New Zealand Dollar Bid As China Announces New Stimulus Moves

- Written by: Gary Howes

- NZD in outperformance mode

- Chinese stimulus hopes offer NZD a boost

- U.S. equity market rally underpins sharp NZD rise on Monday

Above: File image of President Xi. Image: Paul Kagame (Government of Rwanda). Source location. Licensing: CC.

The New Zealand Dollar has extended this week's gains amidst a sharp improvement in sentiment in Asian markets and a fresh push by Chinese authorities to reboot the country's economic growth.

China raised its fiscal deficit ratio to about 3.8% of GDP (from the 3% target set in March), suggesting it is creating more room for fiscal stimulus.

Indeed, authorities said midweek that more sovereign debt will be issued to support disaster relief and construction.

"The Chinese authorities are stepping up support for the economy," says Kristina Clifton, a strategist at Commonwealth Bank. "The target for the budget deficit has been eased to 3.8% of GDP, from 3.0% previously. A change in budget mid‑year is rare in China and may signal an increased focus on the economy."

The New Zealand Dollar is one of the week's best-performing currencies and is considered well-placed to take advantage of any improvement in sentiment pertaining to China.

China is New Zealand's premier export destination meaning its economic health is highly relevant to the health of New Zealand's economy.

This linkage explains why the New Zealand Dollar - alongside the Aussie Dollar - are considered liquid proxies for exposure to China by investors.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Also in China, President Xi Jinping made an unexpected central bank visit to the central bank, which some economists see as a further signal the government is adopting a more hands-on approach to boosting the economy.

Xi, joined by Vice Premier He Lifeng and other government officials, visited the People's Bank of China (PBoC) and the State Administration of Foreign Exchange (SAFE) in Beijing on Tuesday, said Reuters.

"The details of the meeting were not publicised, but the visit is in line with the government’s efforts to strengthen the economy and stabilise markets," says Jim Reid, Research Strategist at Deutsche Bank.

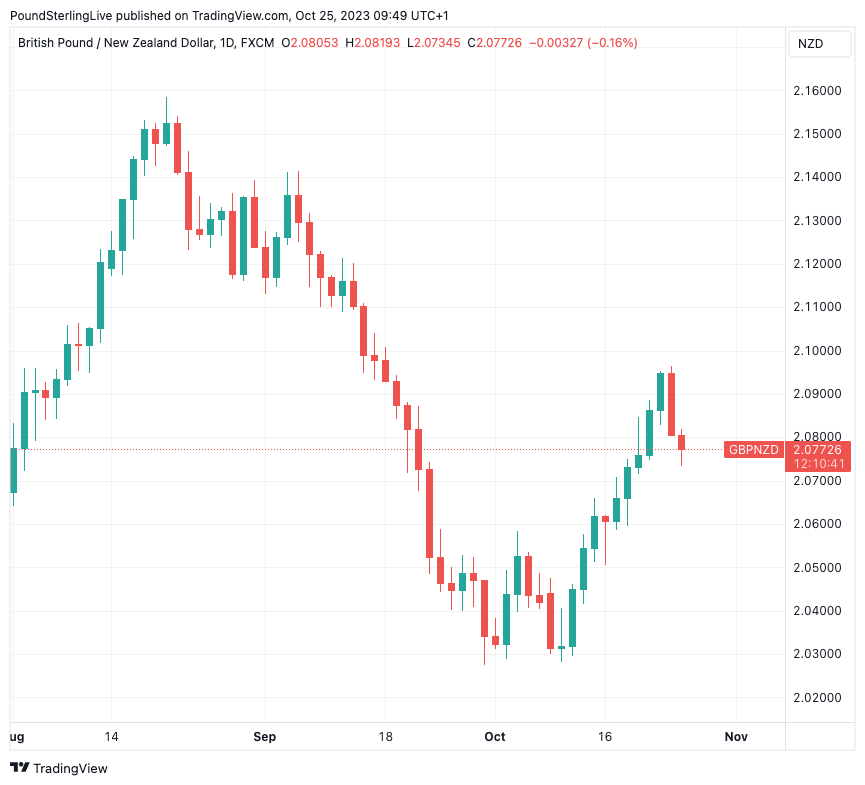

The Pound to New Zealand Dollar had been rising ahead of this week's developments amidst a broad-based NZD weakness but has since pared its recent advance by approximately 0.80% to quote at 2.0785 at the time of writing.

The New Zealand Dollar to U.S. Dollar exchange rate is up by half a per cent this week at 0.5851, the Euro to New Zealand Dollar exchange rate is down a third of a per cent at 1.8109.

Above: GBPNZD at daily intervals. Monday's big 'down day' linked to improved U.S. sentiment is clearly visible. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The New Zealand Dollar put in a strong rally on Monday thanks to another improvement in global risk sentiment, this time triggered by the U.S., where falling ten-year bond yields have offered equities some room to breathe.

"The bulls held sway," says Steve Clayton, head of equity funds, Hargreaves Lansdown. "Bonds rallied too, with investors following renowned fund managers Bill Ackman and Bill Gross’s separate comments this week about seeing value reappearing in the U.S. Treasury markets."

(Recall, rising bond values = falling bond yields).

"Spirits were buoyant ahead of after-market results due from Microsoft and Google parent, Alphabet. In the event, Microsoft pleased with robust growth and confidence in the future growth of its cloud-computing division, Azure," adds Clayton.

Investors will be watching incoming earning results for signs the U.S. economy continues to outperform despite elevated interest rates.

Should the optimism on U.S. markets extend into what is traditionally a bullish time of year for equities, and sentiment towards China improve further, then the NZ Dollar could find itself better supported into year-end, regardless of domestic issues.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes