GBP/NZD Rate at Fresh 3-year High Following Wage and Jobs Report

- Written by: Gary Howes

- GBPNZD rate hits 2.0958

- NZD retreat after labour stats release

- NZ wage pressures easing

- As economic slack opens up

- Odds of RBNZ rate cuts increase

Image © Adobe Stock

The New Zealand Dollar was under pressure following the release of a labour market report that sent a clear signal to the Reserve Bank of New Zealand that it was right to quit its interest rate hiking cycle back in May.

Easing wage pressures and 1.0% growth in employment were reported by StatsNZ, as the working-age population spiked by 91K amidst a 72K surge in migrants over the last year.

The increased availability of workers was reflected in a tick higher in the unemployment rate to 3.6% from 3.4% as participation rose to 72.40% in Q2 from 72% in Q1.

"The most wounded currency is the kiwi, which came under pressure after New Zealand's jobs data revealed that the nation’s unemployment rate rose by more than expected," says Charalampos Pissouros, Senior Investment Analyst at XM.com.

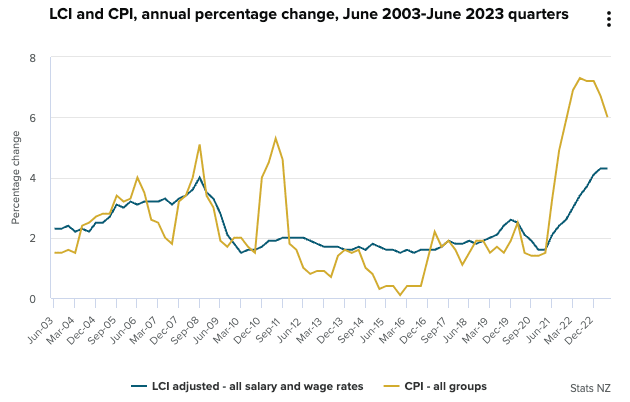

Crucially, from a monetary policy point of view, wage pressures were seen to be easing with the labour cost index growing by 4.3% in the year to the second quarter, which was less than the 4.4% the market was looking for and a decrease on Q1's 4.5%.

Above: Chart plotting the labour cost index (LCI) and CPI inflation. Source: StatsNZ.

The data suggest economic slack in the economy is opening up, therefore the RBNZ will likely stick with a decision to maintain interest rates at 5.5%.

"It looks like the growth in wages has peaked, as inflation eases and labour supply meets demand. We are likely to see wages growth soften further into next year as labour demand softens with a weakening economy," says Jarrod Kerr, Chief Economist at Kiwi Bank.

The Pound to New Zealand Dollar exchange rate rose to a new high at 2.0958, levels last seen in April 2020, amidst the broader NZD retracement. Against the U.S. Dollar the Kiwi was half a percent lower on the day at 0.6111.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Interest rate differentials between the various central banks are proving a potent driver of currency value in 2023: currency 1 will tend to appreciate against currency 2 if the market thinks currency 1's central bank has more interest rate hikes in the bag than that of currency 2.

In this instance, markets are reckoning the Bank of England will take its base rate to above that of the RBNZ, providing a 'carry' in favour of the Pound.

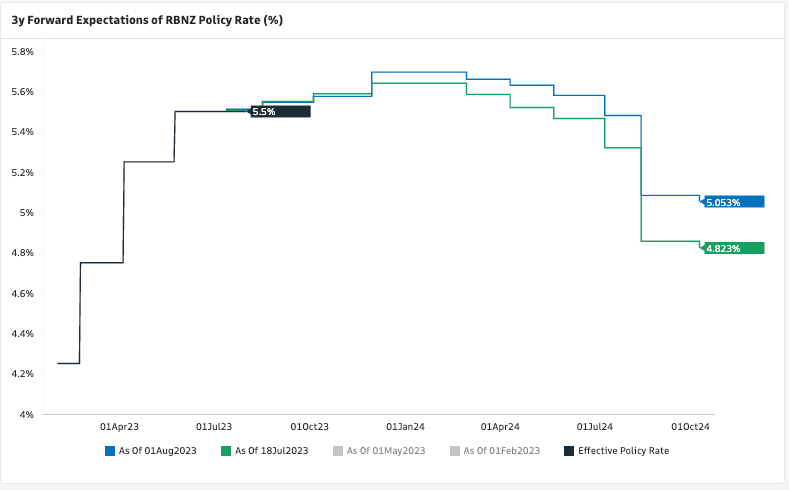

Furthermore, the odds of an RBNZ rate cut have also grown following the labour market data, which is another outright bearish development for the Kiwi Dollar.

Above: The market sees limited odds of further rate hikes in 2022 but solid odds of rate cuts in 2023. Image courtesy of Goldman Sachs. Note the market has priced in greater cuts since July 18, a development that is weighing on the NZ Dollar.

"We see this 'rate cut' pricing being pulled forward over the rest of this year," says Kerr. "The earlier delivery of rate cuts, as soon as February, will see all wholesale rates grind lower."

Kiwi Bank's economists see the prospects for rate cuts growing as a result of the economic slowdown currently underway in New Zealand.

"The RBNZ-engineered recession, which is upon us, is likely to cause a lift in unemployment over the second half of this year, and into 2024," says Kerr. "The demand for labour is likely to weaken into next year, as the economy records further contractions, or at best, no growth."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes