Pound-to-New Zealand Dollar Rate eyes big 2.00 this Week

Image © Pavel Ignatov, Adobe Stock

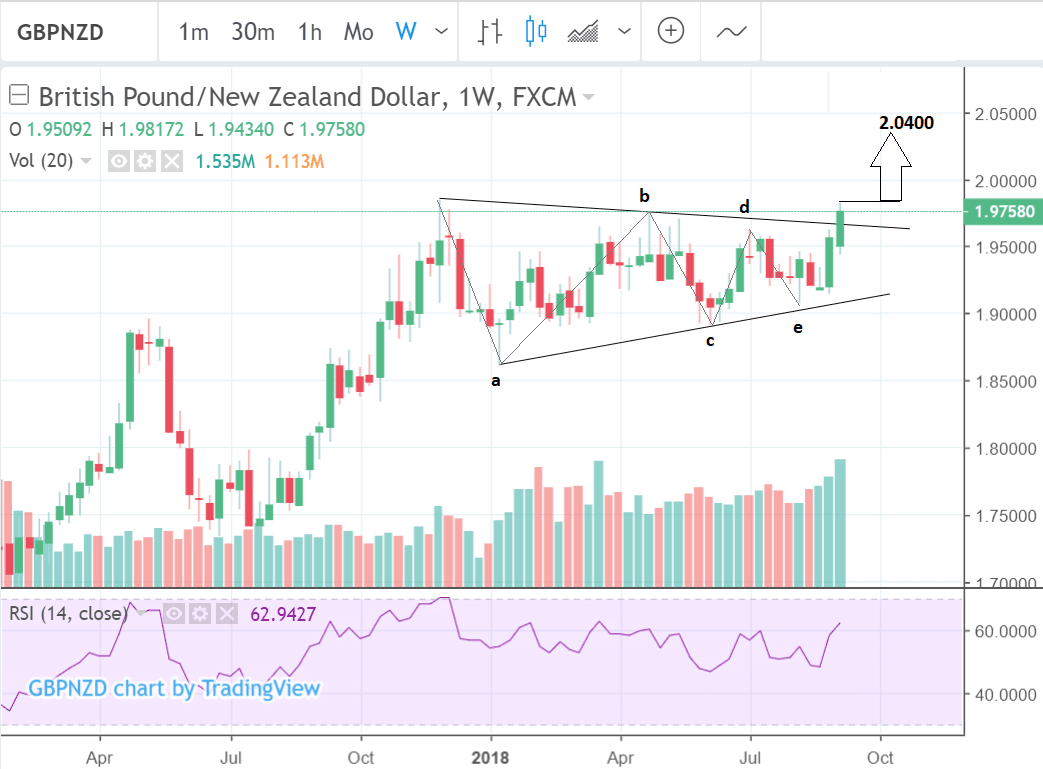

- GBP/NZD has broken above the upper border of a triangle pattern

- The pair is likely to continue rising strongly as the breakout extends to its price target

- The main event for Sterling is the Bank of England meeting; for the New Zealand Dollar it is the Business PMI

The Pound-to-New Zealand Dollar rate opens the new week at 1.9758 on the interbank market, having risen over a cent and a half over the course of the previous week.

The pair has now broken out of a tight range between 1.85 and 1.98 which it was trapped in since November 2017. This is a major game-changing moment for the pair and could result in a strong move higher to above double parity in the weeks to come.

GBP/NZD rose on a mixture of a stronger Pound due to progress being made on Brexit loose ends such as the Irish border question and ongoing New Zealand Dollar weakness which appears linked to an escalation of global trade tensions and expectations for the domestic economy to cool somewhat.

From a technical standpoint, GBP/NZD is showing what is probably an exciting upside breakout from a large triangle pattern.

We see a continuation higher resulting from the breakout since the exchange rate has not reached anywhere near the triangle's upside target at 2.0400.

The target is calculated by extrapolating the height of the triangle at its widest part and projecting it by a ratio of 0.618 higher.

Although the exchange rate has already broken above the confirmation level for an upside break at 1.9750 we would be looking for extra confirmation from a break above the 1.9817 highs before adding to the position.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch

The main economic data releases for the Kiwi in the week ahead are NZ Business PMI and electronic card sales.

The former is based on a survey of key purchasing managers within companies and provides an insight into general activity levels amongst NZ Businesses in August. It is also a useful leading indicator for general economic growth. It is scheduled to be released on Thursday, September 13, at 23.30 B.S.T.

Electronic card sales in August, meanwhile, is out on Monday, September 10 at 23.45. In July sales rose 0.7%.

Given China is New Zealand's largest trading partner news relating to the US-China trade spat is likely to impact the Kiwi, which has shown sympathy for broader EM currencies and sold off on worsening news flow.

A final decision has not yet been made by the US on whether or not to impose fresh tariffs on a wider number of Chinese goods but an announcement on the issue is possible in the week ahead.

If the US goes ahead with its plan to raise a 25% tariff on an extra $200bn worth of Chinese imports it is likely to hit the Kiwi; if not, however, then the Kiwi could see a relief rally of sorts.

The Pound: What to Watch

It is a busy week for UK data with several key data releases, and the Bank of England (BOE) meeting scheduled to finish on Thursday at 12.00 B.S.T.

The BOE raised interest rates by 0.25% at their August meeting but they are not expected to continue raising them in September.

Brexit uncertainty remains a key risk factor preventing them from going ahead - unless a deal is struck by Thursday, which seems a little unlikely even under the most optimistic scenarios.

"As for the BoE, which is scheduled to announce policy on Thursday of next week, we do not expect many new developments. The BoE raised its Bank Rate 25 bps to 0.75% at its August meeting, and further increases seem unlikely to be considered unless or until Brexit uncertainty is resolved," say Wells Fargo Securities.

The September meeting does not include a press conference or quarterly inflation report further reducing the chances they will use it to announce any changes in policy.

"The BoE last raised interest rates in August, lifting them above 0.50% for the first time since 2009. It is widely anticipated to hold rates unchanged at 0.75% next week. With no press conference and quarterly inflation report at the September meeting, the Pound may struggle to get much reaction from the BoE’s decision," say brokers XM in a preview of the event.

Another key event for the Pound in the week ahead is wage data which is scheduled for release at 9.30 B.S.T. on Tuesday, September 11.

Wages are leading indicator of growth and inflation pressures and a higher-than-expected increase would probably result in a rise in the Pound as it would increase the probability of the BOE raising interest rates.

Consensus expectations are for wages to rise by 2.5% in July from 2.4% previously (plus bonus). The Unemployment rate is forecast to remain unchanged at 4.0%.

Industrial and manufacturing production figures for July are out at 9.30 on Monday and are both forecast to show 0.2% growth from the previous month.

"Among the key releases will be industrial output figures, which will likely be closely watched for any clues that Brexit uncertainty is affecting manufacturing sentiment," say Wells Fargo.

Trade data is also out in the week ahead with the trade balance forecast to show a marginal widening to 11.75bn July, and Non-EU balance to show an increase to -3.30bn from -2.94bn previously, when the data is released at 9.30 on Monday.

Monthly GDP data at 9.30 and The National Institute of Economic and Social Research (NIESR) GDP mates at 14.00 are also out on Monday and could impact on the Pound if they present a negative outlook for growth.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here