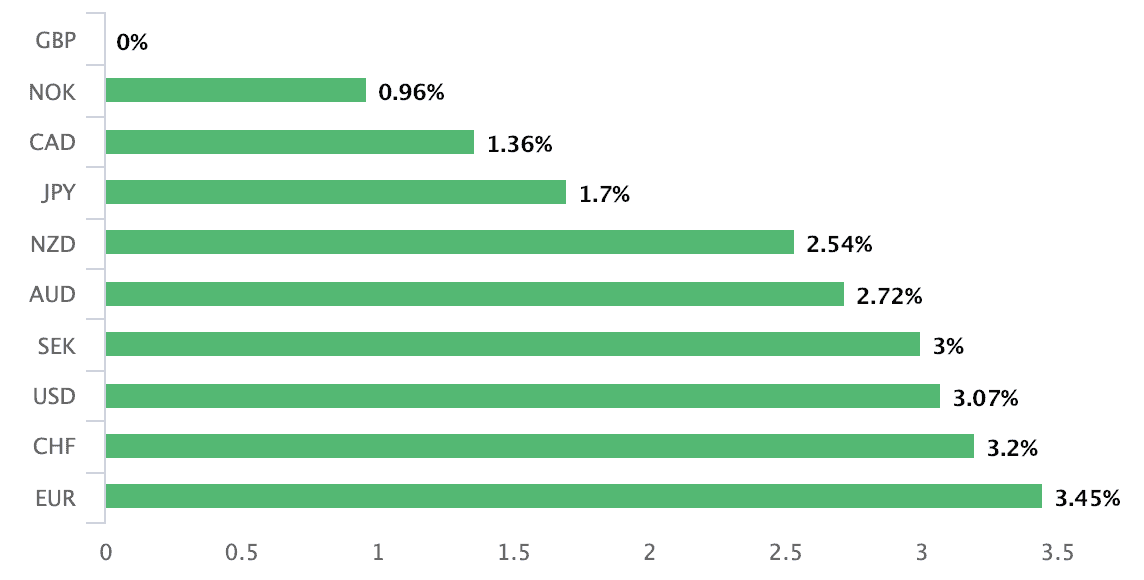

- GBP, G10's best performer, could rise even further says Lloyds Bank

- As Fed retreat sees investors call time on their U.S. Dollar holdings.

- Because the market is yet to accept today's new interest rate reality.

The Pound could rise further against the Dollar in the months ahead according to Lloyds Bank, outperforming rivals in a race to recoup ground lost to the greenback last year, as investors jetttison the U.S. currency from their portfolios.

Lloyds' call comes with the Pound riding high, in first place within the G10 currency league table for 2019, as markets are increasingly betting that Prime Minister Theresa May will eventually ask the EU for an extension to the Article 50 withdrawal period.

That could ultimately lead to a second referendum, a Brexit-cancelling election or some other kind of exit-nullifying agreement between the political parties in Westminster, which would remove the Brexit-shaped Damocles Sword that's been hanging over Sterling since June 2016.

"Market positioning dynamics suggest there is a risk of a sell-off in the US dollar. This is particularly the case among the ‘real money’ community (and the adjustment is already underway)," says Gajan Mahedevan, a strategist at Lloyds, in a note to clients. "From ‘narrative’ and positioning perspectives, there is greatest scope for GBP, AUD and CAD to outperform."

Above: GBP performance in 2019, Pound Sterling Live.

Mahadevan draws his insights from theories popular with behavioural scientists, who often argue that investors suffer from confirmation bias and that they are also prone to being taken in by "narrative fallacy", which basically means they hear only what they want to and often base their decisions based on flawed interpretations of events.

Lloyds' sees this bias and narrative fallacy at work in the currency market today, given the Dollar has barely depreciated ever since the Federal Reserve said in December and January that it will not raise rates again until it is satisfied a possible implosion of the Chinese and Eurozone economies will not blow back and crimp U.S. growth.

The Dollar index was down by just -0.67% for the last calendar month Thursday, after having reversed a -4% first-quarter loss to go on and finish the 2018 year with what was almost a 5% annual gain. That was a significant swing that dominated market headlines all year.

The Dollar has been resilient because investors have not yet given up on their bets that the U.S. Dollar will rise even further during the months ahead, "positioning" data shows. Mahadevan says this suggests investors are still clinging to the idea the Fed will go on raising interest rates, even in the face of mounting evidence that it might not.

Such a disconnect between investor expectations of the Fed and the reality on the ground in parts of the global economy tells Mahadevan and the Lloyds team that violent moment of realisation could soon dawn on the currency market, which sees investors rush to jettison the Dollar from their portfolios.

There are some signs that this might already be happening with some currencies, although not with Sterling rates or those of the Australian and Canadian Dollars.

"Between October and today, there have been notable changes in implied EUR and JPY positioning. The ‘short’ EUR position has been significantly reduced and the JPY position has switched from ‘short’ to ‘long’. In contrast, the change in ‘short’ positioning in GBP and AUD has been much less pronounced and in CAD there has actually been an increase in size of the market’s ‘short’," Mahadevan explains.

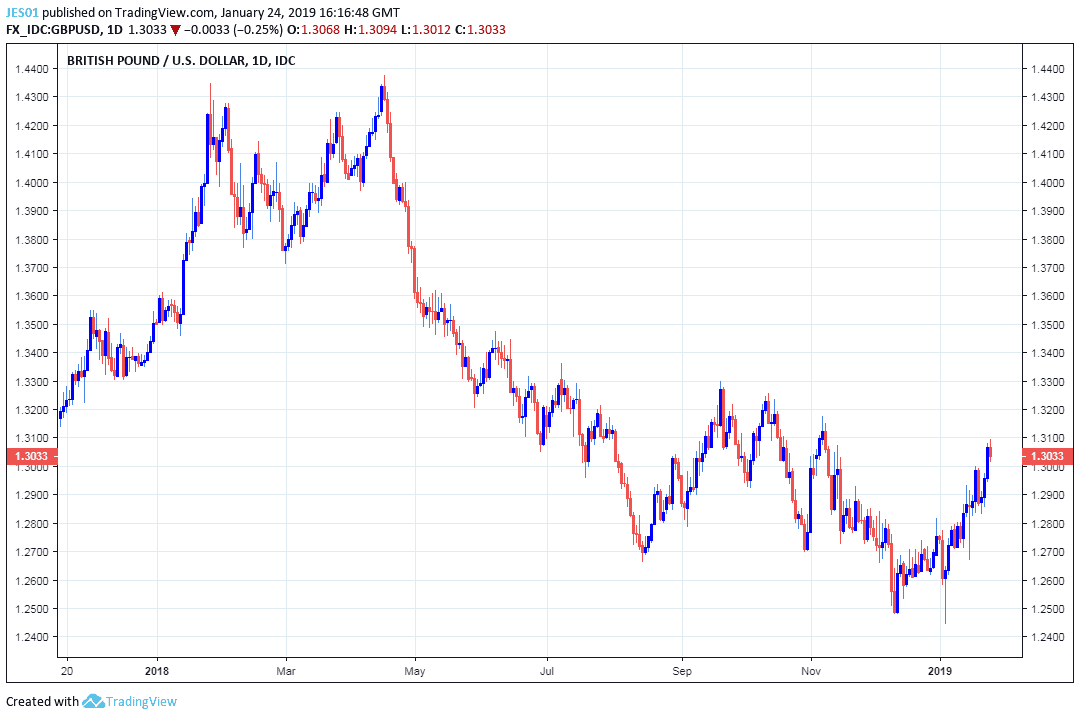

Above: Pound-to-Dollar rate shown at hourly intervals.

Pound Sterling has risen strongly against the U.S. Dollar this year and so too have the Australian and Canadian Dollars, but most analyst models show those currencies are still undervalued relative to the U.S. Dollar, while Lloyds says market positioning is also still slaned heavily against them.

In other words, all of those currencies have the most scope to recover against the U.S. Dollar if and when the market gives up betting the Fed will continue its rate hiking cycle even as the global economy falls apart.

However, the current market environment and litany of risks facing the global economy mean such a turn could take quite some time to materialise, not least of all because the greenback is a so-called safe-haven currency that tends to do well in times of uncertainty or strife.

For Sterling, the ongoing Brexit saga could be a headwind to further meaningful gains until markets can be confident that a disorderly exit from the EU on March 29, 2019 can be avoided. Some analysts say the Pound-to-Dollar rate could fall sharply over the coming weeks.

"Trade tensions with China and volatility in equity markets have weighed on confidence and led to a paring back of policy rate expectations. Brexit developments are crucial for GBP/USD. Given the high degree of uncertainty around the outcome, the currency pair is likely to remain volatile," Mahadevan concedes, in a separate note to clients.

Mahadevan forecasts the Pound-to-Dollar rate will rise to 1.35 before the end of March, from just below 1.31 Thursday, and that it will end 2019 at 1.33.

Above: Pound-to-Dollar rate shown at daily intervals.

For the market, resolving the U.S.-China trade war is key too because it's hurt the world's second largest economy, leading growth and industrial production to fall steeply in 2018, while stoking fears for the global economy.

Negoatiators from both sides are in talks aimed at reaching a deal to end the tariff fight between the world's two largest economies before March 01, the date when tariffs on more than $200 billion of Chinese goods exported to the U.S. each year will more than double to 25%.

The White House wants to end China's "unfair trade practices" and has threatened to clobber the nation with tariffs on all of its $567 billion annual exports to the U.S. if the country does not fall into line.

Mahadevan and the Lloyds team forecast the Dollar index will fall to 94.5 before the end of March and that it will close the 2019 year at 90.3.

This implies the American unit will lose all of its 2018 gains this year, given the Dollar index entered 2018 at 92.30.

f

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.