New Zealand Dollar To Be A G10 "Poster Boy" Says Monex

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar will be one of G10 FX's "poster boys" for 2024, according to a new analysis.

"We think this year will be more conducive for sustained AUD and NZD appreciation," says Simon Harvey, Head of FX Analysis at Monex Europe.

The international payments firm says it is unlikely the New Zealand Dollar will replicate 2023's underperformance, which had a lacklustre Chinese economic recovery and rising U.S. bond yields to thank.

U.S. bond yields rose sharply in 2023 as the U.S. Federal Reserve led a global central bank interest rate hiking cycle, something Monex expects to reverse in the coming months, which can, in turn, bring U.S. yields lower relative to elsewhere.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"With both the RBNZ and RBA set to join the cutting party late due to structural supply constraints, strong levels of growth and the market focus now set firmly on Fed easing in 24H1, we think this year will be more conducive for sustained AUD and NZD appreciation," says Harvey.

China will remain a key driver of New Zealand Dollar value over 2024, and although markets are expected to remain cautious on China’s growth outlook, Monex thinks this is less likely to weigh on risk sentiment amidst an environment of falling core yields and continued policy support by Chinese officials.

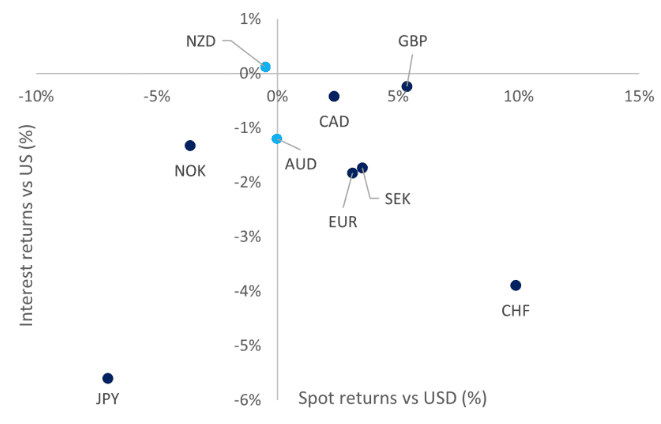

Above: "AUD and NZD underperformed their yield pickup in 2023 as market conditions were unfavourable for China-linked high beta FX" - Monex.

"As such, we expect the later sequencing of RBA and RBNZ easing cycles to support structural rallies, with the impact of eventual rate cuts in 24H2 to be negated by improved cyclical optimism and broad USD depreciation," says Harvey.

Monex expects AUD and NZD to rank as some of the best performers against the marginally weaker dollar in 2024, with gains of around 9%, respectively.

New Zealand Dollar Faces Decline in 2024 Says BCA Research

However, analysts caution that a NZD rally won't likely materialise until the Fed's easing cycle comes into reasonable scope, possibly in the second quarter of the year.

What would undermine this constructive stance on the Kiwi Dollar?

Monex's conviction on AUD and NZD outperformance is strong, but analysts acknowledge that downside risks remain acute from a lagged transmission of central bank tightening efforts, which, if materialised, could increase global recession risks and weigh on overall risk sentiment.

A further risk lies with systemic financial stability issues emanating from China’s shadow banking and real estate markets.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes