Looming New Zealand Elections Weighing On NZD

- Written by: Sam Coventry

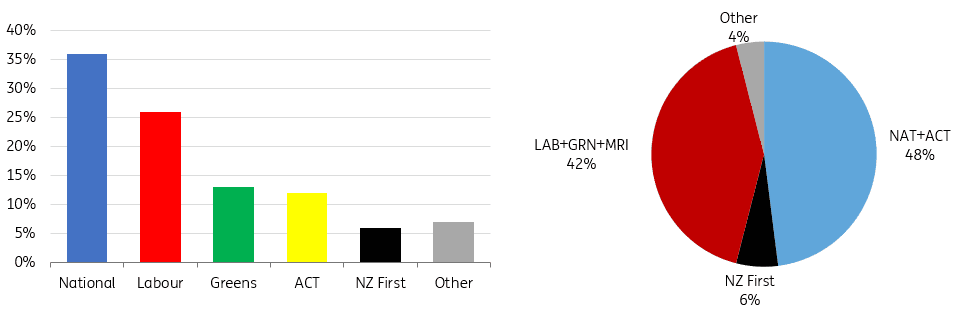

- National Party on course to win

- Commits to change RBNZ remit

- This could mean higher rates for longer = NZD supportive

- But a more fiscally austere policy could weigh = NZD negative

Image © Adobe Stock

New Zealand's impending election might have been a significant contributor to the Reserve Bank of New Zealand's announcement that interest rates were to remain at 5.5%, a decision that has implications for the value of the NZD.

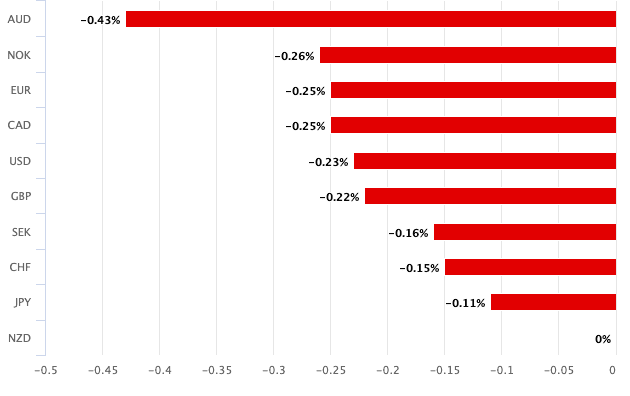

The New Zealand Dollar fell by a notable amount in the wake of the midweek decision to keep rates unchanged which was accompanied by guidance suggesting there was no pressing need to raise them again in the foreseeable future.

Reasons to keep interest rates unchanged included an economy that continued to evolve as expected and a belief the full force of previous interest rate hikes was yet to be felt.

But economists at one of the world's largest investment banks say the October general election is also a major reason behind the decision to keep interest rates and guidance unchanged, suggesting the looming vote is already having a direct bearing on the New Zealand Dollar.

Citibank's post-RBNZ assessment finds the bar was always high for the RBNZ to change its outlook prior to the General Election on October 14, "not least of all because the incumbent and opposition political parties have vastly different economic policies."

The RBNZ noted the Treasury's Pre-election Economic and Fiscal Update saw spending as a share of GDP still declining, albeit less than previously expected.

Moreover, government investment is expected to remain elevated over the medium term.

"Meanwhile, the opposition National Party is aiming to form a coalition on a platform based on income tax cuts," says Citi.

Above: The NZD was the biggest loser on the G10 following the RBNZ's Sept. rate call.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Tax cuts and higher-than-expected spending commitments are by nature inflationary and therefore have a direct bearing on where the RBNZ steers policy, which matters for the NZ Dollar.

But The National Party, which leads the polls, also believes the RBNZ's remit needs to be changed with the singular focus on targetting inflation restored. The Labor Party government had changed the central bank's remit and tasked it with targetting employment.

"Polls suggest a National-led coalition may win: NZD might benefit from a promised change in the RBNZ remit," says Francesco Pesole, FX Strategist at ING Bank.

Pesole says the impact of politics on NZD has traditionally proven quite limited. "This time though, a change of government (assuming the polls are right and NZ First joins a National-led coalition) might have some implications for the RBNZ further down the road," he says.

Image courtesy of ING Bank.

ING notes the National Party's pre-election fiscal plan pledged more fiscal discipline compared to Labour. Specifically, the party said it would spend around NZD3BN less than Labour over four years.

"If the RBNZ links any rebound in CPI to additional fiscal spending, the change in government could suggest a less hawkish RBNZ in the longer run," says Pesole.

The general rule of thumb is that a 'less hawkish' central bank spells a weaker currency performance, therefore suggesting the impact of a win by the National Party on the NZ Dollar is not so clear cut.

The election clearly poses an element of uncertainty for currency markets and central bank policy, which is typically associated with currency underperformance.

When it comes to the immediate election outcome, a hung parliament with parties failing to find a working coalition would increase uncertainty and be the worst scenario for NZD says Pesole.

Should either Labor or National manage to lead a government after the vote, ING expects the market implications to be mostly bonded to those for the RBNZ remit (and less so to fiscal spending).

"So, very limited in the event of Labour staying in power, and moderately positive for NZD (negative for NZ short-dated bonds) in a win by the National Party as markets may speculate on the remit being changed to focus solely on a strict inflation target," says Pesole.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes