New Zealand Dollar at Risk of Further Weakness post-RBNZ

- Written by: Gary Howes

- NZD is down notably on the week

- Sales follow RBNZ rate hike

- Which was well anticipated by the market

- Further risk that RBNZ under-delivers on rate hikes

Image © Adobe Stock

The Reserve Bank of New Zealand's bold 50 basis point interest rate hike has been met by a barrage of New Zealand Dollar selling as investors call an end to the currency's 2022 outperformance, and there is a risk of further disappointment for Kiwi bulls say some analysts.

The New Zealand Dollar fell after the RBNZ raised interest rates by 50 basis points, which at first makes for a counterintuitive currency market reaction as the text book suggests a currency rises when its central bank raises rates.

But, "this hike did not represent any change in the path of interest rates, only the pace of change," says Marshall Gittler, Head of Investment Research at BDSwiss Holding Ltd.

"All they were doing is bringing future rate hikes forward," says Gittler.

The 50 basis point hike was therefore expected by market participants who were looking for a potentially more 'hawkish' message on the prospect for further rate hikes in the future.

"The price action supported our view that there was a high hurdle for the RBNZ to deliver a hawkish policy surprise required to encourage a stronger kiwi," says analyst Lee Hardman at MUFG.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

He says money market pricing showed investors to have already almost fully pricing in a 50bps hike at Wednesday's policy meeting, even if the consensus view of economists surveyed by Bloomberg was for a smaller 25bps hike.

Therefore the decision was largely expected and offered no obvious upside surprise for New Zealand Dollar bulls.

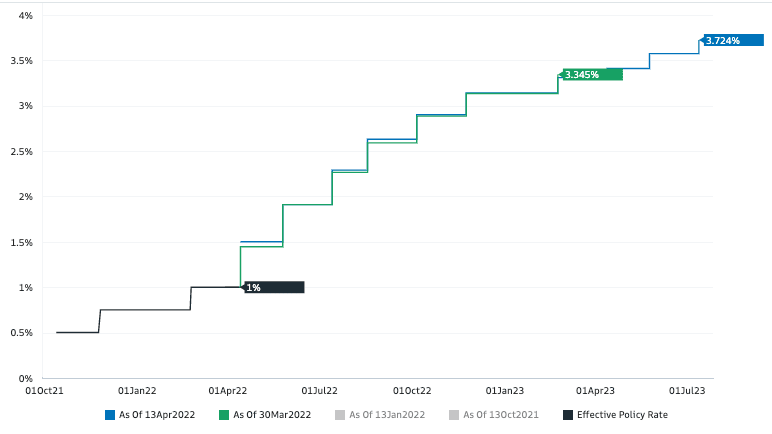

Gittler notes the market's expectation for where the cash rate would be in February 2023 actually fell in the wake of the RBNZ, to 3.36% from 3.54%, on the assumption that hiking more now means less need for hiking in the future.

"The RBNZ’s message that it will deliver quicker rate hikes in the near-term has also encouraged the market participants to scale back tightening further out," says Hardman.

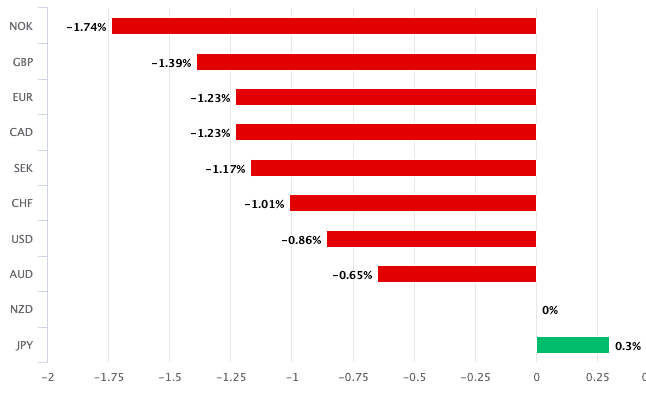

Above: The NZD has lost ground to all peers, apart from JPY, in the week the RBNZ hiked interest rates.

The Pound to New Zealand Dollar has been under sustained pressure since February and Russia's invasion of Ukraine, but the pressure has certainly eased now, helped by Wednesday's 1.67% jump to 1.9246.

The New Zealand-U.S. Dollar exchange rate meanwhile fell 0.80% to trade at 0.68.

"Importantly, the RBNZ has emphasised today’s 50bp hike is not increasing the totality of rate hikes it expects to undertake. Instead, the central bank says it has only brought forward rate hikes as part of its path of least regret philosophy in making the decision and suggested a “stitch in time” now would save more rate hikes later on," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"While high commodity prices and the RBNZ continuing to raise rates will support the NZD’s gradual appreciation, we believe there is risk of NZ curve inversion in the coming months, which would significantly dent the NZD’s strength," adds Marinov.

"We think that market pricing is still too aggressive for this year. As such, we expect some more weakness of the New Zealand dollar," says Georgette Boele, Senior FX Strategist at ABN AMRO.

There are further explanations for the NZ Dollar's sharp sell-off, with some economists say the RBNZ joins a host of other central banks fearing the outlook for domestic growth is pointed lower.

"The RBNZ’s growth outlook leaned more dovish, with the central bank noting that the pace of global economic activity has continued to slow. While it recognised that New Zealand’s economy continued to show underlying strength, the domestic economy is small and reliant on global growth, which faces numerous uncertainties," says Jonathan Koh, Economist at Standard Chartered Bank.

Standard Chartered estimate the OCR at 2.25% by end-2022, which is some way below the ~3.50% money markets are currently priced for, according to OIS markets.

Above: The expected path for RBNZ interest rates, as implied by OIS markets. Source: Goldman Sachs.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"Given today's 50bps hike and the risk of another 50bps hike in May, we see a chance that the last two 25bps hikes that we expect in August and October may not occur. We think that it will be challenging for the RBNZ to tighten significantly beyond neutral because of the challenges ahead, including heightened geopolitical tensions," says Koh.

This would prove a disappointment for NZ Dollar bulls, if correct.

"We now expect a follow-up 50bp hike in May, with four more 25bp hikes to reach a peak of 3% by the end of this year," says Michael Gordon, Acting Chief Economist at Westpac.

This expectation is more closely aligned with the market's view and if correct would therefore undermine NZD levels.

"Our view on the peak OCR for this cycle is slightly lower than the RBNZ’s. We acknowledge that the risks are skewed towards

a higher peak," adds Gordon.

Given the higher starting point for the OCR after today’s decision Westpac have adjusted their forecasts accordingly.

"We now expect a follow-up 50 basis point hike at the May Monetary Policy Statement, with further 25 basis point hikes at the four remaining reviews this year. This would see the OCR reach a peak of 3% by November, instead of mid-2023 as in our previous forecast," says Gordon.