New Zealand Dollar Slips in Wake of RBNZ's Big Stride

- Written by: James Skinner and Gary Howes

- NZD falls post-RBNZ decision

- RBNZ raises cash rate in larger 0.50 basis point increment

- Reiterates February guidance on NZ rate outlook

Above: File image of RBNZ Governor Adrian Orr. © Pound Sterling, Still Courtesy of RBNZ

The New Zealand Dollar was lower against major counterparts after the Reserve Bank of New Zealand (RBNZ) raised its cash rate by 50 basis points - the first major central bank to do so in over a decade - while warning borrowing costs will rise further during the months ahead.

New Zealand’s Dollar experienced only a brief flurry of demand on Wednesday after the RBNZ raised its cash rate from 1% to 1.5%, surprising some economists but merely matching what were already hawkish market expectations.

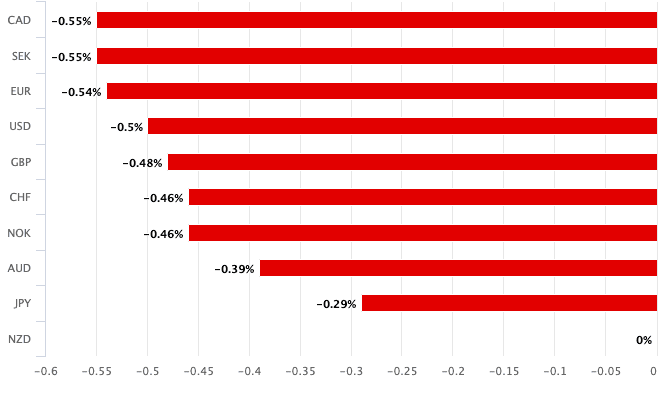

By the time European desks were opening the currency was the day's biggest loser, recording losses against all G10 rivals.

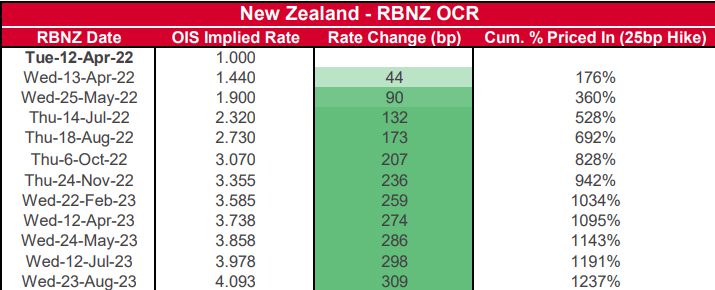

The RBNZ reaffirmed February forecasts suggesting its cash rate could rise to more than 3% before the end of next year, but this too had already been more-than fully reflected in New Zealand interest rate and currency markets ahead of the decision.

“The risk of more persistent high inflation expectations has increased. The Committee agreed that their policy ‘path of least regret’ is to increase the OCR by more now, rather than later, to head off rising inflation expectations and minimise any unnecessary volatility in output, interest rates, and the exchange rate in the future,” the summary of the RBNZ meeting states.

Above: NZD was down against all its major rivals on April 13.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

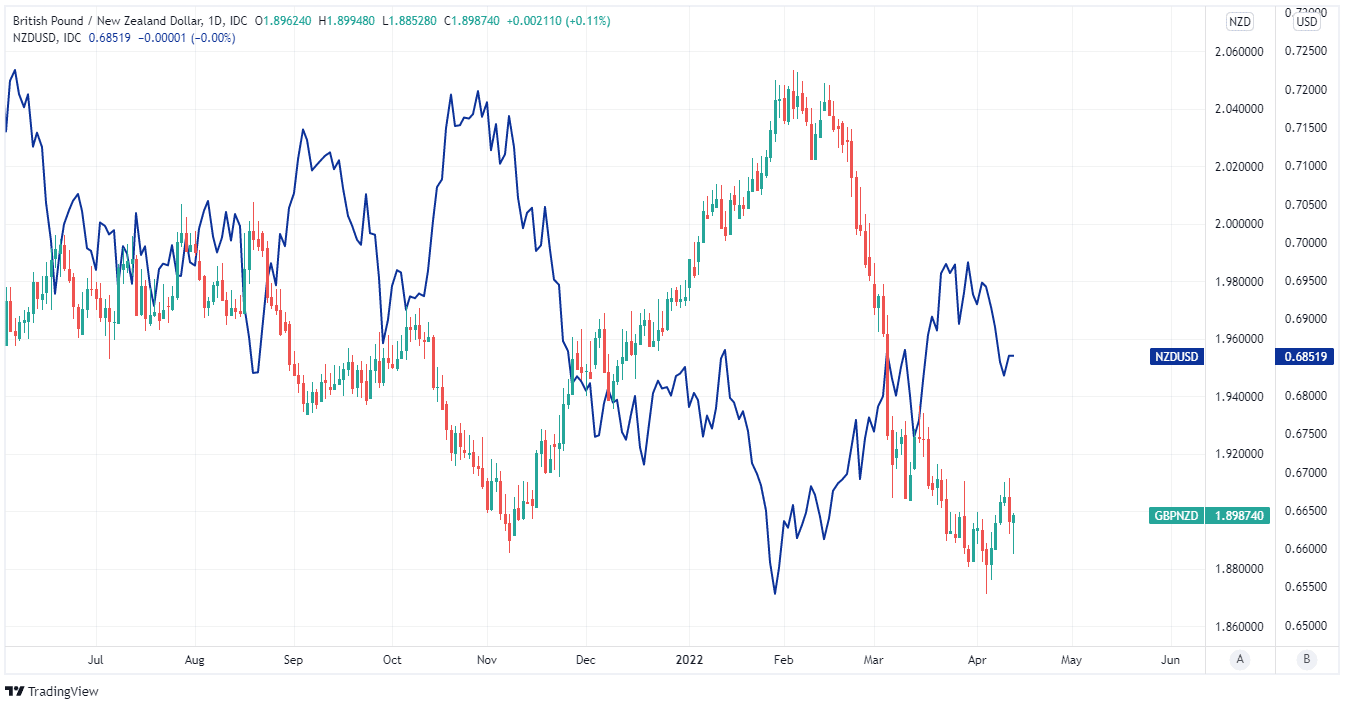

The Pound to New Zealand Dollar exchange rate was seen at 1.9052 at publication, having been as low as 1.8852 earlier in the day. The New Zealand Dollar to U.S. Dollar exchange rate was at 0.6827, having been as high as 0.6896 earlier in the day. (Set your exchange rate alert here).

Wednesday’s is the fourth interest rate rise from the RBNZ since long before the coronavirus crisis and comes as part of an effort by the bank to rein in inflation by withdrawing monetary stimulus from the New Zealand economy.

“While the RBNZ’s decision was more in line with market pricing on the day, it emphasised that there is a key difference regarding the OCR outlook over the longer term,” says Michael Gordon, an economist at Westpac.

“In recent weeks, financial markets have pushed towards pricing in an ever-higher peak in the OCR for this cycle, now getting towards 4%. In contrast, the RBNZ viewed today’s decision as a “stitch in time saves nine” approach,” Gordon said on Wednesday.

New Zealand’s inflation rate is still forecast to top 7% during the first half of 2022 and the RBNZ is concerned that this level of price growth will lead business, household and financial market expectations to also rise, which can have knock-on impacts on inflation in the future.

Above: Overnight indexed swap implied market expectations for RBNZ’s cash rate following each of its pending meetings. Source: Westpac.

Rising expectations can influence behaviour and prices including for wages and salaries, which is partly why the RBNZ wants to use its interest rate and other policy tools to discourage the kinds of economic activity or expectations that could keep inflation elevated into the medium and longer-term.

“We’re forecasting that annual CPI inflation reached 7.4% in the March quarter – up from 5.9% at the end of 2021. But uncertainty is high in the wake of Omicron disruption and the commodity price volatility resulting from the invasion of Ukraine,” says Finn Robinson, an economist at ANZ.

“Whatever the headline figure ends up being, we know the underlying inflation impulse is already far too strong for the RBNZ’s comfort – and will likely have moved further in the wrong direction in the past three months. This should prompt the RBNZ to act aggressively,” Robinson adds.

While the RBNZ made no secret of its intention to continue lifting Kiwi interest rates, the already hawkish elevation of market expectations is a good candidate for explaining why the New Zealand Dollar gained little from the decision and statement on Wednesday.