The Top Four FX Trades for Early 2019 from Nordea Bank

Image © DragonImages, Adobe Stock

- USD to fall

- NOK on a roll from seasonal scarcity

- AUD to fall due to slowing housing market

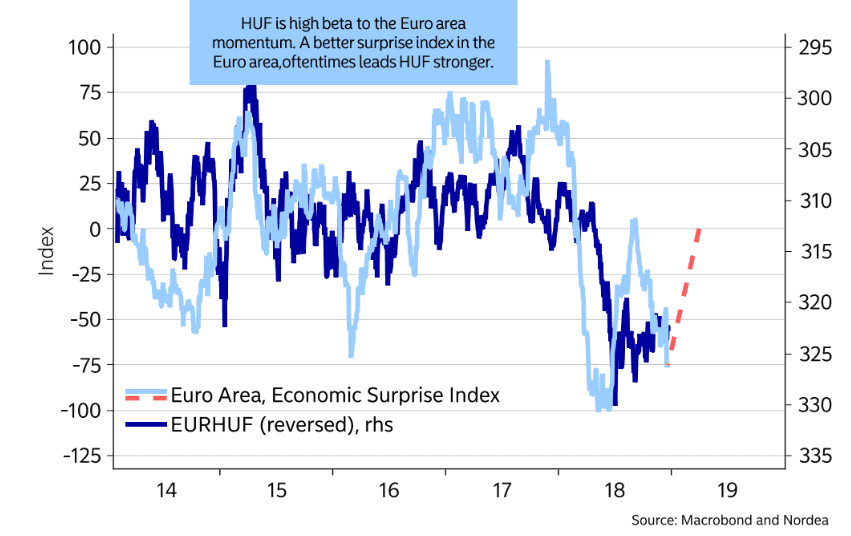

- HUF higher as Eurozone data rebounds

The U.S. debt-ceiling, an Aussie housing market in decline, seasonal extremes in Norway, and the Hungarian Forint's relationship with Eurozone data are all key factors expected to drive markets in the first quarter of Q1, according to Nordea Bank, which has published a list of ‘top trades’ for the start of the year.

These include selling USD (versus a variety of others, including JPY, NZD and NOK), shorting EUR/NOK, selling AUD (versus SEK), and buying HUF/CAD.

Below we discuss each of these in more detail.

Nordea have a good track record with their ‘top trade ideas’ series, with a 67.7% hit rate over 27 trades, and an average profit of 1.52%.

Trade 1. Short USD

The US Dollar will probably fall in Q1 because of a rise in liquidity triggered by a release of emergency funds as the U.S. government reaches its debt ceiling limit extension deadline, on March 1.

After that, it will be a lot harder for ‘Uncle Sam’ to borrow the money it needs to run government. As a result, money for essential services will have to come out of reserves, which will cause a short-term liquidity glut, diluting the Dollar in the process.

The government will seek to extend the debt ceiling but a reluctant house will probably reject the proposal leading to a standoff and continued reliance on reserves, thereby keeping up the excess liquidity problem.

“Currently the US Treasury holds around $400bn in liquidity at the cash buffer at the Fed. This cash buffer will be brought down by at the very least 200bn already 1-1.5 months ahead of the March 1 deadline,” says Andreas Steno Larsen and Martin Enlund, analysts at Nordea Bank. “This could be a game-changer (at least temporarily) for the USD, risky assets and potentially also EM, as scarcer USD liquidity has likely been a co-culprit behind a stronger USD, weaker risky assets and struggling emerging markets.”

Previous debt-ceiling standoffs have almost always led to a reduction of the Treasury's reserves to only $50bn, suggesting a substantial cash of “$350bn is potentially on the cards ($400bn-50bn). The U.S. Treasury has promised to make this a “smoother process” than in 2017,” say Larsen and Enlund.

The “odd-bedfellows” of NZD and JPY could be perfect partners for Nordea's soft-Dollar trade due to their heavy short-positioning and propensity for a short-squeeze higher.

Trade 2. Short EUR/NOK

History shows that a fall in the ‘seasonal’ liquidity of the Norwegian Krone tends to lead to an appreciation of the currency and result in a decline in EUR/NOK. This effect is likely to happen again in Q1, says Nordea.

“Trend-shifts in EUR/NOK have tended to coincide with major trend shifts in structural bank liquidity in NOK,” say Larsen and Enlund.

Structural bank liquidity tends to be highly dependent on the cyclical non-oil budget deficit and this suggests a rise in NOK in Q1.

“From January until mid-May the structural liquidity will shrink,” says Enlund and Steno Larsson. “EUR/NOK seems like a super “sell-case” from current levels. In particular in Q1 due to the shrinking liquidity picture,” say the strategists.

Trade 3. Short AUD/SEK

AUD/SEK is forecast to weaken as the Australian Dollar losses ground, the main fundamental reason being the fragility of the Australian housing market.

Nordea see the possibility of an interest rate cut from the Reserve Bank of Australia (RBA) in 2019 in an attempt to prop up house prices. This would be very negative for AUD since most other central banks are either neutral or about to raise rates, and higher interest rates tend to support a currency by attracting and keeping greater inflows of foreign capital.

“If the old saying as homes go, so goes the economy has any truth in it, so then maybe a risk of a cut should be priced in soon,” says Larsen and Enlund.

Trade 4. Long HUF/CAD

Dubbed the “long Orban versus Trudeau trade” by Nordea, after the leaders of the respective countries in the pair, this is a call for the Hungarian Forint to rise versus the Canadian Dollar.

The trade is based on evidence that when the Eurozone economic surprise index recovers it tends to coincide with a recovery in HUF.

Even though data in the Eurozone has tended to be on the negative side recently, “from current levels in the Euro-area surprise index a rebound is most likely,” say Enlund and Larsen.

HUF also tends to perform well when the Dollar is weak (which could happen as a result of the debt ceiling), whilst CAD is more likely to fall in such a scenario.

Inflation is rising rapidly in Hungary which may help HUF if it leads to higher interest rates, whilst CAD could suffer from a slowing housing market which could make the Bank of Canada (BOC) keep interest rates low.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here