Pound-to-Dollar Rate in the Week Ahead: Break Above 50-day M.A. Will Green-Light More Gains

Image © Goroden Kkoff, Adobe Stock

- Pound has risen on renewed Brexit hopes

- A break above the 50-day will extend rally

- Main release for Sterling is GDP data

- Dollar eyes mid-term election results and Federal Reserve

The British Pound rallied strongly versus the U.S. Dollar last week buoyed by renewed hopes of a compromise on the question of the Irish border backstop as well as deal covering the trade in services for U.K. firms after Brexit.

However, it can be argued at least half the move higher in GBP/USD, that took it back above 1.30, can be attributed to a sharp bout of Dollar selling that characterised global FX, with traders apparently lightening up on long Dollar exposure ahead of the U.S. mid-term elections and improved sentiment on U.S.-China trade relations.

The same overarching themes driving the Dollar and Pound will remain in place over coming days.

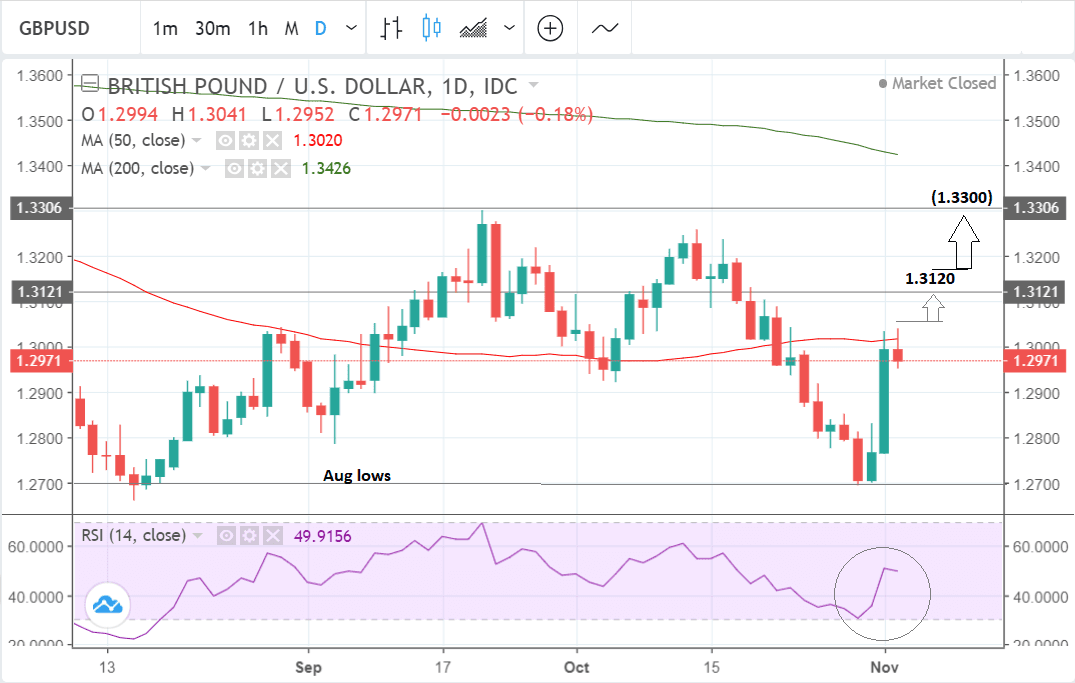

Technical studies see the reversal higher being supported by strong momentum as measured by the RSI indicator, which is showing a steep rise in the lower panel of the daily chart below.

The steepness of the rise compared to the gentler slope down which preceded it, is a sign the short-term trend may be changing.

GBP/USD lost ground slightly on Friday after U.S. payrolls showed a better-than-expected result in October.

This coincided with the exchange rate touching its 50-day moving average (MA) at 1.3020. The MA is likely to present a tough obstacle to further appreciation but if the exchange rate can successfully break above 1.3055 it will probably confirm a continuation up to the R1 monthly pivot at 1.3120.

Whilst R1 may produce some temporary resistance to further gains the bullish trend is expected to continue eventually, and a move above 1.3145 would confirm an extension up to the next target at the 1.3300 level of the September highs.

Monthly pivots are used by technical traders to fade the dominant trend in anticipation of a pull-back. They are also used as short-hand to access overbought and oversold levels.

Advertisement

Bank-beating GBP/USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The U.S. Dollar: What to Watch this Week

The mid-term elections will take place this week, with the outcome widely tipped to result in a stalemate in Congress with Republicans maintaining control of the Senate and Democrats retaking control of House of Representatives.

The outcome, "is unlikely to drive a market reaction," says Daniel Been, Head of FX Research at ANZ Bank. "In the medium term, we don’t see this as a positive outcome. It would halt policy progress and very likely push the President to focus on what he can control without support from the houses – notably, trade policy."

The main economic calendar event for the U.S. Dollar in the week ahead is likely to be the meeting of the US Federal Reserve (Fed), on Thursday at 19.00 GMT.

The Fed sets interest rates, which have a profound impact on the Dollar. When interest rates rise, so does the greenback.

Currently, analysts do not think the Fed will change interest rates at their meeting on Thursday. The market, will, however, nevertheless, be watching for any changes in wording in the accompanying statement from the Fed, and J Powell's press conference, about their expectations for future policy.

Analysts at Westpac think it is unlikely, the Fed will alter their stance given strong recent economic data which has, if anything, reinforced, their hawkish outlook for about an average of three 0.25% interest rate hikes in 2019.

"Come the November meeting, there is no reason to expect a material change in view, though rates will not be raised. Employment growth has remained strong, so too GDP," says a currency strategy note from Westpac Bank. "The nascent evidence of interest rate sensitive sectors coming under pressure is unlikely to concern the Committee at this stage with policy still seen as accommodative. This is also true of recent market declines as equities remain at elevated levels."

The other main release in the coming week is non-manufacturing ISM which is forecast to slow to 59.3 from 61.6 previously when it is released on Monday at 15.00.

JOLTS Job openings are also out at 15.00 on Tuesday.

The Pound: What to Watch this Week

For Sterling, Brexit remains central to the outlook with the swinging in sentiment on whether or not a deal will be agreed by year-end being the main driver of the currency.

"Headlines on Brexit will intensify, but short of a material sign that negotiations are progressing (or that we are heading towards a ‘no deal’), they are unlikely to trigger a decisive directional shift in Sterling," says Daniel Been, Head of FX Research with ANZ Bank.

Data releases have however moved Sterling over recent days, but the moves tend to be short-lived in nature and therefore tend to be faded.

Nevertheless, there are some important numbers to watch.

Services PMI for October is another important release for the Pound in the week ahead. It is released on Monday at 9.30. It is forecast to slow to 53.3 from 53.9 previously.

The PMI numbers already released this week have been mixed with manufacturing PMI released Thursday disappointing while construction on Friday beat expectations.

The key release for the Pound in the week ahead is GDP data, out on Friday, November 9 at 9.30 GMT.

Month-on-month GDP is forecast to have only grown 0.1% while third quarter GDP is forecast to show a 1.5% rise on an annualised basis (1.2% previously) and a 0.6% rise on a quarterly basis (quarter-on-quarter) compared to 0.4% previously.

If growth accelerates as much as expected it may boost the Pound - if it beats expectations it could rise even more strongly.

Industrial and manufacturing production for October are out on Friday at 9.30 and forecast to show -0.1% and 0.1% changes in October on a monthly basis. While the data will be important we feel that from a Sterling perspective it will be overshadowed by the more timely monthly statistic.

Also on Friday are trade data with the balance forecast to reveal a deficit of £11.40BN in September.

Apart from this, there are also several housing metrics out including Halifax house prices at 8.30 on Wednesday and the RICS house price balance at 0.01 on Thursday.

The British Retail Consortium's retail sales monitor is often a good leading indicator for retail sales in general and it is forecast to show a 0.6% rise in October when released at 0.01 on Tuesday.

Advertisement

Bank-beating GBP/USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here