Ardern's Budget Puts Concerns Over New Government to Rest but Kiwi Cedes Ground as US Yields Step Higher Again

- Written by: James Skinner

-Ardern's maiden budget puts fears over new government to rest.

-It provides more fiscal stimulus, lower debt and budget surplus.

-But NZD reverses overnight gains as US yields step higher again.

© Naru Edom, Adobe Stock

The New Zealand Dollar reversed course and headed lower during the morning session Thursday as markets responded to another spike higher in US bond yields that overshadowed Prime Minister Jacinda Ardern's maiden full-year budget and has increasingly undermined the Kiwi during recent weeks.

Thursday's price action marks an almost complete reversal of gains racked up during the overnight session when Prime Minister Ardern unveilled an updated budget plan that promises more fiscal stimulus for the economy than was previously expected.

The budget will bring larger volumes of government spending on health and education over the coming years than was guided for at the half-year update back in 2017 but also avoids a large increase in government borrowing, which may now help put to rest any lingering fears over the coalition government's competence when it comes to the economy.

Markets had panicked last October when kingmakers from the Kiwi election, New Zealand First, opted to go into coalition with the NZ Labour Party. Both parties had campaigned on pledges to reform the Reserve Bank of New Zealand by clobbering it with an employment mandate as well as its inflation target, to radically reduce net-migration into New Zealand and prevent foreign investors from buying up existing residential property in the country.

The upshot was that markets were left fearing higher inflation and slower levels of long term economic growth, both of which helped drive the Kiwi currency to a 6% loss against the US Dollar between late September and November 2017. While these fears had gradually ebbed away during recent months, Thursday's budget may put to rest any last lingering concerns held by investors.

“Budget 2018 makes responsible investments for the future, while delivering a surplus of more than $3 billion and taking a responsible approach to debt reduction," says Grant Robertson, New Zealand's Finance Minister, in a statement. “We are committed to living within our means and having a buffer to deal with the risks and shocks that a small country like New Zealand inevitably faces."

New Zealand's coalition government announced increased spending on health services by a total of $4 billion for the next four years Thursday and unveilled plans to invest an extra $1.6 billion into education over four years. Housing and welfare budgets also saw increases in funding for the coming years, taking the total increase in government spending inside the current parliament over the $8 billion threshold.

Despite this, government figures suggest it will still run a budget surplus of more than $3 billion over the forecast period and that government debt will from 25% of GDP last year to just 22% of GDP in 2021/22, even after adjusting for a $3 billion increase in the issuance of new government debt.

This is largely because government also forecasts faster GDP growth over the coming years, which dilutes the impact of higher borrowing on the debt-to-GDP metric. Although if the economy underperforms or the tax take does not rise in-line with government forecasts, the fiscal picture would be less rosy.

"The NZD strengthened slightly following the release, potentially a relief rally in response to the Budget confirming a prudent set of fiscal numbers. The slight lift in debt issuance initially nudged 10-year bond yields up 2-3 basis points, adding to momentum from earlier overseas moves," says Nathan Penny, a senior rural economist at Auckland Savings Bank (ASB Bank). "The overall market reaction was very muted, indicating financial markets are quite comfortable with the fiscal numbers."

Above: NZD/USD rate shown at daily intervals.

The NZD/USD rate was quoted 0.23% lower at 0.6885 during the morning session Thursday after reversing all of the 50 points it gained during the overnight session.

However, the Kiwi held onto some of its gains over a beleaguered Pound Sterling, with the Pound-to-New-Zealand-Dollar rate quoted 0.14% lower at 1.9596 mid-morning.

Above: Pound-to-Kiwi rate shown at daily intervals.

Despite the market's initial positive reaction to the budget, fiscal developments on the ground in New Zealand were quickly overshadowed by events in the global bond market Thursday, which appeared to be the catalyst behind the Kiwi's retreat.

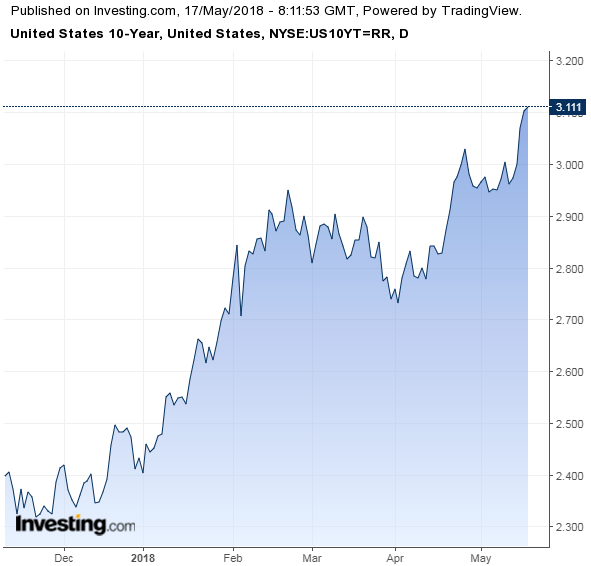

Above: US 10 Year Government Bond Yield.

US treasury yields broke above 3.1% Thursday, further widening the gulf between them and those of their New Zealand counterparts, which trail behind with a yield of around 2.85%.

Above: New Zealand 10 Year Government Bond Yield.

That means investors are further incentivised to sell Kiwi Dollars and buy the greenback in order to invest in the American bond market rather than vice versa, which is the opposite of how the so called carry trade used to work and has been the primary driver behind the New Zealand Dollar's 2.7% year-to-date fall in value relative to the US Dollar.

The only thing that will prevent this from continuing, as well as pressuring the Kiwi currency, during the months ahead is signs of a change in RBNZ monetary policy being on the horizon. However, Kiwi interest rates have been held at a record low of 1.75% for approaching 18 months now are not expected to change until well into the second half of 2019.

Meanwhile, other central banks have long-since begun to raise their interest rates as the global economic recovery from the financial crisis enters its advanced stages, which threatens to see the Kiwi at a disadvantage to other currencies as well.

The Bank of Canada is firmly entrenched in an interest rate hiking cycle while the Bank of England and European Central Bank are also in the process of withdrawing stimulus from their respective economies. This is not to mention the US Federal Reserve, which has raised its interest rate six times since the end of 2015.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.