New Zealand Dollar: Improved Business Confidence Not Yet Enough to Turn the Tide of Weakness

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar advanced against the Pound and a number of European currencies on Thursday following signs of improved Kiwi business confidence, however, the economy must generate further positive data surprises if the tide is to truly turn for the currency.

Hopes for improvement in the recession-struck economy emerged after New Zealand business confidence read at -3.7 in August according to an ANZ survey, which represents a marked improvement on July's -13.1.

However, the improvement was still less than the market expected (-1.9) and perhaps explains why the NZ Dollar's reaction to the figures is relatively subdued.

"Business confidence is still low, but sentiment is on the rise," says Shania Bonenkamp at Westpac.

Following the figures the Pound to New Zealand Dollar exchange rate eased back to 2.1330, although the move was not enough to erase the 1.0% advance that emerged through the course of the midweek session.

"All up, in contrast to some indicators – notably the BNZ-Business NZ PMIs – the ANZ survey points towards the economy maintaining its head above water this year ahead, rather than recessing," says Bonenkamp.

New Zealand officially entered recession in the first quarter after the economy shrank 0.1% over that quarter, after shrinking 0.7% in the final quarter of 2022.

The economic decline gave the Reserve Bank of New Zealand (RBNZ) reason to end its rate hiking cycle well ahead of other developed market central banks, in turn denying the New Zealand Dollar support from the interest rate channel.

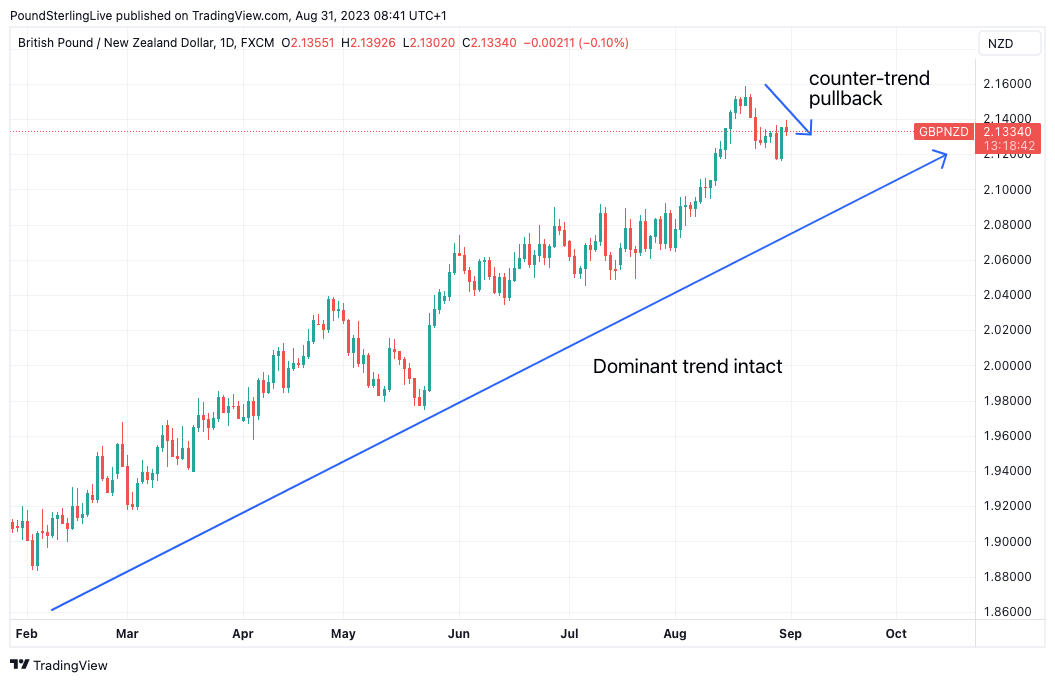

The Pound to New Zealand Dollar exchange rate has rallied over the course of 2023 but over the latter half of August it has pulled back in a counter-trend rebalancing.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The trend nevertheless remains firmly in favour of the Pound and a strong 1.0% rebound for GBPNZD through the course of the midweek session signalled that the recent retracement might be drawing to a close and Sterling bulls will once again be looking for a retest of the 2023 highs at 2.1585.

Part of the GBPNZD's 1.0% advance could come down to news the RBNZ was active in the foreign exchange markets selling NZ Dollars to build forex reserves.

"The RBNZ announced yesterday that it had sold a net NZ$4 billion during July to build foreign reserves noting also that it wasn’t an intervention. An updated FX reserves framework was published in January which outlined that an increase in reserves was required," says analyst Stuart Ritson at BNZ.

The GBPNZD uptrend is nevertheless underpinned by fundamental narratives, one of which is an expectation for further rate hikes at the Bank of England and a UK economy that continues to defy gloomy expectations by avoiding recession.

Above: GBPNZD at daily intervals with some near-term and medium-term considerations annotated.

New Zealand is meanwhile already in recession with money markets showing investors see the prospect of RBNZ rate cuts occurring well ahead of those at the Bank of England. The country is also expected to earn billions less in foreign exchange this year as the price of agricultural commodities is expected by economists to remain under pressure.

Fonterra lopped a full $1 from its milk price forecast in August and evidence lamb prices are trending lower will add pressure to New Zealand's foreign exchange earnings potential amidst an already-established downtrend in the NZ Dollar.

"Dairy is NZ’s largest export earner, so material changes are of macroeconomic importance. Lower dairy sector returns will have flow-on consequences through regional areas and the wider national economy," says Doug Steel, an economist at BNZ.

Fonterra caused waves when it dropped its milk price forecast range to 6.25-7.25 $NZ/kg of milk solid for this season. The mid-point of the tighter range is now $7, down fully $1 from Fonterra’s initial forecast range.

"Global dairy markets are continuing to weaken and are now expected to remain soft for the rest of 2023. Global milk supplies are easing, which will help rebalance the market, but at this stage prices are likely to be driven still lower due to soft demand," says Sharon Zollner, Chief Economist at ANZ Bank.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes