New Zealand Dollar: The China Reopening Bet Fades

- Written by: Gary Howes

- NZD is best performer of past month

- But this strength is now being tested

- As China reopening narrative fades

- Could be a story for Q2 2023 say analysts

Image © Adobe Stock

Markets are coming to terms with the likelihood that China is unlikely to drop its zero-Covid policy until the spring, triggering a reversal in fortunes for the New Zealand Dollar and similar 'commodity currencies'.

The New Zealand Dollar is proving to be an obvious bet for a Chinese economic rebound, however analysts warn the recent hype witnessed over the past ten days is misplaced and reopening is likely to be a slow and bumpy affair.

Goldman Sachs' China economists believe recent headlines simply mark the start of a multi-month preparation period for reopening, and so have maintained their current base case of 2Q23 reopening, once the winter flu season has passed.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Last week saw numerous headlines suggesting Chinese authorities were inching towards the abandonment of China's zero-Covid policy, a policy that has undermined the economic growth potential of the world's second-largest economy.

The rumours triggered a strong performance by Chinese equity markets, which in turn led to an outperformance of the Australian and New Zealand Dollars, two G10 currencies that have traditionally enjoyed a positive correlation with sentiment towards China.

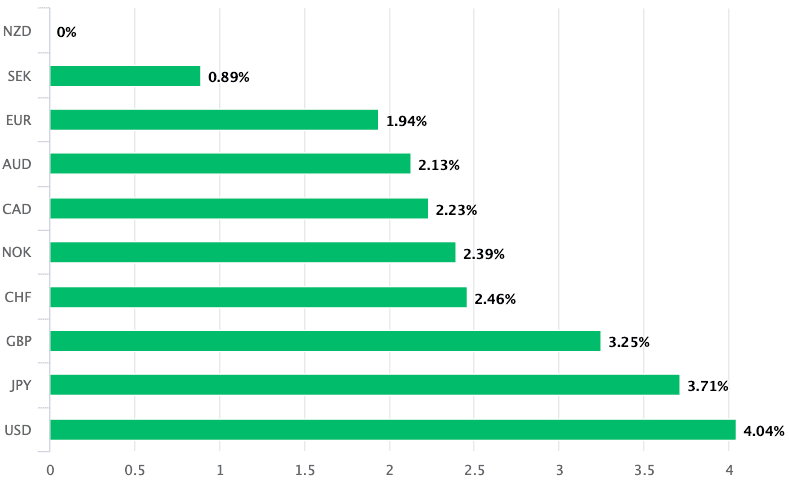

This outperformance has helped propel the New Zealand Dollar to the top of the G10 performance board when screened over the past month:

Above: NZD over the course of the past month. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

But, Pound Sterling Live warned at the start of this week that this strength would be tested as the China reopening trade inevitably fades, and at the time of writing the observation is proving accurate.

Underperformance is confirmed as the Pound to New Zealand Dollar is up 1.50% this week, the U.S. Dollar-New Zealand Dollar rate is higher by 1.33% and the Euro to New Zealand Dollar exchange rate is up 1.25%.

In fact, the Kiwi is lower against all its major rivals this week.

The mixed fortunes confirm this currency's outlook will rely heavily on the Chinese story over the coming weeks and months, and on this basis, near-term weakness can be expected but a more robust performance looks set to characterise 2023.

Over the weekend China's National Health Commission (NHC) made it clear that there were to be no official policy tweaks, such as reducing mass testing requirements or easing inter-provincial travel rules.

China will "unswervingly" adhere to its zero-Covid policy, said the NHC.

"We acknowledge that the central government is likely having internal debates about reopening, but we still hold the view that it is too 'early days' for China's leaders to make an official announcement," says Maximillian Lin, an economist at Credit Suisse.

Lin says, "for the optimists, a nationwide relaxation could come after the March 2023 National People’s Congress in Beijing, when the new Politburo members will be given state portfolio roles."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

This could prompt some buying of China-focussed assets, but the coming weeks could nevertheless be fraught with risk for China-focussed assets, which could include the New Zealand Dollar.

"Betting on further reopening is not without risks. As winter sets in and cases rise, the news cycle could easily switch from one of scattershot loosening to one of spreading lockdowns across major cities," says Lin.

Goldman Sachs' China economists update their view recent rumours of easing restrictions simply mark the beginning of what is a lengthy, multi-month preparation period before domestic reopening.

The key preparations are to increase the elderly vaccination rates to acceptable levels and ramp up domestic production capacity for treatment drugs.

To that end, they maintain a base case of a second-quarter 2023 reopening, when the winter flu season comes to an end.

Christopher Wong, FX Strategist at OCBC Bank, says although officials have pushed back on reopening rumour, he believes the endgame to zero-covid policy could be close, "possibly in a few months and likely to be done in phases".

He says a China reopening boost can provide some support for commodity-linked currencies, such as the Australian Dollar and New Zealand Dollar.

Such a recovery looks to be one scheduled for 2023 and near-term underperformance for these two currencies centred on this narrative therefore remains possible.

Economists at Barclays meanwhile have further words of caution, saying they are "highly sceptical

of a quick end to zero covid" and have lowered further their 2023 GDP forecasts to 3.8%.

This downgrade is based on "deepening property woes, a looming global recession and rising geopolitical tensions. Even under a full-reopening scenario, they are cautious about potential upside in consumption".

China might therefore not be the silver bullet many commodity-dollar bulls are expecting.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes