U.S. Dollar Looks Intent on Rallying into Year-End

- Written by: Gary Howes

Image © RCP, Adobe Stock

- Dollar could be in for strong end to 2018

- Dollar strength remains key theme for global FX markets

- PCE data supports Dollar strength at start of the week

- Pound-to-Dollar rate @ 1.2809 today, Euro-to-Dollar rate @ 1.1379

What will the Dollar do this week? This will be foremost in the minds of currency market participants following the currency's ongoing push higher that has cast aside all others

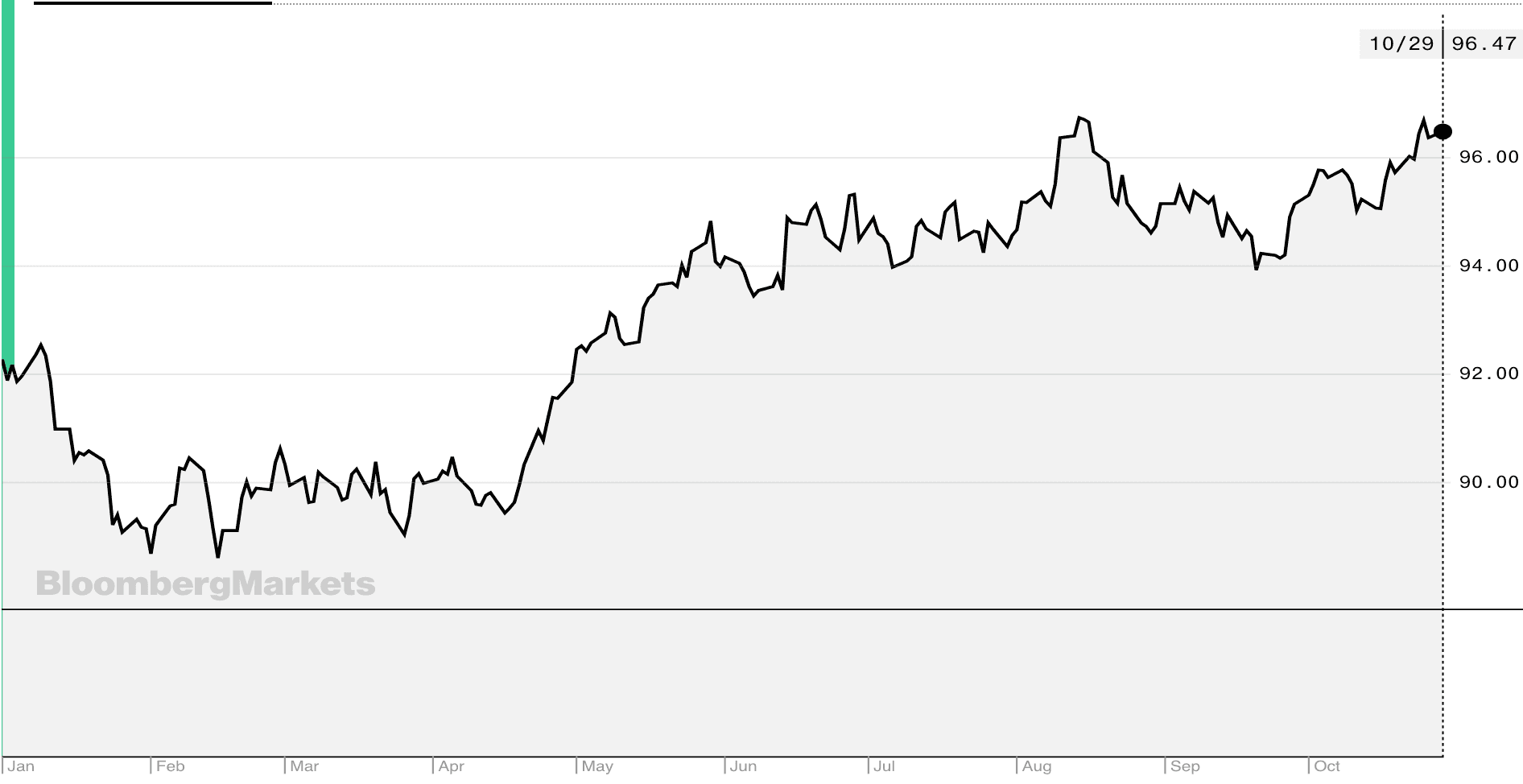

Dollar strength resumed last week in several markets, with the Dollar index breaking out to new highs for the current move; the Dollar index which provides a broad measure of Dollar performance against a basket of currencies, hovers near multi-year highs.

"The long-term trend currently favours the Dollar against all of the majors," says Phil Seaton with LS Trader. "Dollar strength resumed this week in several markets, with the Dollar Index breaking out to new highs for the current move. The dollar also broke out against the Euro and Swiss franc."

Above: The Dollar's performance over the past year shows we are in for a strong finish to 2018. Image courtesy of Bloomberg.

We note though Friday saw the Dollar pause for breath, allowing other currencies to squeeze in some gains.

"It looks to me like the fall in tech stocks Friday hit sentiment for USD in general, as the currency fell against most of its counterparts despite a higher-than-expected US Q3 GDP figure (+3.5% qoq SAAR vs +3.3% expected)," says Marshall Gittler, an analyst with ACLS Global.

Treasury bonds rallied throughout the U.S. session despite the good GDP figure, which suggests to Gittler that people are expecting a “Powell put” – that the fall in the stock market may delay the Fed’s hiking plans regardless of the performance of the economy.

But expectation for falling stocks to ultimately play negative for the Dollar via a shift in stance at the Fed is seen to be misplaced by many analysts.

"I think this is wishful thinking," warns Gittler.

U.S. President Donald Trump has blamed falling stocks on the U.S. Federal Reserve, saying they are raising interest rates “too fast”; a big question for financial markets is whether the stock market slide will stop the Fed from continuing to raise rates at the pace we have seen so far this year?

"So far at least the answer appears to be no. Certainly the majority of Fed policymakers who commented last week suggested that US interest rates are set to continue to rise," says Rhys Herbert, Senior Economist, Commercial Banking, at Lloyds Bank.

The U.S. economy continues to grow strongly with Q3 GDP growing at an impressive 3.5% annualised pace.

U.S. equities in contrast to those in Asia have still not fallen by that much compared to their previous rise.

"At least for now then we appear to still be on course for a fourth US interest rate rise for this year in December with more to come next year. However, a further marked fall in equities over the next few weeks could still change that picture," says Herbert.

Advertisement

Get more Dollars: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Month-End Demand

Near-term we are wary of a strong move higher in the Dollar as we enter the volatile month-end period where global fund managers buy and sell currencies to adjust their portfolios.

"The underperformance of U.S. stocks is expected to fuel large demand for the dollar over the month's end, and today's moves may reflect its beginning. But a USD rally fuelled by one-off flows versus safer assets like JPY, CHF and Euro may be one worth selling into," says Jeremy Boulton, an analyst who sits on the Thomson Reuters currency desk.

PCE Data Underpins Strong Dollar Valuations

The U.S. Dollar firmed at the start of the week following some key price data out of the U.S.

The Personal Consumption Expenditure (PCE) series confirmed to markets that inflation dynamics are indeed consistent with higher interest rates at the U.S. Federal Reserve over coming months; a situation that plays Dollar-bullish.

According to the BEA, the core PCE index read at 0.2% in September, unchanged on August but above analyst expectations for a reading of 0.1%.

The core PCE deflator is watched by the U.S. Federal Reserve when it comes to setting policy; therefore any unexpected jump in this number would hint at the need for the Fed to keep its foot on the pedal when it comes to raising interest rates.

This should in turn be positive for the USD.

"USD will consolidate near its recent highs this week supported in part by favourable US inflation dynamics. Today, the policy-relevant US core PCE deflator is expected to remain sticky near the Fed’s 2% inflation target in September," says Elias Haddad at Commonwealth Bank of Australia.

The PCe deflator read in line with analyst expectations at 0.1% in September, taking the annualised rate to 2.0% from 2.2%.

Advertisement

Get more Dollars: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here