New Zealand Dollar: One More RBNZ Hike Expected, But Prospect of Cuts Could Weigh

- Written by: Gary Howes

Image © Adobe Stock

For the RBNZ's upcoming April meeting, the market is pricing in a 91% chance of a hike to 5.0% in the Overnight Cash Rate (OCR).

But, the New Zealand Dollar might not find itself any better supported as a result of another hike given the odds of an additional hike have receded to about 50/50 odds.

Furthermore, market expectations show an increasingly popular expectation for the RBNZ to start cutting interest rates from around the third quarter.

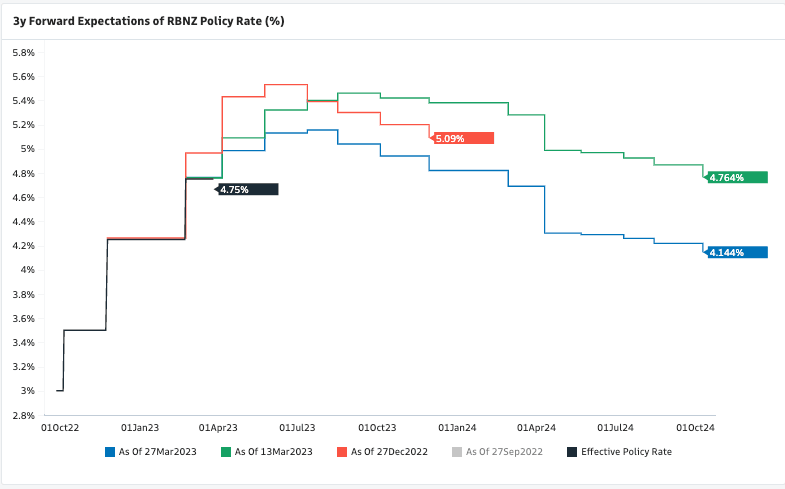

Above: RBNZ rate hike expectations have been receding since December, weighing on the NZD in 2023.

The scale and pace of future cuts appear to be weighing on the New Zealand Dollar which has lost value to all but two of the G10 currencies in 2023 (NOK and AUD).

Money markets show that by year-end interest rates might have been slashed back down to the current OCR level of 4.75%.

The dynamics confirm interest rate expectations for New Zealand relative to elsewhere matter greatly for the Kiwi Dollar.

The repricing lower in expectations has been greater in New Zealand as at the turn of the year investors were expecting the RBNZ to be one of the biggest hikers amongst developed markets (see the December red line in the above chart).

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The retracement in expectations has therefore been significant.

This is particularly so against the Pound as markets had expected a relatively subdued pace of rate hikes from the Bank of England at the turn of the year.

The BoE could also be set to raise interest rates by 25bp in May, data depending, underpinning UK interest rates expectations and yields relative to those of New Zealand.

Indeed, the Pound to New Zealand Dollar exchange rate (GBP/NZD) is now 3.60% higher for 2023 at 1.9167 with the pair trending higher since early February.

The chart shows that as of March 13 the peak for the RBNZ's OCR was expected to stand at 5.50%, but this has now since been reduced to 5.25%.

Potentially more significant for the New Zealand Dollar, however, is that markets see a steeper and deeper descent in rates from this peak as investors price in upcoming interest rate cuts.

An end to the rate hiking cycle would be welcomed by homeowners given New Zealand is witnessing one of the sharpest pullbacks in house prices in the developed world, and the currency won't be immune to the fallout says a leading Wall Street Bank.

JP Morgan says house prices matter for currency markets and developments in New Zealand prompt it to hold a "bearish bias" on the New Zealand Dollar.

"House prices have fallen in the Antipodeans but the decline has been deeper for New Zealand, where they are down 16% from the peak," says Meera Chandan, an economist and currency analyst at JP Morgan in London.

JP Morgan's New Zealand strategists meanwhile note the deeper decline in New Zealand's housing sector "is symptomatic of weaker credit demand/activity, and household consumption is more sensitive to that in NZ than Australia."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But China Could Offer NZD Support Further Out

The New Zealand Dollar's slide against Sterling, Euro and U.S. Dollar since early February also coincides with a fading of the China reopening trade that bolstered the commodity Dollar complex in January.

The trade was undermined by data that suggested the initial economic rebound was proving weaker than expected amidst fears rising global interest rates would dent global economic growth, in turn capping Chinese economic activity.

But analysts say Chinese growth could accelerate again over the coming weeks, which could boost the New Zealand Dollar.

Roberto Mialich, FX Strategist at UniCredit Bank in Milan says, "commodity currencies (such as the AUD, the NZD and the CAD) look set to be the major beneficiaries of stronger economic growth in China in the future."

"This result is not too surprising, as China is currently Canada’s second-largest export partner after the US, 12 while over 41% of Australian exports go to China," he explains.

The GBP/NZD exchange rate's upside could therefore be limited by another Chinese-centred global growth rebound.