Further New Zealand Dollar Strength Against Euro, Pound and US Dollar Expected by Westpac

Expect further NZD strength say analysts at Westpac Bank who cite the economy's continued solid performance as a reason to expect further gains.

Expectations for further strength come as we observe the New Zealand Dollar is at its highest level in nearly two years when considered on a trade-weighted basis.

When talking about a currency from a trade-weighted perspective we refer to it’s overall performance against the currencies of its main trade partners. Therefore, this is a form of currency basket.

Importantly, it does tell us that the currency is probably uncomfortably expensive for policy makers who would observe New Zealand exports will suffer as a result.

It also has the side-effect of keeping New Zealand imports cheap, which in turn ensures inflation should remain low.

Much of the strength in the trade-weighted NZD can be attributed to the currency’s recent good form against the US Dollar.

The NZD/USD has risen from around 69 cents at the end of December to above 72 cents, which is just shy of the level that prevailed prior to the US election.

“After the US election in November the market's initial assessment was that Trump would boost the US economy through spending on infrastructure and tax cuts, and that would strengthen the US Dollar against other currencies. But markets are now back-pedalling on that assessment a little,” say Westpac in a client briefing.

The strengthening NZD is predicted to place renewed downward pressure on imported goods prices over the coming year.

This will in turn ensure New Zealand inflation remains in the lower end of the 1-3% band set out at the Reserve Bank of New Zealand. It was reported in January that inflation has finally risen back into the band.

The NZD caught a bid on the reading and moved higher.

However, don't expect inflation to trigger too much by way of strength going forward because the top end of the band is unlikely to be threatened.

Analysts believe this should ensure the RBNZ does not feel the pressure to raise interest rates in 2017.

If the RBNZ were to look to raise rates then expect the NZD to move higher as it is bid higher by inflows of foreign capital seeking to take advantage of the higher yield offered by NZD-based assets.

Nevertheless, the overall outlook for the economy is bright and this should ultimately determine the path of the currency going forward.

“We suspect that as long as New Zealand remains one of the relative bright spots in the world economy, the NZ Dollar is going to remain strong,” say Westpac.

Traders Bet on Further NZD Upside

Speculative positioning in NZD/USD, proxied by CFTC futures positions of leveraged and non-commercial trader types, indicates longs are starting to be rebuilt.

“The combination of a strong NZ economy and USD concerns has unsurprisingly flipped net positioning from a small short state to a moderately long one,” says Imre Speizer at Westpac in Aukland.

Westpac’s fair value model shows NZD/USD to be around 3c undervalued according to interest rates, commodity prices and risk sentiment, although using a broad range of risk sentiment variables they find it is just inside a fair value range:

Concerning the three-month outlook, Westpac are wary of the longer-term US Dollar bull run reasserting:

“If the US economy improves further than expected and US interest rates rise further than currently predicted, the US dollar should resume its multi-year trend rise. That should cause NZD/USD to fall below 0.70.

“However much depends on how reflationary the Trump Administration’s policies will be, and how isolationist the US becomes.”

New Zealand Dollar to Trend Higher Against Pound and Euro

With regards to the Kiwi’s prospects against the two European majors, the outlook is positive.

“NZD/EUR continues to trend higher, now at the highest level since mid-2015. We see no obvious reason for this to reverse near-term, targeting 0.6875+ this week,” says Speizer.

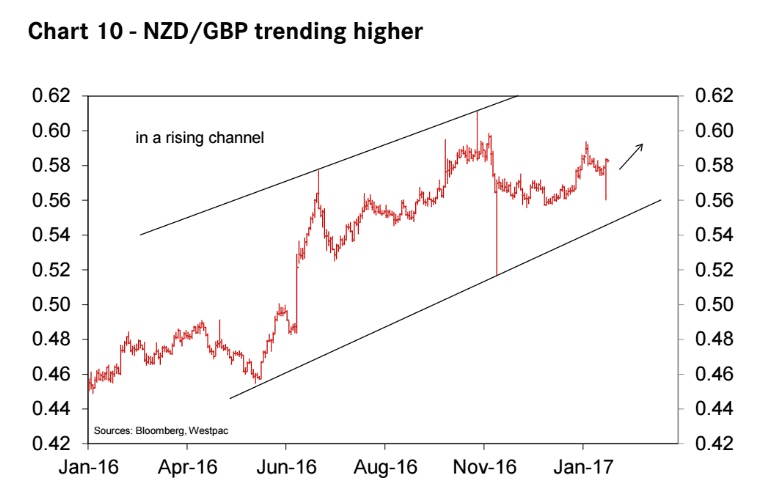

“NZD/GBP has further upside potential, and there’s potential for an all-time high (in 1973 it was 0.63),” says Speizer.

However, near-term, Westpac are watching the Bank of England as they believe any decision to withdraw current accommodation (raise interest rates, confirm an end to quantitative easing) could put a stronger base under GBP.