The Pound-to-Dollar Rate in the Week Ahead: Range-Bound With Marginal Upside Skew

- Political uncertainty could hurt GBP

- Times reports P.M. May faces imminent leadership challenge

- GDP data is key for USD

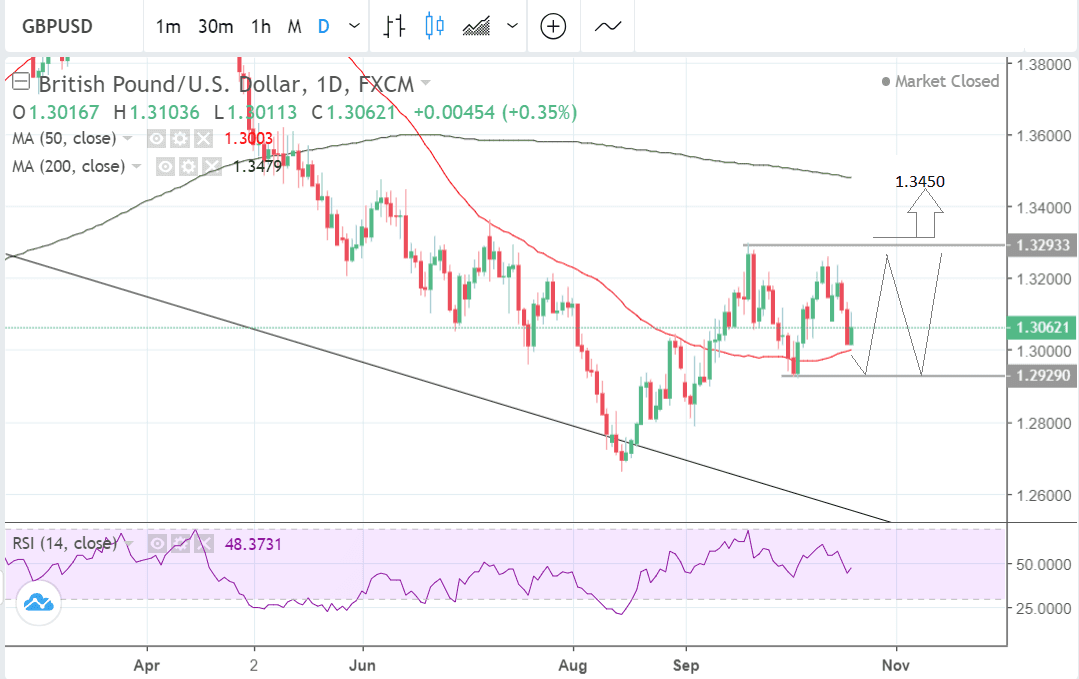

The GBP/USD rate is currently trading within a sideways range between a 1.2930 floor and a 1.3290 ceiling high, and it is likely to continue oscillating within that range in the week ahead.

We see a probable move down initially, from the current 1.3060 level to the floor at 1.2930, followed by a recovery back up to the range highs at 1.3290. A subsequent break above the 1.3300 level would probably open the way to an extension higher to a subsequent target at 1.3450 and the 50-week moving average (MA).

We feel that overall the charts have a marginal medium-term bullish bias and so we see the chances of a break out higher from the range as slightly higher than a break lower.

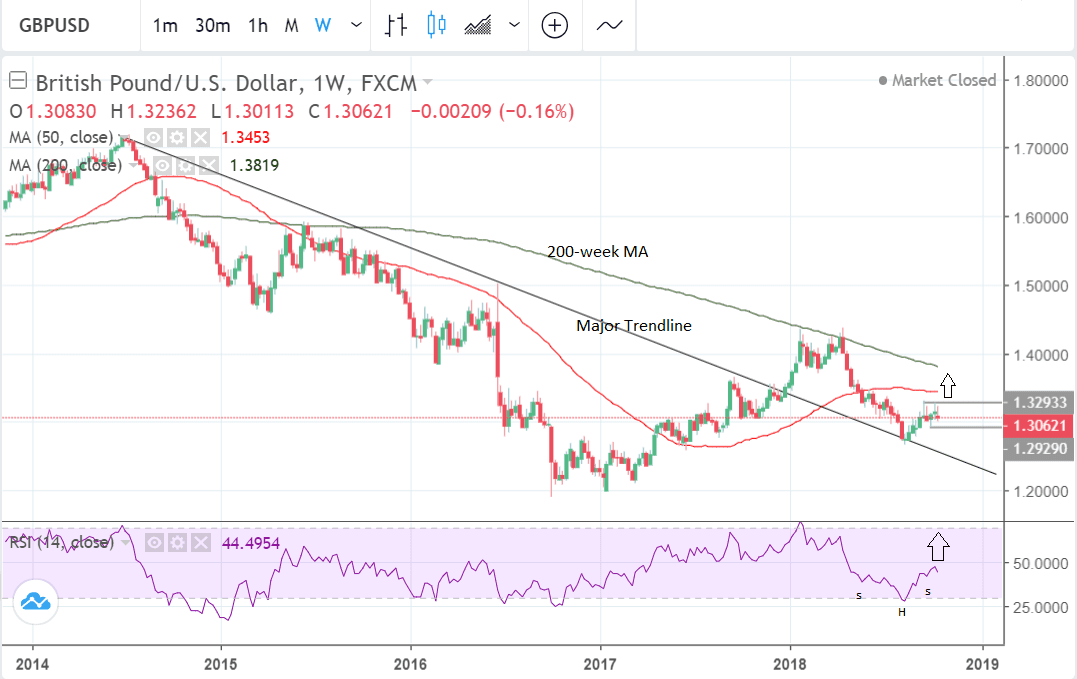

The longer-term charts also reveal a bullish bias. They show that that the pair has managed to hold above the major trendline which it broke above at the end of 2017.

GBP/USD rallied up to the 200-week MA before falling back down to the level of the trendline in August 2018. It then used the line as a base from which to recover to its current level.

The RSI momentum indicator in the lower pane is possibly showing a bullish chart pattern after forming what could be an inverse head and shoulders pattern.

The strong momentum on the last leg higher on the RSI is a sign the most recent rally since August has been underpinned by strong momentum and is a sign of bullish confidence. This makes it more likely the pair will rise than fall.

Advertisement

Bank-beating GBP/USD exchange rates: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The US Dollar: What to Watch this Week

The main release for the US Dollar in the week ahead is Q3 GDP data out on Friday at 13.30 B.S.T, which is forecast to show a 3.3% rise compared to the previous quarter.

This will be lower than the strong 4.2% result in Q2 but still above trend. Economists think there will be a decline because Q3 data will not benefit from exporters - such as those of soybeans - upping their volumes before the imposition of tariffs in August.

"Growth is forecast to have moderated to 3.3% in the third quarter, which still represents above-trend growth for the US economy. The Dollar, which against a basket of currencies has been consolidating since mid-August, could resume its uptrend if there is an upside surprise to the GDP figures," says broker XM.com.

October Manufacturing sector PMI data is forecast to show a slight down-tick to 55.5 from 55.6 when it is released on Wednesday at 14.45, Services, however, is expected to have risen to 54.1 from 53.5.

PMIs are survey-based gauges which have been found to be relatively accurate leading indicators for growth; a result over 50 represents expansion and below 50 contraction.

Durable goods orders is a key release on Thursday, at 13.30. It is forecast to show a -1.3% drop compared to the previous month, mainly because that result was so high due to the outsized 70% contribution from the aircraft component.

This explains why core durable goods orders are expected to show a rise of 0.3% in September - because it strips out the volatile aircraft component.

Other data on Thursday includes Pending Home Sales out at 15.00, which is forecast to show a -0.2% fall in September month-on-month in line with the recent sluggish trend in housing data.

New Home Sales are out on Wednesday at 15.00 and expected to show a -1.4% slowdown in September compared to August.

Tuesday is a busy day for commentary from policymakers at the US Federal Reserve with Kashkari set to speak at 14.30, and Bostic at 18.30

The Pound: What to Watch this Week

The most important fundamental driver for the Pound in the week ahead is likely to be the evolution of Brexit talks and domestic political risks.

The main focus now appears to be how long a potential 'transition period' could be.

Originally it was envisaged as a 2-year period starting after March 2019 in which the two sides could iron out the finer points of a new trade deal, but last week Theresa May tested the waters on whether a transition could be lengthened to 3-years.

This has raised opposition amongst hard-Brexiteers who want the transition to be as short as possible.

The new rift may generate news in the week ahead which could impact on the Pound although the impact on the pound so-far has been mildly negative as markets reckon this issue is not enough to derail a Brexit deal being agreed by year-end.

Over the weekend the Sunday Times reported May had entered "the kill zone" a reference to her facing an imminent leadership challenge as hard-brexiteers grow increasingly frustrated with her approach to Brexit negotiations.

We believe such an outcome to be extremely negative to Sterling as a change in leader could well delay a Brexit deal being achieved before year-end and it raises sharply the prospects of the U.K. exiting the E.U. without a deal in March 2019.

On the hard-data front, the calendar is rather quiet.

The main events are at the start of the week, with several Bank of England (BOE) speakers on Tuesday, including Andy Haldane at 11.30 B.S.T and Governor Mark Carney at 16.20.

Also out is the Consortium of British Industry (CBI's) Industrial Trends Orders survey report for October out at 11.00.

CBI reports are useful forward indicators of economic trends and this may be widely followed by market participants.

The other main release for Sterling is Gross Mortgage Approvals out on Wednesday at 9.30 which is forecast to show a slight decline in approvals in September to 39k from 39.4k previously.

Advertisement

Bank-beating GBP/USD exchange rates: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here