GBP/NZD Rate Chopping and Potentially Topping

- Written by: James Skinner

"GBP’s 2023 rally still has decent momentum and the BoE meets tomorrow. Most expect a +25bp hike, some expect a pause, none expect +50bp" - ANZ.

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate has receded from this year's highs in recently toppy trade and could remain choppy around the nearby 2.0 level through the remainder of the week without a potentially unlikely dovish surprise from the Bank of England (BoE) on Thursday.

New Zealand's Dollar has turned the tables on an earlier outperforming Pound and others around the market to claim second place in the G20 table for the recent week as well as for the month to Wednesday but there could still be further gains in store for the undervalued Kiwi up ahead.

"The Kiwi remains one of the market’s preferred ways to fade USD strength as the US rate hike cycle matures, markets press for cuts," says David Croy, a senior FX strategist at ANZ, in a Wednesday market commentary.

"Tonight’s US CPI data will be key as markets eye an end to the hiking cycle; if that thesis is refuted, there will be volatility," he adds.

April's inflation data out in the U.S. this Wednesday could offer the New Zealand Dollar rally a boost if a nine-month downtrend extends in contrast to a consensus suggesting an unchanged annual rate of 5%.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of September 2022 recovery indicating possible areas of technical support for Sterling.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Any decline would partially absolve the markets for betting that the Federal Reserve (Fed) interest rate cycle is all but over and could lead to further selling of the U.S. Dollar with positive implications for negatively-correlated currencies like the Kiwi this week.

It's not clear what Friday's Reserve Bank of New Zealand's (RBNZ) inflation expectations survey would mean now the local economy appears to be slowing faster than forecasters envisaged, though it's the highlight in NZ this week.

"Moderation in economic activity is being reflected in the Government’s books, although New Zealand is still well positioned to deal with the challenges ahead, including the cost of living, the impact of recent extreme weather and the uncertain global economy," Finance Minister Grant Roberston said on Tuesday.

Expectations for inflation are monitored closely because they can influence actual inflation through their effect on corporate pricing intentions.

The RBNZ raised its cash rate to 5.25% last month, making for a 500 basis point or total 5% increase since late 2021, and said it could reach 5.5% this year.

"We think the RBNZ will be particularly attentive to how expectations respond to the impact of the cyclone and the subsequent rebuild, particularly in terms of medium-term expectations," says Bill Zu, an Australia & New Zealand economist at Goldman Sachs.

"With the NZ labour market continuing to show resilience in 1Q2023 – given solid job gains and a 3.5% unemployment rate – and a 25bp hike widely expected by the market, we think the path of least resistance is for the RBNZ to deliver a final hike in May," Zu adds in a Tuesday research briefing.

Much about the remainder of this week's price action in the Pound to New Zealand Dollar pair is yet be determined by Thursday's forecast update and interest rate decision from the Bank of England, however.

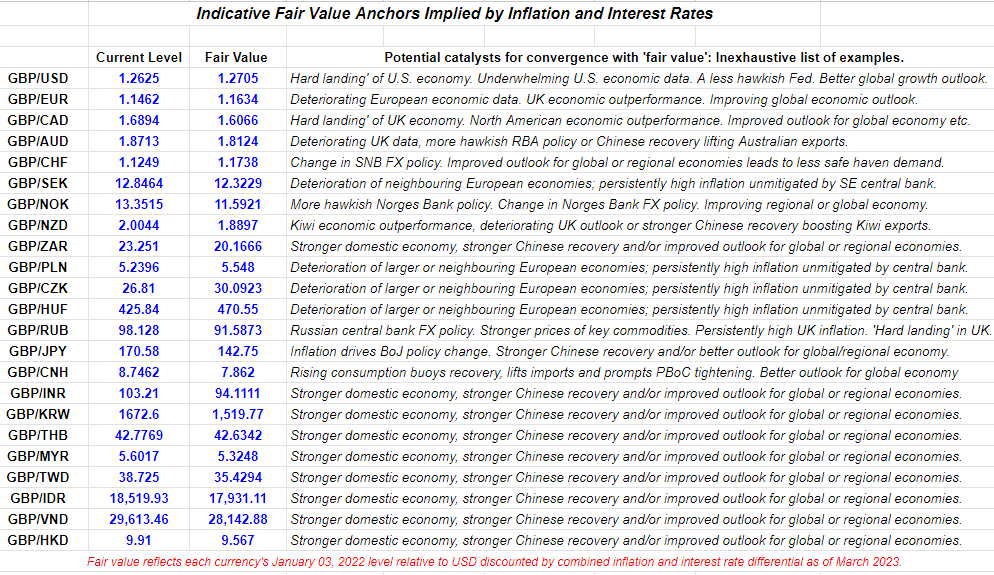

Above: Pound Sterling Live estimates of 'fair value.' Click the image for closer inspection.

"GBP’s 2023 rally still has decent momentum and the BoE meets tomorrow," ANZ's Croy says.

"Most expect a +25bp hike, some expect a pause, none expect +50bp," he adds.

There is uncertainty over what the BoE will say with UK inflation proving slower to dissipate than many economists had expected for the first quarter and given that the BoE has itself been looking to see a rapid decline this quarter.

But economists widely expect Bank Rate to be raised from 4.25% to 4.5% while markets are betting that it might rise as far as 5% later in the year.

That may mean there isn't much the BoE could say or do to drive the Pound stronger in advance of GDP data for March out on Friday.

The consensus among economists suggests the opening quarter likely ended with another month of 0% growth in March.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes