The Pound is in "The Driving Seat" Vs New Zealand Dollar Says BNZ

- Sterling to rise against New Zealand Dollar in medium-term

- Easing Brexit risks and slowing global growth to drive the exchange rate

- Risks to NZ economy from global monetary tightening and commodity devaluation

© Goodpics, Adobe Stock

The Pound is set to strengthen versus the New Zealand Dollar (Kiwi) due to a combination of easing Brexit risks and a negative 'macro' outlook for the the New Zealand economy, says a major bank.

The Kiwi Dollar is expected to take a hammering from changing global economic conditions over the medium and long-term, says BNZ bank's head of research, Stephen Toplis.

The Pound, in contrast, is expected to recover as the UK gets its Brexit transition deal and moves towards a softer landing avoiding the cliff-edge scenario of a no-deal break.

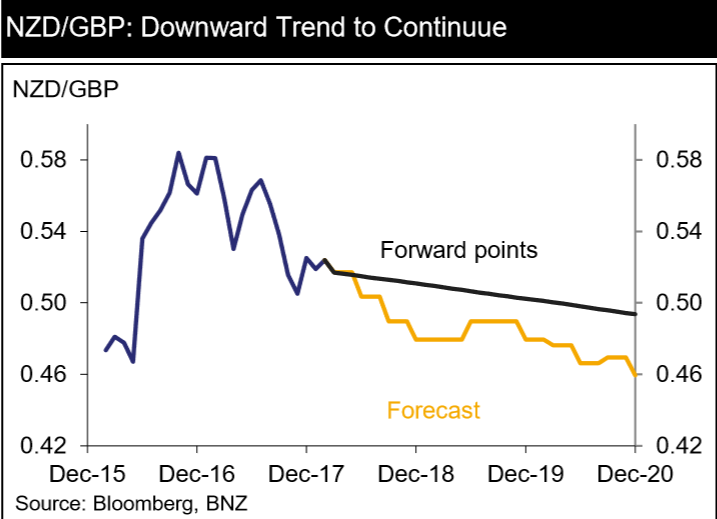

The result is likely to be a steady appreciation of sterling versus the Kiwi, which BNZ forecast will result in NZD/GBP falling (because it is the number of Pounds bought by one Kiwi) to 0.46 by 2020.

This translates into a rise in GBP/NZD (the number of Kiwi Dollar's bought by one Pound) to circa 2.19 (current market rate 1.9470).

"GBP is expected to be in the driving seat, recovering from its depressed level when viewed in a medium-long term context," says BNZ's Toplis.

The main headwind for NZD is a gear shift down in global growth and risk appetite due to the current trend in central banks' raising interest rates.

Higher interest rates, or 'monetary tightening' as it is known, curbs lending by making it more expensive to borrow, eventually reducing investment and growth.

Slowing growth will limit demand for commodities leading to a fall in commodity prices.

The New Zealand economy is heavily reliant on commodity exports, especially of soft commodities so its economy will be particularly hit by a slowdown.

"We still think this is a slow-burning headwind for the NZD through 2018," says Toplis.

In addition, the threat of the imposition of greater barriers to trade or tariffs from a trade war will negatively impact on its economy, as well as direct demand for Kiwi Dollars from foreign importers purchasing NZ produce.

Meanwhile, interest rates in the two countries will converge and eventually potentially see UK rates exceed those in NZ.

Interest rate differentials are a major driver of FX valuations in the modern world as they influence capital allocation, with the country bearing the higher interest rate generally attracting higher inflows of foreign capital because they offer better returns.

The higher inflows increase demand for their currency, raising its value.

Increasingly freed of the concern of a hard-Brexit, the Bank of England (BOE), which is tasked with raising interest rates in the UK, will feel more confident about raising UK interest rates to combat high inflation.

The Reserve Bank of New Zealand (RBNZ), in contrast, is expected to keep rates largely unchanged as the outlook for growth and inflation stays subdued.

"The RBNZ seems content to keep policy unchanged. The lack of any interest rate support for the NZD is likely to continue for some time yet," says Toplis.

In his analysis of the BOE, on the other hand, he suggests much more incentive to raise rates:

"We expect a transitional deal on Brexit to be agreed soon, which might extend the current trade arrangements for two years or even longer. This would provide the UK with some much-needed breathing space, boosting business confidence and lead to increased pricing of future BoE rate hikes."

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.