Why the New Zealand Dollar has Just Touched 2018 Lows vs. Pound and Greenback

Image © Naru Edom, Adobe Stock

- GBP/NZD surges on positive Brexit developments

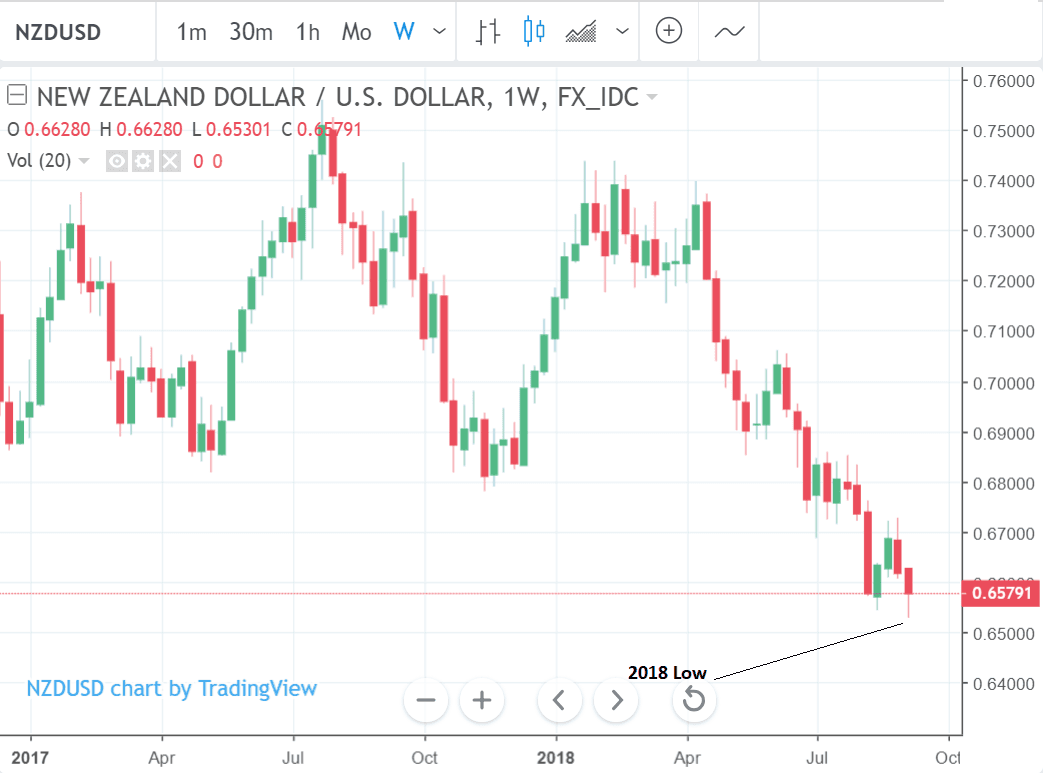

- NZD/USD falls to new yearly lows in 0.65s

- Markets await US decision on China tariffs

- Dollar rising as investors expect Trump to go ahead with tariffs

The New Zealand Dollar fell to 0.6530 vs. the US Dollar, and in the process printed a new 2018 low on Wednesday amidst fears intensified that President Trump would go ahead with his threat to increase tariffs on Chinese imports.

The Kiwi Dollar meanwhile succumbed to its lowest level against the Pound since April amidst a fresh move higher in the UK currency following news Germany is leaning towards making concessions to the UK in order to guarantee a Brexit deal is achieved by year-end.

It appears a report about the potential softening of demands made by the EU, combined with comments from chief EU negotiator Michel Barnier, are behind the move.

Bloomberg report "the British and German governments have abandoned key Brexit demands, potentially easing the path for the EU and UK to strike a deal."

People familiar with the matter said Germany is ready to accept a less detailed agreement on the UK’s future economic and trade ties with the EU in a bid to get a Brexit deal done.

However, the New Zealand Dollar appears to be a broad-based underperformer and appears to be showing a sympathy with emerging market assets which are taking a beating.

Markets were in suspense mode as they awaited a final decision by the US on whether or not to expand the tariff regime on Chinese goods.

Wednesday saw the deadline for the consultation period.

The US is deciding whether to add an extra 25% tariff on $200bn more Chinese imports.

"One might argue that we’re seeing some front-running of USD strength ahead of Trump moving ahead with additional tariffs on $200b of Chinese imports, possibly as soon as Friday NZ time, or the decision could still drift into next week," says Jason Wong, an senior markets strategist at New Zealand-based BNZ bank.

Trade war fears have exacerbated the impact of idiosyncratic domestic risks in emerging market hotpots like Turkey, Argentina, Indonesia and Brazil.

The result has been an increase in outflows from vulnerable EM markets into safer US markets and US Treasury Bonds, a classic safe-haven choice for investors.

Commodity currencies such as the Aussie and New Zealand Dollars were also hit as their heavily commodity export-orientated economies would be hurt by a down-turn in global trade, which has already weighed on mainstream commodity prices.

The New Zealand Dollar is particularly sensitive to a slowdown in the Chinese economy as its primarily food and dairy-based exports are heavily reliant on demand from China's wealthier classes who have adopted more western-style diets.

On the data front the US dollar was supported by a strong manufacturing ISM which showed activity increasing to 61.3 in August from 58.1 in July. Not only was this higher than the forecast 57.6 but it was above the 60 level considered a sign of exceptionally strong growth. The ISM is often a leading indicator for the broader economy.

"Strong US ISM data has supported higher US Treasury rates. The end of the US public holiday saw the USD well-bid from the start of the European open," says Wong. "USD strength across the board has seen the NZD and AUD reach fresh multi-year lows, alongside further weakness in emerging market currencies."

"So while the NZD spent the local session hovering 0.66, it steadily fell to around 0.6540 over the following few hours and has found support at that level, a fresh 2½-year low,2 adds Wong.

Recent data showed a further -2.2% decline in dairy prices which has seen whole milk powder, New Zealand's main export, fall by over 10.0% in under 6-months.

Whilst the Kiwi was not heavily affected by the fall in milk prices, the data continued to support a backdrop of NZD weakness, which has arguably, contributed to the erosion of the exchange rate in 2018.

New Zealand Terms of trade data, which shows the change in the difference between average export and import prices, came out lower-than-expected, although higher than the previous quarter which registered declines.

The terms of trade index which measures changes in average export and import prices rose by only 0.6% in Q2, revealing a greater rise in exports. This was below the 1.0% forecast by economists but higher than the -1.9% in Q1.

Export volumes rose by a lower-than-expected 1.1% from -2.9% previously. Forecasters had said it would rise 2.3%.

The data showed a positive result and gains but not as high as expected.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here