New Zealand Dollar Could be Boosted in Early April if RBNZ Bakes More Hikes into the Outlook

- Written by: Gary Howes

Above: File image of Paul Conway, RBNZ Director of Economics and Chief Economist.

The New Zealand Dollar's weak run could come to an end if the Reserve Bank of New Zealand inspires markets to raise bets that further interest rate hikes over the coming months are likely, something that is probable says BNZ.

"We believe that the RBNZ will give an explicit nod to the fact that the tightening cycle is probably not complete," says Stephen Toplis, Head of Research at BNZ.

The New Zealand Dollar has underperformed its G10 peers since early February as investors rapidly reduced the scale of rate hikes yet to come from the RBNZ, while increasing the scale of cuts they anticipate from the central bank prior to year-end.

The foreign exchange textbook says a currency tends to fall when a central bank guides the market to expect lower interest rates in the future or a lower peak in interest rates.

But, analysis from Kiwi lender BNZ finds the 'dovish' market might be surprised as the RBNZ sent a subtle signal last week warning there was more work to be done on interest rates in order to bring inflation back towards the 2.0% target.

Toplis says RBNZ’s Chief Economist, Paul Conway, last week "sent a clear message that the Reserve Bank still thinks it has work to do, and that recent banking sector ructions will not dissuade it from its intended course of action."

Conway delivered a speech entitled The Path Back to Low Inflation in New Zealand, saying recent global and domestic events should not preclude further rate hikes at the central bank.

"This is important because markets have markedly lowered their expectations of where the New Zealand cash rate might peak," says Toplis.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

For the RBNZ's upcoming April meeting, the market is pricing in a 91% chance of a hike to 5.0% in the Overnight Cash Rate (OCR).

But, the New Zealand Dollar might not find itself any better supported as markets price the odds of another hike down to 50/50.

Furthermore, market expectations show an increasingly popular expectation for the RBNZ to start cutting interest rates from around the third quarter.

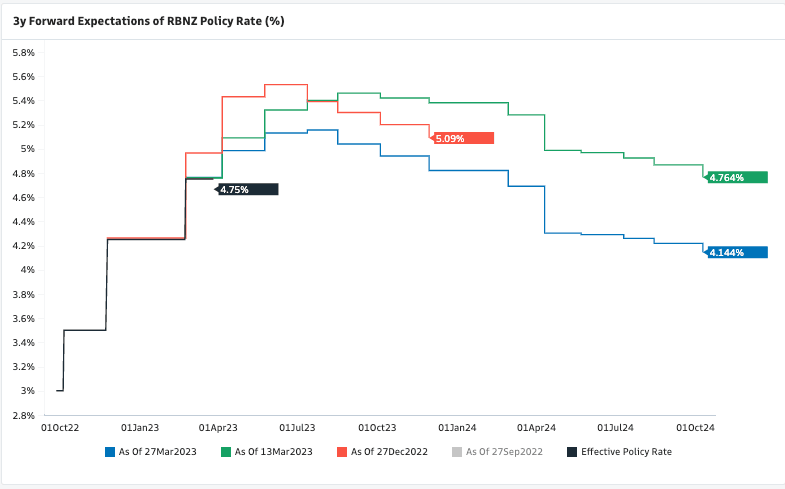

Above: The market has pared back expectations for the peak in the RBNZ's OCR, while pricing in more cuts further out. Image courtesy of Goldman Sachs.

At the time of the February Monetary Policy Statement the RBNZ indicated its cash rate would peak at 5.5%, implying three 25bp increases.

"Shortly thereafter, relatively strong global growth and inflation data saw the domestic market move much closer to expecting a 50 basis point increase at the upcoming meeting and a peak above 5.5%," says Toplis.

But, "then the wheels fell off," he says.

Leading investors to slash rate hike expectations, which in turn weighed on the New Zealand Dollar, was a Q4 GDP print (of -0.6%), which Toplis says was "miles below the RBNZ’s published forecast of 0.7%".

Furthermore, concerns about the impact of cyclone Gabrielle continued to grow and then chaos reigned in the U.S. banking market.

"Markets responded with a sharp about-face questioning whether the RBNZ would ever raise rates again and pushing the expected peak in the cash rate down towards 5.0%," says Toplis.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is now 3.60% higher for 2023 at 1.9167 with the pair trending higher since early February. The pair rose 1.65% in February and a further 1.90% in March.

The New Zealand to U.S. Dollar exchange rate (NZD/USD) fell 4.0% in March and has since settled around current levels at 0.6246.

But the Kiwi Dollar might find itself better supported if the RBNZ pushes back against the market and prompts it to pencil in further rate hikes.

Above: With NZ inflation expectations at such elevated levels the RBNZ might feel it has further work to do. Image courtesy of BNZ.

Toplis says Conway's speech should guide markets in such a direction, noting his assertion that New Zealand's financial sector is not under threat and global banking fears should not stand in the way of the RBNZ's fight against inflation.

Furthermore, he notes the cyclone poses an additional inflationary shock to New Zealand, at the same time inflation expectations look uncomfortably elevated.

"We believe the RBNZ will raise the cash rate 25 basis points when it releases its April 5 decision. It is likely that no move and 50 will also be discussed. The market gives the no move option as being a marginally stronger proposition than 50. We are not so sure," says Toplis.

"We believe that the RBNZ will give an explicit nod to the fact that the tightening cycle is probably not complete," he adds.

Given current market pricing, such an outcome would result in New Zealand Dollar upside momentum in early April.

New Zealand Dollar Outlook still Murky says Wong

Although a more 'hawkish' RBNZ event could support the New Zealand Dollar in April, the broader outlook is less certain.

ANZ's currency analyst Jason Wong says in his latest update the outlook for the currency remains "more uncertain than usual".

"We've always considered the end of the Fed tightening cycle to be a key factor for the NZD to perform better, with a view that a Fed pivot was crucial for the USD to broadly weaker," he says.

However, "the turmoil in the banking system has introduced a complicating factor to the currency outlook."

Wong says if this new risk factor can blow over quickly, then the path towards a stronger NZD/USD exchange rate is clear.

"If risks linger for some time, or conditions deteriorate, then the NZD will be flat at best and the currency could significantly weaken. Our key message to corporates and fund managers is that now is not the time to be taking large positions in currency markets, given the murky outlook," says Wong.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes