New Zealand Dollar Swoons After RBNZ Holds Rates and Cools Guidance

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar is the currency world's laggard in midweek trade after the Reserve Bank of New Zealand (RBNZ) kept interest rates unchanged at 5.5% and offered no fresh clues that it might raise interest rates again.

Non-committal guidance to the potential for further hikes has proved somewhat disappointing to steadily rising expectations for at least one more rate hike in the current cycle, given the recovery in the country's housing market and signs of improvement in the dairy sector.

"RBNZ acknowledged the stronger activity data since the last meeting, but was slightly less explicit on the risk of further hikes than had been expected," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

The apparent disappointment resulted in the Pound to New Zealand Dollar rate spiking by 0.60% in the hour following the decision to go as high as 2.0549, before paring those gains to 2.0488, thereby cementing a short-term base underneath the losses of recent weeks.

"Today’s Statement was marginally dovish, with softening of language around how long interest rates needed to remain elevated," says a note from Citi.

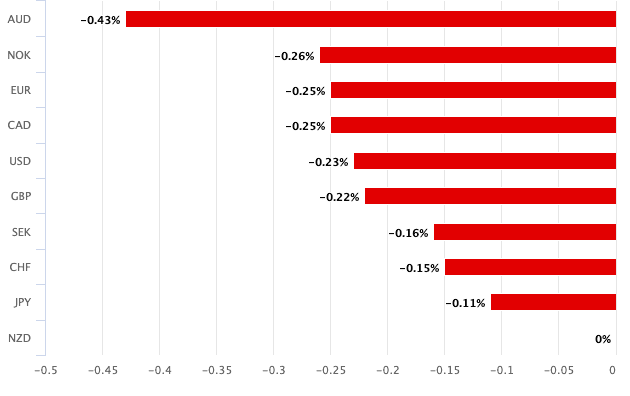

The Kiwi registered losses against all peers, with the largest losses coming against the Aussie Dollar which confirms there are no global factors at play given the typically tight correlation between the two antipodeans:

Above: NZD fell against all its major G10 peers in the wake of the RBNZ's decision.

The RBNZ nevertheless repeated a commitment to maintain interest rates at higher levels for longer and said the outlook "remained similar" to the August meeting, implying little change to the forecasts.

This communication strategy is designed to ensure the market does not get ahead of itself and bring forward expectations for interest rate cuts as this would loosen New Zealand's monetary conditions and work against the RBNZ's objectives.

Sabrina Delgado, an Economist at Kiwi Bank, says the effect of today's RBNZ guidance was to reduce "market traders' perceptions around near-term rate hikes. Hikes are not (yet) necessary."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Rising global oil prices are making the job harder for the world's central banks and contributed to some of the increased market expectations for a further rate hike at the RBNZ.

But, like the RBA on Tuesday, the RBNZ appears willing to look through recent rises in energy costs as a temporary blip.

"The near-term risks are balanced towards higher inflation. The recent spike in oil prices doesn’t help. Although the spike in petrol prices acts more like a tax on households, and consumption. It will inflate near-term inflation prints. Despite these upside risks, the RBNZ can afford to wait and watch the full force of their prior aggressive action feed through," says Delgado.

Furthermore, Kiwi Bank notes around 30% of all outstanding mortgages are rolling off very attractive rates, to very restrictive rates, over the next few months. "That financial pain will show up (again) in weaker spending," says Delgado.

The foreign exchange market's reaction to the RBNZ decision to sell the NZ Dollar underscores that the recent August-September outperformance - mainly against the likes of the Euro and Pound - might be nearing an end.

For the rally to restart it would appear global factors must play their part, and Chinese data will be pivotal in this regard.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes