5-Day Pound-to-Dollar X-Rate Forecast: Strong Support in the 1.29s

Image © RCP, Adobe Stock

- GBP/USD has corrected back into uptrend and reached solid support

- Main event for Pound the Conservative party conference

- For the Dollar, non-farm payrolls

The Pound-to-Dollar exchange rate is trading at 1.3026 on Monday, October 01, having opened the week at 1.3038.

The exchange rate took a modest hit last week after the Dollar strengthened in response to the U.S. Federal Reserve which last week said the path for U.S. interest rates will remain higher for a good while longer.

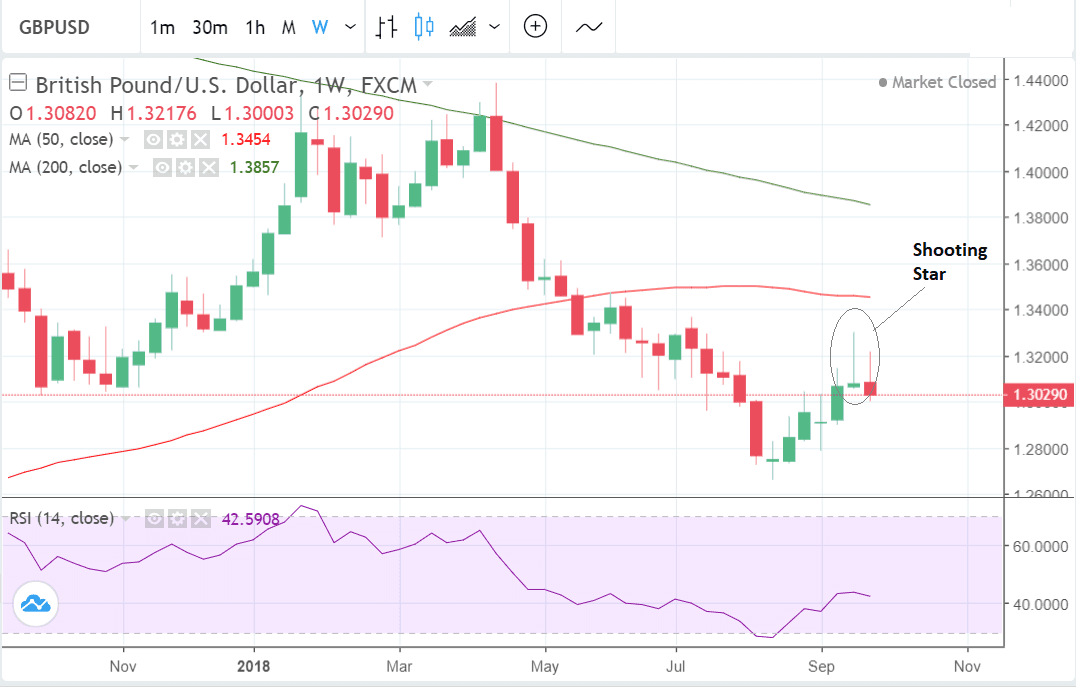

GBP/USD fell from a weekly high at 1.33218 to close the final week of September at 1.3029, but the week ahead sees chances of the Pound rebounding as it looks to have completed a three-wave, abc, corrective pattern, and found support at some major levels.

The 50-day Moving Average (MA) at 1.2982 is likely to act as an obstacle to further downside and the trendline at circa 1.2960 is a further impediment.

All-in-all, this suggests further weakness is likely to be limited.

Yet the short-term trend remains down, on balance, and so there is a marginal bias for it to continue. A break below the 50-day MA and trendline is necessary to revitalise the bearish case.

A move below the 1.2900 level would probably result in a continuation down to a target at 1.2800. The target is calculated by taking the length of the move prior to the trendline break and extrapolating it lower.

This indicates an extension down to a target at roughly 1.2800.

The weekly chart is showing further evidence the bearish trend is dominant after posting a shooting star candlestick in the previous week followed immediately by red, bearish candlestick last week providing confirmation.

For a look at the consensus GBP/USD exchange rate forecasts for the coming month from 50 of the world's leading investment banks, please download this special publication we have curated in partnership with Horizon Currency Ltd.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Dollar: What to Watch this Week

The main release for the Dollar in the week ahead is the release of labour market data with markets likely to focus on average earnings in particular.

Wage dynamics will likely have a steer on the outlook for monetary policy at the U.S. Federal Reserve which in turn is one of the main drivers of the Dollar.

Higher wages can drive up interest rates and higher interest rates tend to push up the value of the Dollar.

The consensus forecast amongst leading economists is that wages will rise by 3.0% in September, which would be the fastest rise in nine years.

If this comes to pass the Dollar could gain a boost from the release.

"The U.S. economy is forecast to have added 188k jobs in September, somewhat less than the 201k gains seen in the prior month. The jobless rate is expected to inch lower by 0.1 percentage points to 3.8%, signaling a further tightening in the labour market and this will likely be evident in the monthly wage numbers. Average hourly earnings are projected to have risen by 3.0% year-on-year in September, which would mark the fastest rate in nine years," says a preview from brokers XM.com.

If the Dollar is not moved by wage or employment figures it may be by commentary from Fed officials such as fed chair Jerome Powell, who is speaking on Wednesday at 17.00 B.S.T.

Markets will be looking for clarification on whether the chairman continues to retain his marginally hawkish stance as shown at the Fed's meeting last week. It is probable he will given the short period time since the FOMC.

ISM Manufacturing data is expected to show a fall to 60.3 from 61.3 previously when it is released at 15.00 B.S.T. on Monday. The ISM is one of the most important gauges of manufacturing in the US and reached a 14-year high in August so some sort of a pullback is possible.

"We expect to see a modest pullback in August, with the index slipping to 60.0. The latest regional Fed purchasing managers’ indices point to some moderation, with the averages for new orders, production and employment having come down in recent months. More generally, such elevated readings are not usually sustainable in a strong-dollar environment," say Wells Fargo in a week ahead analysis.

ISM Non-Manufacturing is forecast to fall to 58.1 from 58.5 when it is released at 15.00 B.S.T. on Wednesday and is also an important economic gauge.

The Pound: What to Watch this Week

The main focus for the Pound in the week ahead will be discussions focused on Brexit at the Conservative party conference which culminates with Theresa May's speech on Wednesday, October 03.

May is expected to continue to try to generate support for her 'Chequers' proposal despite rejection from both the EU and eurosceptics in her own party.

Immediate market attention lies with Chancellor Philip Hammond and Brexit Secretary Dominic Raab who have both delivered addresses defending the government's current proposals known as the Chequers plan, hinting that no major change in course will be delivered by May mid-week.

Brexit Secretary Dominic Raab told the conference the European Union needs to "get serious" on Brexit and "they need to do it now".

"Our prime minister has been constructive and respectful. In return we heard jibes from senior leaders. And we saw a starkly one-sided approach to negotiation, where the EU’s theological approach allows no room for serious compromise," said the Brexit secretary. "And yet we are expected to cast aside the territorial integrity of our own country. If the EU want a deal, they need to get serious. And they need to do it now."

Chancellor Philp Hammond meanwhile told delegates that the Chequers plan was the only plan in town that delivers on a full exit while addressing the difficult question of the Irish border.

That both senior Conservatives towed the existing line suggests we might not hear anything revolutionary from Prime Minister May mid-week.

Therefore we would be wary that expectations for a fall in the Pound might be overblown.

"Brexit developments can buck the market at any moment, either way," says Robert Howard, who sits on the foreign exchange desk at Thomson Reuters. "Fortune may favour the brave, but speculators holding or mulling Sterling longs must be wondering about just how bold they should be as the annual UK Conservative Party conference looms."

Traders will be wary that the Pound has suffered at previous conferences.

Data from Reuters shows the Pound fell 3.75 cents in the first week of October last year, after a disastrous keynote conference speech by PM Theresa May.

"Sterling suffered from May's misfortune, amid perceptions that her hold on power had never looked weaker. A year earlier, the Pound fared even worse after May's conference message was perceived as signalling that Britain was heading for a hard Brexit," says Howard.

That first week of October 2016 ended with a "flash crash" for GBP, which saw cable tank to 1.1491 – its lowest for 31 years.

The main 'hard' data release for the Pound in the week ahead is likely to be Purchasing Manager Indices data (PMIs) for the manufacturing, services and construction sectors.

Manufacturing PMI, an indicator of activity in the Manufacturing sector, is forecast to slow in September, falling to 52.5 from 52.8 in the previous month of August, when it is released at 9.30 B.S.T on Monday.

Services PMI is forecast to fall to 54.0 from 54.3 when it is released at 9.30 on Wednesday.

Construction PMI is expected to decline to 52.5 from 52.9 when it is released on Tuesday.

PMI's are survey-based indicators; a result above 50 signals expansion and below 50 contraction.

Other data for the Pound, includes the Nationwide house price index (HPI), out at 7.00 on Tuesday, and the Halifax house price index, out at 8.30 on Friday.