New Zealand Dollar: November Rate Hike Called by TD Securities

- Written by: Gary Howes

- NZD benefiting from hawkish RBNZ expectations

- RBNZ takes the stage next week

- Markets increasingly see Nov. rate hike

- But RBNZ push-back could disappoint bulls

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 1.9642

- Bank transfers (indicative guide): 1.8955-1.9092

- Money transfer specialist rates (indicative): 1.9465-1.9505

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Reserve Bank of New Zealand is tipped to raise interest rates in 2021 by global investment bank and financial services provider TD Securities.

The call, if correct, would underpin the New Zealand Dollar which has found support over recent months on the Reserve Bank of New Zealand's pivot from a 'dovish' to 'hawkish' central bank.

"The RBNZ's hawkish shift at the May meeting and the stronger data that has followed places the Bank as the most hawkish in the Dollar Bloc and one of the most hawkish amongst Developed Market Central Banks," says Prashant Newnaha, Senior Asia-Pacific Rates Strategist at TD Securities.

The RBNZ would lead its developed market peers if it were to raise interest rates in November, a significant development for a foreign exchange market that is proving sensitive to central bank interest rate expectations.

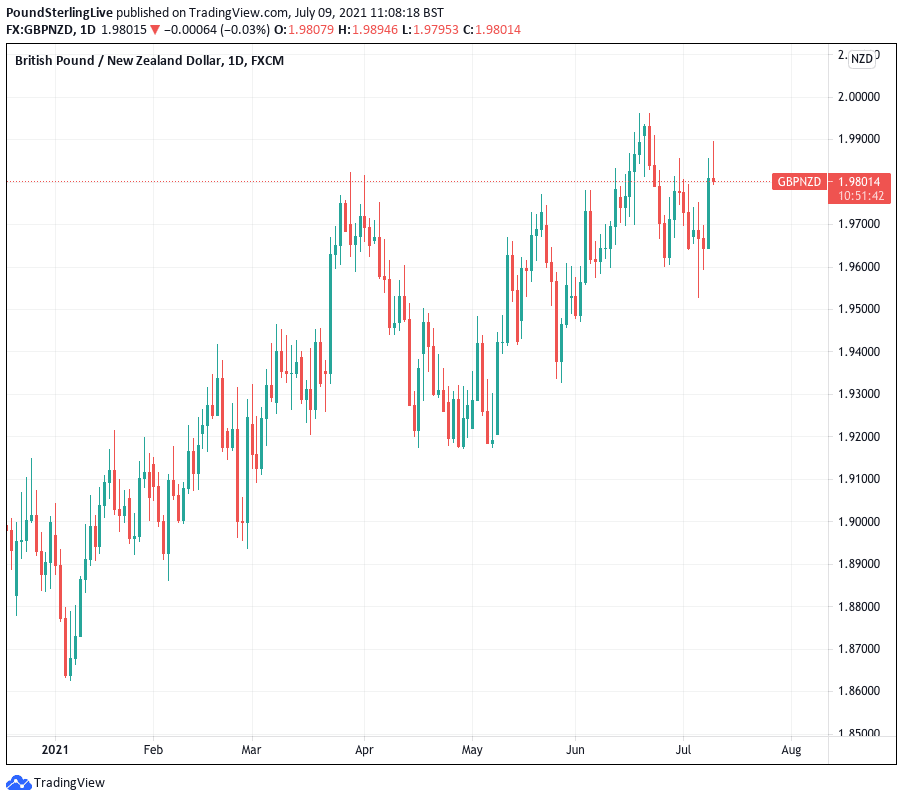

Above: GBP vs. NZD in 2021.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

We reported mid-week that talk of a 2021 interest rate rise were pinging on our radar, a development that coincided with a strong week-on-week performance in the New Zealand Dollar.

Rising expectations for a November rate rise come ahead of the July 14 Monetary Policy Review at the RBNZ, where it is expected Governor Adrian Orr and his team will send signals that higher interest rates are indeed coming.

"We don't expect the Bank to make any formal announcement on Large Scale Asset Purchases (LSAP) or the Funding For Lending Program (FLP) next week. Instead, the Bank may let the pace of purchases slow even further into the August meeting, announce an end to LSAP purchases at the August meeting, sending a clear signal to the market to prepare for a November hike," says Newnaha.

Should the RBNZ oblige markets with such signals the NZ Dollar could find some bidding interest.

However, Jane Foley, Senior FX Strategist at Rabobank, says the RBNZ might have noted the rise in expectations for higher interest rates, a development reflected by the increased cost of lending in money markets.

These expectations might not be welcomed by the RBNZ and could prompt Orr to strike a more cautionary tone with the explicit desire to calm expectations.

Any unexpected caution could disappoint against market expectations and result in a weaker New Zealand Dollar in the wake of next week's Monetary Policy Review.

"The sharp increase in tightening expectations that has taken place over the past week or so however raises the question of whether the RBNZ will be actually able to meet the market’s aggressive outlook," says Alexia Jimenez, an analyst with Credit Suisse.

The RBNZ will nevertheless be required to reflect on incoming economic data that is better than they had expected at the start of 2021.

"We think the data, especially coming from the Q2 survey, should provide the RBNZ with sufficient confidence to sound constructive at next week’s meeting, even amid ongoing uncertainty in the travel sector," says Jimenez.

GDP growth is ahead of expectations with 1.6% q/q growth being reported in the first quarter.

Sentiment was bolstered further this week by the New Zealand Institute of Economic Research (NZIER) quarterly QSBO survey which showed a strong pick-up in both demand and confidence.

Above: Lower starting point for growth, but forecasts revised up for the next two year by NZIESR.

The survey showed that a net 26% of businesses reported increased demand during the second quarter.

The ultra-low interest rate environment is therefore not consistent with economic data and expectations for higher growth and inflation in the outlook.

"We do not see a strong reason for the RBNZ to push back against the sharp recent hawkish repricing in RBNZ policy expectations at the 14 July rate decision," says Jimenez.

The RBNZ will nevertheless reflect on the ongoing global covid-19 crisis which has taken a turn for the worse over recent weeks owing to the spread of the Delta variant of the virus.

The highly transmissible variant sets the bar for 'herd immunity' notably higher than with other variants and the UK is finding that even a strong vaccine programme is not enough to stop its spread.

The variant therefore poses considerable risks to New Zealand which has a slow vaccine rollout and almost no natural population immunity. For New Zealand to ever return to normal it will therefore have to at some point accept Covid-19 will inevitably take hold in the community.

"Aside from an offshore risk-off event, the only domestic event we can pinpoint that could see the RBNZ not hike this year and slow the pace of hikes next year is a surge in covid cases," says Newnaha.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

This week New Zealand Prime Minister Jacinda Ardern doubled-down on the country's zero-covid policy approach while the government slashed the amount of permitted international arrivals by 50%.

TD Securities assess that New Zealand's borders are likely to remain closed until mid next year to lower the risk of a surge in covid cases.

Such an outcome would mean the country's economy would be running at below-capacity levels, a relative risk for the NZ Dollar should peers continue to open borders as the UK, U.S. and Eurozone are doing.

TD Securities nevertheless anticipate the RBNZ to raise rates again in the third quarter of 2022, hold them for a further 6 months and then hike at each MPS in 2023 to take the cash rate to 1.50% by the end of 2023.

Credit Suisse meanwhile say they are "are fundamentally constructive on NZD", particularly against the Australian Dollar.