U.S. Dollar to Dominate into Year-end but is Now Enjoying its "Last Hurrah" says Societe Generale

- Written by: James Skinner

© jcomp, Adobe Stock

- USD to advance further into year-end as economy outpeforms.

- But it is now in the final stages of its rally, will turn lower in 2019.

- It tracks TIPS yields closely, but growth and inflation to fall in 2019.

The U.S. Dollar will continue to reign supreme over currency markets into year-end but it is now enjoying what is likely to be its last hurrah in the current economic cycle, according to strategists at Societe Generale.

America's Dollar has risen sharply during the seven months to November 2018, thanks to a superior performance from the world's largest economy on the global stage, and also due to President Donald Trump's "trade war" against China, which has supported demand for the safe-haven currency.

But it's had a volatile week going into the opening days of November, falling progressively until noon Friday after it emerged that the U.S. and China have agreed to discuss a trade deal that would end the tariff fight between the two.

This undermined the safe-haven bid for the greenback, pushing it lower, only for the U.S. currency to find fresh impetus for gains on Friday after official data showed U.S. wage growth coming back with a bang in October.

"The dollar had a very strong October, and while it’s come down to earth with a bump as November starts, upcoming US economic data are likely to be supportive. The mid-term elections are a potential threat if the Democrats perform much better than expected, but otherwise, a turn lower is more likely in 2019 than in late 2018," says Kit Juckes, chief currency strategist at Societe Generale.

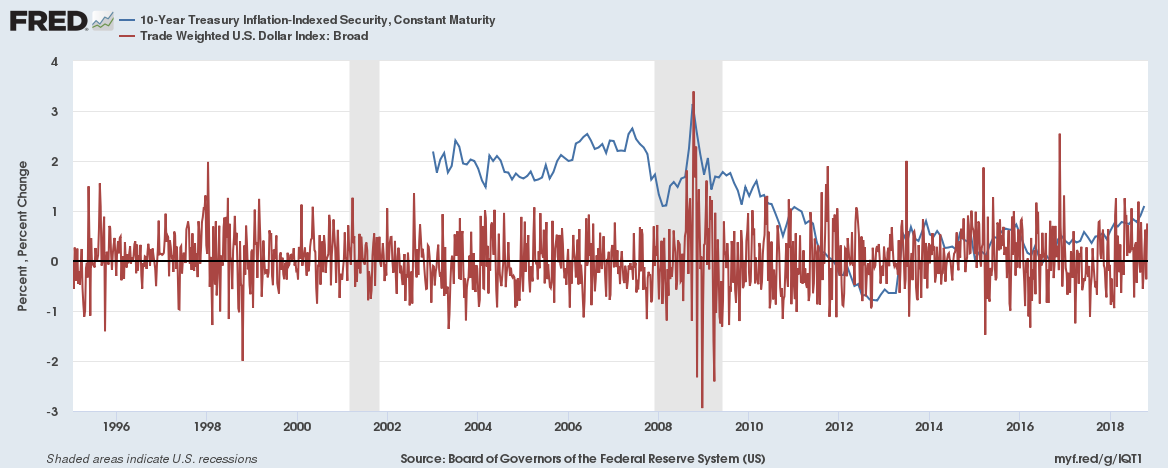

The Dollar has tracked the yield on U.S. Treasury-Inflation-Protected-Securities (TIPS) quite closely in recent years, Juckes flags, and there are grounds to think that yield might decline once into 2019.

TIPS pay investors a yield that floats alongside the consumer price index so the interest paid rises and falls along with inflation. This works for bond investors because the greatest threat they face, apart from default, is from inflation.

There are many factors that can influence inflation but the most important are growth in economic output and the wages of workers.

Above: Dollar index (Red) percentage change U.S. 10-year TIPS yield (Blue).

"The good news (for the dollar but definitely not for some of our FX forecasts, which will be revised in November) is there has been a reasonable relationship in recent years between the US’s real exchange rate and 10-year TIPS yields," Juckes writes, in a note to clients. "As real yields edge higher, so the dollar will continue to find support."

The stimulatory effect of President Donald Trump's 2018 tax cuts enabled the economy to grow even faster this year, at a time when most other developed economies were slowing.

This in turn has lifted inflation and enabled the Federal Reserve to go on raising its interest rate at a time when the monetary policy outlook elsewhere in the developed world has darkened.

However, U.S. economic growth is forecast to slow in 2019, by almost all economists including the Societe Generale team. This is largely because without further stimulus the economy will not be able to maintain its inflated rate of expansion.

But some also say the Federal Reserve's interest rate policy will soon begin to bite the economy, eventually leading inflation and interest rates to decline.

The US Dollar index was quoted 0.24% higher at 96.53 Friday while the Pound-to-Dollar rate was 0.31% lower at 1.2962 and the Euro-to-Dollar rate was 0.16% lower at 1.1385 for the session.

Juckes and the Societe Generale team's latest forecasts were for the Dollar index to finish 2018 at 93.02 and the Pound-to-Dollar rate to end the year at 1.29, while the EUR/USD rate closes at 1.19.

They are set to revise those forecasts later in November. It's not clear how much higher the U.S. Dollar forecasts will be raised, or for how much longer they expect the greenback to dominate currency markets.

Bank-beating exchange rates! Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here